Author: Patchanok Kluabkaew, SAP Finance Lead

Important Update for Businesses in Poland!

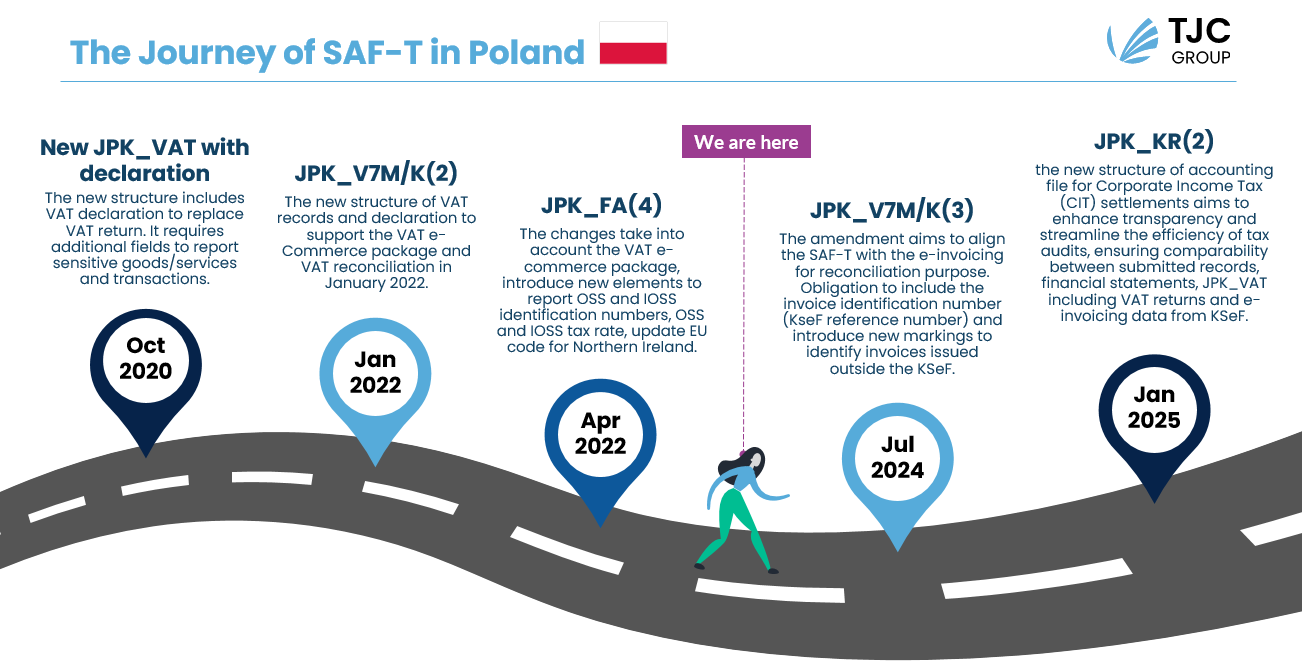

A draft regulation by the Minister of Finance is set to elevate the SAF-T Poland accounting file (JPK_KR) from optional to mandatory for Corporate Income Tax (CIT) settlements. This regulatory change under the Corporate Income Tax Act aims to enhance transparency and streamline the efficiency of tax audits, ensuring comparability between submitted records, financial statements, JPK_VAT including VAT returns and e-invoicing data from the KSeF system. The consultation phase is currently underway, and the regulation is slated to take effect on January 1, 2025.

Find here the proposal for the new JPK_KR structure released by the Polish government

The timeline for SAF-T Poland will be as follows:

- January 1, 2025: Applicable to large Corporate Income Tax taxpayers (revenues above EUR 50 million) and tax capital groups.

- January 1, 2026: Extending to other Corporate Income Tax and Personal Income Tax taxpayers obliged to submit JPK_VAT.

- January 1, 2027: Enforced for all Corporate Income Tax taxpayers.

Additional key data requirements in the new JPK_KR structure include:

- Identification data of the taxpayer’s contractor.

- Invoice identification number in the National e-Invoice System (KSeF reference number).

- Markings (tags) identifying booking accounts at the level of the trial balance (“ZOiS”) segment.

- Data confirming the acquisition, creation, or removal from the record of a fixed asset or intangible asset.

- The amount, type, and classification of differences between the balance sheet and tax result including:

◽ tax expense that is not a balance sheet expense

◽ balance sheet costs that are not a tax expenses

◽ tax revenue which is not balance sheet revenue

◽ balance sheet income that is not taxable income

◽ non-taxable income

◽ costs related to non-taxable revenues

◽ tax-free income - The amount and type of taxable income for taxpayers taxed with a lump sum on corporate income.

We highly recommend you to start the engine and analyse your financial and accounting systems to ensure compliance with the new requirements. TJC Group is here to assist you with SAF-T Poland inquiries or any other SAF-T requirements as well as e-invoicing-related queries.

Stay informed, stay compliant! Subscribe to B2G TJC Group newsletter to receive the latest updates on SAP Tax Compliance: https://info.tjc-group.com/tjc_newsletter-tax-compliance

FAQs

Q1. What is SAF-T in Poland?

Answer:

Poland is among the many countries that use the Standard Audit File for Tax (SAF-T) to streamline tax compliance and reporting for businesses. The country was one of the first in Europe to replace the traditional VAT return with SAF-T.

Q2. What is JPK in Poland?

Answer:

Jednolity Plik Knotrolby, also known as JPK in SAF-T in Poland, is an electronic document containing information about transactions made by a company during its business activity. The most important JPK files are the JPK VAT, which includes detailed value-added tax information. The adaptation of JPK is a part of a broader initiative to improve tax audits and fight illegal trade.

Q3. Why is the Polish government updating their SAF-T compliance?

Answer:

This regulatory change under the Corporate Income Tax is projected to improve transparency and streamline the efficiency of tax audits, which ensure the comparability between submitted records, financial statements, VAT information, including VAT returns, and invoicing data from the KSeF system.

Q4. What is the SAF-T Poland (JPK_KR) mandatory implementation timeline?

Answer:

The timeline for SAF-T Poland will be as follows:

- January 1, 2025: Applicable for large CIT taxpayers, who have revenue above EUR 50 million

- January 1, 2026: Extending to other CIT and PIT taxpayers obliged to submit JPK_VAT

- January 1, 2027: applicable for all CIT taxpayers

Q5. What additional information is required in the new JPK_KR structure?

Answer:

The new structure includes details, such as:

- Invoice identification number in the National e-invoice system

- Identification data of the taxpayer’s contractor

- Information that confirms acquisition, creation, or removal from the records of fixed assets

- The amount, type, and classification of differences between the balance sheet and tax result

- The amount and type of taxable income

Q6. In what format is JPK_KR submitted?

Answer:

JPK_KR must be generated and submitted in a specific XML format that adheres to the structure defined by the Polish Ministry of Finance.

Q7. What is the benefit of SAF-T?

Answer:

One of the key benefits of SAF-T in Poland is the enhancement of efficiency and speed of tax audits conducted by the tax authorities. By providing a specific and standardised format for data exchange, SAF-T allows tax authorities to access the required information quickly, reducing the time and effort needed for audits.