With e-invoicing and e-reporting gaining momentum across the world, knowing even the slightest of its aspects is paramount. Quite an important aspect here would be to Continuous Transactions Control (CTC). Fact of the matter, many governments are turning towards CTC to strengthen their economies. But do you know why? Fret not if you don’t know about it. We have just the right blog for you. Read on!

Table of contents

A digitalised approach to revolutionising tax compliance

Digital transformation is a magic that casts its spell everywhere – and, of course, for the good! Now that digitalisation in the financial sector is moving towards a monumental journey, the introduction of Continuous Transactions Control for e-invoicing is more important than ever.

What is Continuous Transactions Control?

Abbreviated as CTC, it helps law enforcement organisations like tax authorities collect data on various business activities in their respective countries. Using this method, authorities can obtain data directly from business transactions or data management systems in real-time or near real-time.

Encompassing a compilation of regulatory mandates and technological solutions, CTC for e-invoicing signifies a ground-breaking and innovative approach towards tax reporting and compliance. The solutions and mandates are curated meticulously to administer and authenticate business transactions in real time. CTC touted as a transformative system, helps achieve transparency and efficiency to a heightened extent.

What are the basic functionalities of CTC?

The Continuous Transactions Control systems for e-invoicing compel businesses to submit or disclose transactional data to tax authorities during invoice issuance or at a given point of exchange. The system also guarantees that sales, purchases, and other financial transactional data are accessible to tax authorities seamlessly. It will furthermore help the authorities determine the accuracy and compliance of the submitted transactions.

However, the primary objective is to ensure enhanced transparency, reduce and entirely terminate tax evasion, and streamline the associated tax reporting processes. Benefiting from digital technology, these CTC systems allow autonomous cross-verification of transactional data against tax reporting, further minimising errors and discrepancies.

Advantages of Continuous Transaction Controls for e-invoicing

With the help of CTC for e-invoicing, tax administration can conduct checks and validations on VAT compliance, thereby ensuring a more effective tax collection and minimising tax evasion and fraud. Consequently, countries also aim to reduce the VAT gap through CTC systems. VAT gaps are the difference between the estimated VAT revenues and the actual revenue collected. Over the years, the VAT gaps have been tremendous; however, the implementation of Continuous Transactions Control for e-invoicing has significantly helped in reducing these gaps. Statistically speaking, Brazil saw an increase in their tax revenue by approximately USD 58 billion after their CTC approach.

Additionally, Mexico and Chile reported a reduced VAT gap of around 50% with CTC. Another statistic shows that Poland – a country that usually reported VAT gaps of around 25%- saw a huge decline in the gaps, reporting only 10% in 2020. As a matter of fact, this decline in the gap has made Poland one of the most successful countries in the European Union in tackling VAT gap reduction.

The overall VAT gap across the world, as estimated, falls between 15% and 30%; Continuous Transactions Control for e-invoicing has tremendous potential to save governments significant amounts of money through enhanced tax compliance measures.

Different models of CTC for e-invoicing

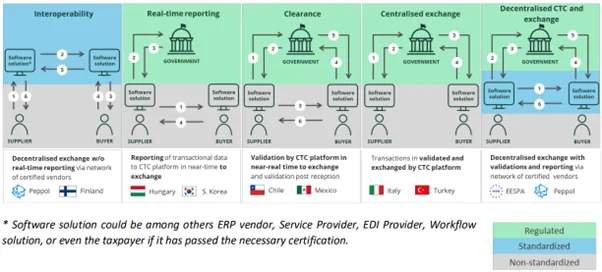

The models for Continuous Transactions Control are country-specific and vary in design and implementation. The models can either be centralised or decentralised. The centralised systems require suppliers to send the e-invoices through a centralised system for tax authorities. On the other hand, the decentralised models enable suppliers to send the e-invoices to the buyers directly, simultaneously reporting data to the tax authorities.

Having said that, even though the models may vary from country to country, we can group the Continuous Transactions Control for e-invoicing models into broad categories as per their features –

Interoperability

The interoperability feature in the CTC model for e-invoicing allows taxpayers to use a service provider for exchanging e-invoices. Furthermore, the service providers can decide which formats to use for e-invoice exchanges, thereby resulting in open networks with several interoperable formats. Also called the 4-corner model, this model helps facilitate business automation and digitalisation.

Real-time invoice reporting (RTIR)

Abbreviated as RTIT, the real-time invoice reporting CTC model is established in Hungary and South Korea, where there are no regulations for invoice exchanges. However, the supplier still must report a subset of the invoice data to the respective tax authorities in real-time. However, you can send it once the invoice is sent to the buyer. Additionally, the submitted invoice dataset must be in the mandatory format, including specified data such as document type, name, and VAT number of trading parties and VAT amounts.

Clearance model

Around 2002, we saw countries like Chile, Mexico, etc., implement certain requisites for taxpayers, where businesses had to clear (fiscal validation and approval) or authorise invoices through tax authority platforms. It had to be done before businesses could send the invoices to the end recipients, like the buyers. Consequently, it came to be known as the “Clearance model”. This Continuous Transactions Control model for e-invoicing gained rapid traction, wherein most LATAM countries adopted it. But there is a twist! Even though LATAM countries opted for the clearance model, each of them has implemented its own essence to the model.

For example, a few countries like Mexico, Panama, and Guatemala delegated their invoice clearance to the Accredited PAC Service Providers instead of the local tax authorities.

Apart from this, the clearance model has two more verticals namely, the pre-clearance or hard clearance models and the post-clearance or soft clearance models. For the pre-clearance CTC models for e-invoicing, invoices must be cleared through the local government authorities before you send them to the buyer. Whereas, in the post-clearance model, there are no such requisites. Countries like Chile and Peru have adopted the post-clearance model, allowing taxpayers to distribute the tax invoices to the buyer before sending them to the tax authorities for clearance.

Overall, the clearance Continuous Transactions Control models for e-invoicing have expanded to several other countries like India, Saudi Arabia, and a few in Southeast Asia.

Centralised exchange

Ever since the release of the EU Procurement Directive, requiring public entities to accept e-invoices, many new requisites have been implemented by European countries. As a matter of fact, e-invoicing for B2G transactions is growing to be a common ground across the EU.

Centralised exchange basically means having a mandatory exchange mechanism throughout the country across all the businesses for e-invoicing and e-reporting via the central platform established by a government agency. Countries like France, Belgium, Italy, Spain, and Portugal have already established infrastructures for receiving e-invoices on behalf of public buyers. Having said that, some countries have chosen formats like PEPPOL to receive e-invoices.

Specifically, businesses in Italy must send FatturaPA e-invoices to SDI to deliver the invoices to the buyer. Fact of the matter, it reduced tax evasion successfully while strengthening the economy. Thereby, inspiring other European countries to implement similar centralised CTC for e-invoicing models.

Decentralised CTC and Exchange (DCTCE)

PEPPOL CTC

An upgraded version of the PEPPOL 4-corner model, the PEPPOL CTC model has the PEPPOL Access Points. It reports transactional data to the tax authorities. One of the unique features of this Continuous Transactions Control for e-invoicing model is that it allows automation for businesses. Additionally, it also allows greater control over the economy for tax authorities.

Hybrid model

The hybrid CTC model for e-invoicing is an amalgamation of DCTCE and centralised exchange models. As a matter of fact, Spain is potentially looking for its implementation in the country. Additionally, while France has implemented the hybrid model, they planned to utilise the PEPPOL network for establishing interoperability amongst the PDPs.

Adopt Continuous Transactions Control for efficiency & compliance

The widespread adoption of CTC models for e-invoicing reflects a much larger trend of businesses, legal and government authorities steering towards the ongoing digital transformation. Of course, this aligns with the global initiatives aimed at strengthening the efficiency of tax processes and financial transparency.

As the number of countries embracing Continuous Transactions Control for e-invoicing keeps increasing, businesses engaging in international operations must navigate its requirements for CTC to ensure compliance.

E-invoicing and e-reporting, together, is an ocean where these CTC models are just a few corals emerging upwards. There are several channels, formats, and more encompassing the shore of electronic invoicing and reporting. To cross this ocean, your ship needs experienced navigators who will ensure a smooth sail. In this case, TJC Group is that navigator for you!

For e-invoicing and e-reporting, SAP Document Reporting and Compliance or SAP DRC is your go-to solution. We use the SAP Activate Methodology for implementing SAP DRC. We plan, execute, and deliver the project with optimised templates and accelerators. Our experts will assist you from start to finish with the entire process and even beyond that (post-go-live). Join hands with us to implement SAP DRC and leverage the expertise of our senior SAP finance consultants. Connect now!