Written by Graham Little, Software Architect at TJC Group.

We came across this blog by Claire Worledge at Aufinia and wanted to offer our thoughts on the important topic of skills diversity. Aufinia’s article raises some very interesting points about the advantages of having a skills cross over spanning different areas of expertise within project teams, and how this can enhance audit processes. This need for skills diversity is especially true in Business to Government (B2G) scenarios, which require IT, compliance, audit and financial skills.

Polymaths, a “T-shaped skillset” mindset

Working with B2G projects brings to mind some research published by Dr. Angela Cotellessa from George Washington University within the Association for Talent Development[1]. Her work highlights the importance of having diversity in teams. Not just ethnic, social and gender diversity – although this is very relevant too —but what she calls diversity within individuals, or intrapersonal diversity.

She is referring to having polymaths – people who have a good working knowledge of many different topics. A polymath is someone who has broad and disparate but also deep skills across multiple disciplines. They have the ability to access a wide toolkit to help solve audit and data management problems. Contrast this with the functional specialists who have a narrower, domain-limited set of professional experiences and knowledge.

[1] https://www.td.org/insights/polymathy-a-new-kind-of-diversity-that-could-take-your-business-to-the-cutting-edge

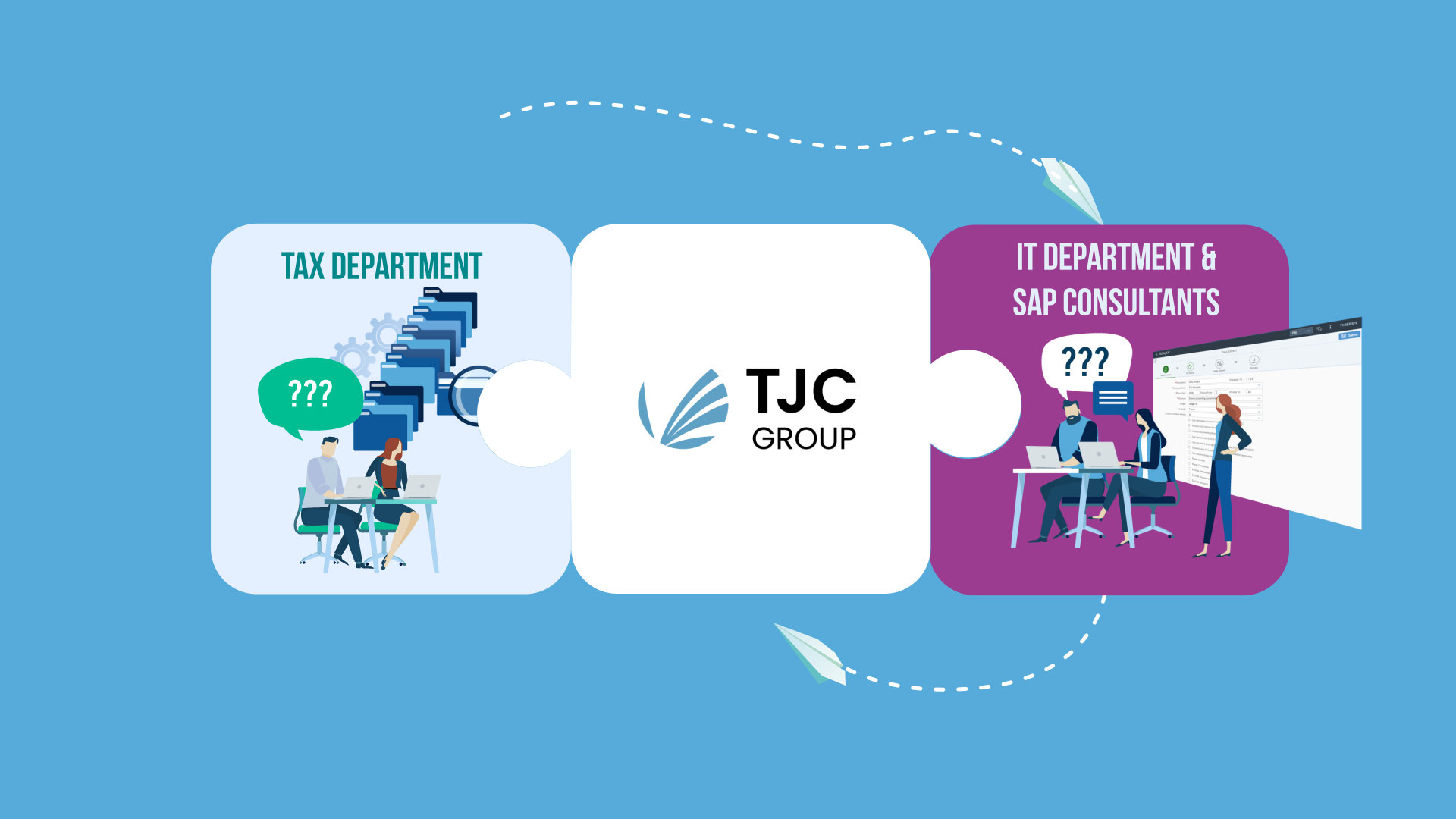

Providing the kind of multi-skilled profile found among polymaths forms the basis of TJC’s B2G -T-shaped team. However, the usefulness they bring to any organisation is limited without the right tools – which is why our software solutions can add a greater degree of value. For example, being able to understand the intricacies of data analytics and audit requires the knowledge of these two disciplines, but it also needs access to the right data and tools.

A polymath is someone who has broad and disparate but also deep skills across multiple disciplines. They have the ability to access a wide toolkit to help solve audit and data management problems.

A polymath (or five legged sheep) will have highly prized and specialised skills, but they can only add value to audit processes if they have access to the right resources, for example by outsourcing to expand your portfolio of software and consulting solutions. TJC has a combined portfolio of software and consulting solutions to help address this gap.

“T-shaped’ skills are essential to tackle tax compliance projects today. Is your team ready to tackle tax compliance in a Volatile, Uncertain, Complex and Ambiguous environment? Download this infographic to find out the answer.

Ensure your auditors are fed the correct diet of data

Even the most innovative auditor may have to fight off organisational inertia to gain access to the potentially complex data required for a compliance project. Frequently, this occurs because the data being requested is different to the data that existing processes require. Auditors may need extra data at short notice to ‘dig down’ in certain analyses, or to enhance existing data for tax reporting purposes. The data they require may even reside outside the SAP ecosystem.

Asking customers (who may be the internal IT department) for ad-hoc complex data extracts, or for data within large database volumes or that has been archived off can become a real limitation on how efficiently auditors can work. And does the ‘customer’ have the technical skills or software solutions to even get targeted archive data in a realistic time frame anyway? It may not be feasible to get access because internal IT teams will need to respect their organisation’s SLAs or internal data access rules. They may not have the capacity to repeatedly spend time providing data.

TJC’s Audit Extraction Cockpit (AEC) is designed to resolve this issue. is a SAP certified self-service tool that frees IT teams from the burden of audit data extraction, by allowing IT administrators to set rules regarding data access or system load. It means auditors can get the data they need on demand whilst respecting security and IT restrictions. AEC ensures all transactions are logged and data access always follows the organisation’s internal rules.

B2G Compliance Services – simplify and add value to audit compliance

An interesting parallel to the relationship between data analytics and audit is that between data analytics and B2G (business to government) compliance. Many of the issues experienced by data auditors – like data coherence and tracking down inconsistencies in the data sources – are also present in B2G.

There are also often strict time limitations, which mean getting the correct data and validating it become urgent tasks. For instance, in Spain SII invoices must be submitted in under 4 days and in Poland, VAT invoices have to be submitted monthly. There is no margin for error.

TJC Group’s B2G range of tools and consulting services can help your compliance teams with the extraction, analysis and validation of data and files. By automating these processes and allowing auditors independent access to the data they need saves precious time. It enables auditors to focus on added-value tasks rather than spending time on repetitive tasks associated with data extraction and validation. Simple health checks conducted by our B2G team will ensure data consistency and can flag basic errors in the data when there is still time to make necessary corrections.

Learn how to perform a health check to ensure the accuracy of your Fichier des Écritures Comptables (FEC) submission in this blog article.

Add more legs to your sheep with TJC Group”

In addition to developing audit software solutions, such as AEC and SAF-T, TJC Group can help your compliance teams streamline processes and introduce automation. In essence we’ll help you ‘add more legs to your sheep’! Our B2G specialists are polymaths, able to deliver impartial advice on the best audit and tax processes to adopt, the most effective software solutions and how best to structure your audit and tax teams. Software tools for auditors are cloud based, incorporating multiple data sources both inside and outside the SAP ecosystem. They offer a wide range of added value and time saving functionality, including workflow management, data validation, analysis tools and can be fully integrated with external specialists including Aufinia.

If you want to know more about TJC Group Business to Government consulting services or software solutions for tax and audit, have a look at this video.

Contact TJC Group to learn more about our B2G services and SAP Data Extraction solutions for auditors.

Source:

- The Five Legged Sheep that knows Data Analytics and Internal Audit https://dataanalytics.aufinia.com/the-five-legged-sheep42267171

- Association for Talent development. https://www.td.org/insights/polymathy-a-new-kind-of-diversity-that-could-take-your-business-to-the-cutting-edge