Table of contents

1. Introduction

Nothing exists in isolation and tax policy is no exception. New taxes are continually arising, with existing policies being modified to reflect changing social, economic and environmental trends. Governments are constantly seeking new, more accurate ways of securing tax revenues and financial information. This creates a minefield for international companies who operate in multiple geographies and who must comply with different regulatory standards. To help you stay up to date, TJC Group’s dedicated B2G (business to government) compliance team have compiled the latest B2G regulatory trends to be aware of.

2. Changes to tax policy structures

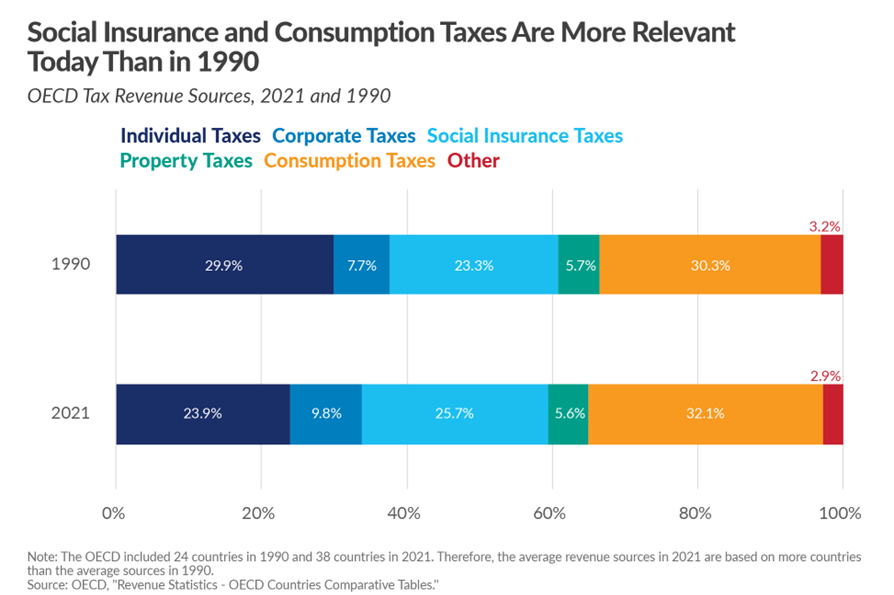

Over the past 30 years, we have seen significant changes to the way that governments are taxing different populations and for good reason. Taxes levied on goods and some services have become a much more important source of revenues, together with social care taxes, like national insurance contributions. This is expected given the aging demographic and the high cost of providing social security and social care.

Our ever-expanding appetite for consumer goods and the lucrative services economy provides an excellent revenue opportunity for governments who are now implementing measures to secure their incomes and prevent fraud. This is evident in the number of initiatives focusing on e-invoicing and e-reporting, designed to ensure taxes are paid on an ongoing basis as frequently as possible, which safeguards against avoidance measures.

The diagram below produced by the OECD illustrates how tax structures have shifted over the past 30 years, as populations have aged, and patterns of wealth have changed.

As indicated, much of this shift can be attributed to ongoing demographic changes. The global population is aging, and life expectancy is now generally higher worldwide, averaging at 70 in 2021. In under 30 years, by 2050, the United Nations is projecting that there will be 3.7 million centenarians alive globally, which has significant implications for tax and healthcare provision.

New sources of tax must be found, to counter the impact of a declining workforce and higher global unemployment. These will be significant macro trends, in part due to the advent of automation. If robots and machines are automating routine tasks, there will be a redistribution of jobs towards robotics and engineering roles. The skill mismatch also means some young people might end up working in underpaid jobs that do not match their skill set.

This trend will create the biggest shift to living standards this century and it will have an adverse effect on tax revenues long term. Fewer people will be contributing to income tax revenues and yet more will be receiving (or will want to be receiving) pension benefits. Yet fewer people will be contributing to income taxes. The early effects of this transition are already evident, with government interest in ensuring that the revenues they can generate are accurately collected increasing and an emphasis on taxing capital and wealth.

Read more on the macroeconomics side of global tax compliance in this article: An in depth understanding of the SAP Global tax compliance

3. Introduction of AI to tax administration

AI is a double-edged sword. While it has become an assistant in several organisations, tax administrations across the world are also investing heavily in digital transformation, including artificial intelligence. The OECD has published a global study which found that across 80 tax administrations globally, 44 countries are embracing Artificial Intelligence (AI) in various ways to enhance tax compliance, reduce fraud, and improve overall efficiency. The main reasons why governments are investing in AI optimise their tax administration activities are as follows:

- 68% – Detecting of tax evasion and fraud,

- 64% – Implementing risk assessment processes e.g. PIT, CIT and VAT,

- 61% – Launching virtual assistant services,

- 39% – Support services for users e.g. recommendations,

- 34% – Supporting tax officers with administrative decisions.

Source: TaxTech – Forum on Tax Administration (oecd.org)

One of the biggest challenges tax administrations comes across is the requirement from tax administrations for increasingly granular and real-time data. For example, in the context of e-invoicing, the challenge lies in identifying errors or non-compliance cases evident in the data before a return is submitted to the tax authority. Software vendors are working to provide solutions to this problem for enterprises, such as the SAP Tax Compliance solution or the SAP Document and Reporting Compliance solution. As specialists in B2G services for international organisations, TJC Group recommends that clients perform reconciliations among e-invoicing data, SAF-T files and tax returns on a regular basis, to ensure consistency.

4. Increased emphasis on carbon taxation

Over the past decade, the number of taxes dedicated to environmental sustainability and carbon consumption have been steadily increasing. Motivations are twofold. There is a clear desire to reduce CO2 emissions and control climate change but in addition, environmental management tax is an excellent revenue source for governments.

In spite of the global energy and economic crisis, many high-income nations have increased their strategies to accelerate the development of a low-carbon economy. This includes the implementation of Emissions Trading Systems (ETS) to offset polluting activities and the introduction of carbon taxes levied against organisational activities, with permit prices rising due to market forces influencing energy prices. The future effectiveness of carbon prices in EU countries was strengthened by the announcement that a Carbon Border Adjustment Mechanism (CBAM) would be implemented across the EU, beginning with a transitional phase in October 2023.

5. How does the CBAM (Carbon Border Adjustment Mechanism) work?

The CBAM, also known as the ‘carbon border tax’, will initially apply to companies importing carbon-intensive products and at high risk of carbon leakages such as cement, iron and steel, aluminum, fertilisers, electricity, and hydrogen. This tax on imports requires importers to pay a levy on all carbon emissions associated with goods that they bring into the EU.

To support users with their carbon emissions reporting obligations, SAP has launched a new solution, SAP Sustainability Footprint Management. SAP Sustainability Footprint Management allows organisations to get highly granular footprint calculations on product and corporate emissions across scope 1, 2, and 3, gaining detailed carbon footprint insights. With emissions data embedded beside operational and financial data in SAP S/4HANA Cloud, business functions including procurement, supply chain, operations, and finance can see the broader context of their sustainability impacts, enabling better business decisions.

6. What are the latest ESG reporting requirements?

There are now many ESG reporting frameworks such as GRI standards, Corporate Sustainability Reporting Directive (CSRD) in the EU and Task Force on Climate-related Financial Disclosures (TCFD). Of these, CSRD reporting forms part of the EU Green Deal, which requires all large companies and all listed companies to report on sustainability. Companies subject to the CSRD will have to report according to European Sustainability Reporting Standards (ESRS). These organisations must apply the new rules in the 2024 financial year for reports published in 2025.

To support companies who need to ESG collate data for reporting purposes, SAP now offers a dedicated solution, the SAP Sustainability Control Tower. Using the SAP Sustainability Control Tower, organisations can combine different data sources for one trusted view of their ESG data. By automating the collection and integration of sustainability data, companies can set targets to steer their business to achieve sustainability goals holistically, monitor progress and gain actionable insights from dependable data, and enhance trust by establishing robust and auditable ESG reporting to global standards.

Like TJC Group’s ELSA (Enterprise Legacy System Application) solution which makes accessing decommissioned data very straightforward, SAP Sustainability Footprint Management and SAP Sustainability Control Tower are built on SAP Business Technology Platform (SAP BTP). This provides a seamless integration with SAP S/4HANA Cloud.

7. Keeping up the global industry tax trends

The widespread adoption of e-invoicing, e-reporting and the integration of AI by tax administrations is reshaping the way businesses engage with tax authorities. Ensuring data accuracy before submission and selecting the optimal reporting solution are pivotal steps in staying ahead of the curve of global tax compliance changes.

TJC Group supports organisations with consulting and software services to keep up to date with the latest regulatory updates, as well as to meet the e-invoicing and e-reporting requirements worldwide. We will ensure you are always compliant with the latest regulatory requirements across multiple geographies, can provide data to regulators in the correct formats and we take the burden away from reporting to the authorities. Given the increasing complexity of government tax policy and the level of reporting required for compliance purposes, working with a B2G specialist like TJC Group makes sound business sense. Contact us to talk to our Business to Government Specialists

Stay up to date on e-invoicing and e-reporting and global tax compliance through our blog posts. We’ve compiled comprehensive insights to make the process of learning about electronic invoicing and reporting both engaging and effortless.

Sources:

- Tax Policy Reforms 2023 : OECD and Selected Partner Economies | OECD iLibrary (oecd-ilibrary.org)

- Consumption Tax Trends 2022 : VAT/GST and Excise, Core Design Features and Trends | Consumption Tax Trends | OECD iLibrary (oecd-ilibrary.org)

- Carbon Border Adjustment Mechanism (europa.eu)

- Corporate sustainability reporting (europa.eu)