Author: Priyasha Purkayastha, Global Content Manager, TJC Group | Co-author: Patchanok Kluabkaew, B2G Lead, TJC Group

From France to Belgium to Italy and more – countries across the world have either implemented or are in the process of implementing e-invoicing and reporting. Today, electronic invoicing has transitioned from being just an optional solution to improve processes to a full-fledged mandate that helps automate the tax landscape. However, the global e-invoicing and reporting solution comes with its fair share of challenges – ranging from ERP integration to country-wise compliance and more. In this blog, we address the top challenges of e-invoicing in 2025 and how SAP DRC can help overcome them.

Table of contents

E-invoicing and reporting: A boon to the tax landscape

More often than not, organisations and tax authorities are burdened with the task of rectifying errors in paper-based invoices, spending time, even weeks, in doing so. Not only did this lead to delays in the process, but it also became financially burdensome due to penalties. That being said, tax authorities had to keep tax fraud and evasion in check, which was not a simple task to handle. Additionally, the growing concerns about sustainable solutions also contributed to the woes of both organisations and authorities.

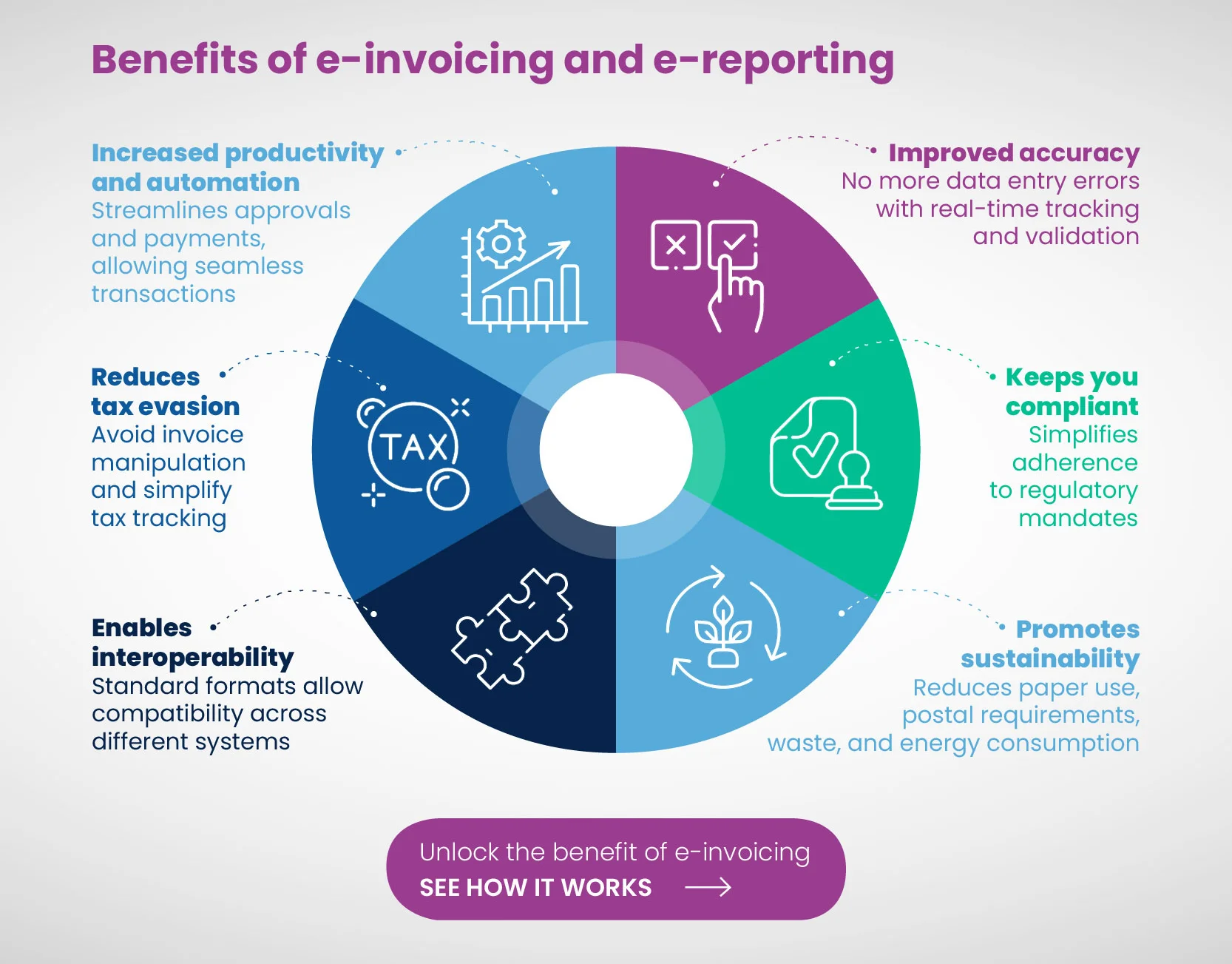

All in all, the shift towards electronic invoicing was not just a welcome move but also a much needed one. With its advent, global e-invoicing and reporting have now become an essential part of organisations’ digital strategies across all industries. The solution is driven by operational efficiency, the need for streamlining financial processes, and much more, helping it gain momentum worldwide. Electronic invoicing and reporting have genuinely become a boon to the global tax landscape, offering numerous benefits that are unparalleled.

Why is e-invoicing and reporting becoming essentially critical for businesses?

As we have mentioned before, the move towards making electronic invoicing and reporting mandatory is driven by the need for better compliance and greater operational efficiency. We are in an era where digitalisation has become a norm for reshaping organisations – be it the IT structure, finance and accounting, or any other department. Despite the challenges of e-invoicing in 2025, several governments have mandated its implementation this year, not just to curb tax fraud but also to increase transparency. As a matter of fact, countries like Brazil, Italy, Mexico, India, Spain, the UK, and so on are already leveraging its benefits through early implementation. If reports are to be started, e-invoicing and reporting will become a standard in the next 3 to 5 years.

Additionally, businesses are transitioning to e-invoicing and reporting due to its numerous benefits, including automating data entry, facilitating easy data validation, and reducing errors associated with mis-typed details, duplicate invoices, delayed or missed payments, and penalties, among others. In fact, automation in global electronic and reporting solutions helps improve accuracy, allowing for better real-time visibility into financial data that enables enhanced business decision-making and forecasting.

With global e-invoicing and reporting solutions, you can reduce the time spent on manual invoice processing. In fact, the comprehensive benefits of electronic invoicing scale extensively for organisations that deal with higher volumes of transactions, thereby improving operational efficiency. Most importantly, electronic invoicing and reporting significantly contribute to reducing paper and transportation-related emissions, thereby reducing carbon footprints and helping organisations achieve their sustainability goals.

What are the challenges of e-invoicing in 2025?

There is no doubt that electronic invoicing and reporting are massive boons to the tax and compliance landscapes. However, organisations can face several challenges when implementing these solutions. These obstacles can vary from integrating the technology with the organisation’s current ERP system to understanding the impact of the mandate’s compatibility issues and many other factors. Addressing these challenges of e-invoicing in 2025 is essential for organisations to achieve a streamlined and smooth implementation.

Integrating e-invoicing software with ERPs

One of the major challenges that organisations face when implementing e-invoicing and reporting is integration with existing ERPs. You see, e-invoices are not simple PDFs; they are built on machine-readable formats that are backed by strict government rules. This means that the integration can be complex, and ERPs may require a few major upgrades. All in all, an organisation’s existing ERP must have the provision to be integrated with APIs and any other business systems that are customised for e-invoicing and reporting structures.

However, the challenge of integrating them arises because businesses typically have different ERPs or billing systems across their departments. Additionally, combining these systems becomes complicated due to several factors, including different data structures, technologies, and versions, as well as varying communication protocols. One of the ways organisations can prepare their ERPs or business systems is by transforming, mapping, or cleaning data for compatibility and accurate information exchange.

An array of regulations to comply with

With global e-invoicing and reporting implementation, organisations face another significant challenge – the array of regulations to comply with. The fact of the matter is that no country will ever have the exact regulatory requirements. Despite the efforts of a unified and harmonised approach, the closest one can get is to have similar regulations but not the same one entirely. There exist various formats, exchange models, CTC models, validation mechanisms, and more. What’s even more surprising is that these variant requirements sometimes exist even within the same region.

Consider the European Union (EU), for example – while France plans to introduce a clearance model, Germany intends to adapt a structured invoice reception system before proceeding to broader mandates. You may say these differences are subtle, and they are, but the implications of these differences are significant. Unfortunately, this lack of a universal approach makes the implementation process significantly more complex, especially for organisations that operate internationally. Having said that, it is not just the legal regulations that businesses must follow; there are also data privacy laws, which differ from country to country, as well as sustainability missions that organisations must consider for compliance.

Ensuring the integrity of data

One of the significant challenges of e-invoicing in 2025 is ensuring and maintaining data integrity. As a matter of fact, it is not just the integrity but also the accuracy of data that plays a crucial role in electronic invoicing and reporting. Organisations must ensure that they have robust and meticulous data validation techniques in place. As government authorities directly receive your data, any errors or discrepancies can result in severe penalties. Additionally, organisations must ensure that they employ digital signatures (as required by the country’s regulations) and other verification methods to protect data against fraud and tampering. However, even with all these methods in place, the question of “how far they are reliable” remains.

Challenges in the reconciliation of e-invoices and VAT returns

Possibly one of the overlooked factors – complications in the reconciliation of data from e-invoices and VAT returns can hinder the global e-invoicing and reporting implementation. At times, there may be a scenario in which, after uploading the invoice to the electronic invoicing portal, organisations may need to reconcile the data. The catch is – this reconciliation should happen automatically; however, there have been instances where the data was not reconciled. In such cases, users would require a tool or utility for data reconciliation, which can be quite tedious.

Cashflow management

For any organisation to operate smoothly, regular and stable cash flow is highly essential. However, with electronic invoicing, a common question arises – what if the cash flow is slow or delayed? Although this may not be an issue in itself, an inefficient system can exacerbate several challenges of e-invoicing in 2025. How? Electronic invoicing systems can lead to significant delays in sending invoices; they may have inaccuracies in the invoices, which can cause disputes, and so on. In turn, this leads to delays in payments from customers as well as missed opportunities for early payment discounts. Thereby impacting the organisation’s receivables and cash flow.

Overcome your e-invoicing challenges with SAP DRC

With these global e-invoicing and reporting challenges, organisations often get sceptical about its implementation. What if there were a solution that could help you overcome electronic invoicing challenges with ease? What if there exists a solution that can help you implement electronic invoicing and reporting seamlessly?

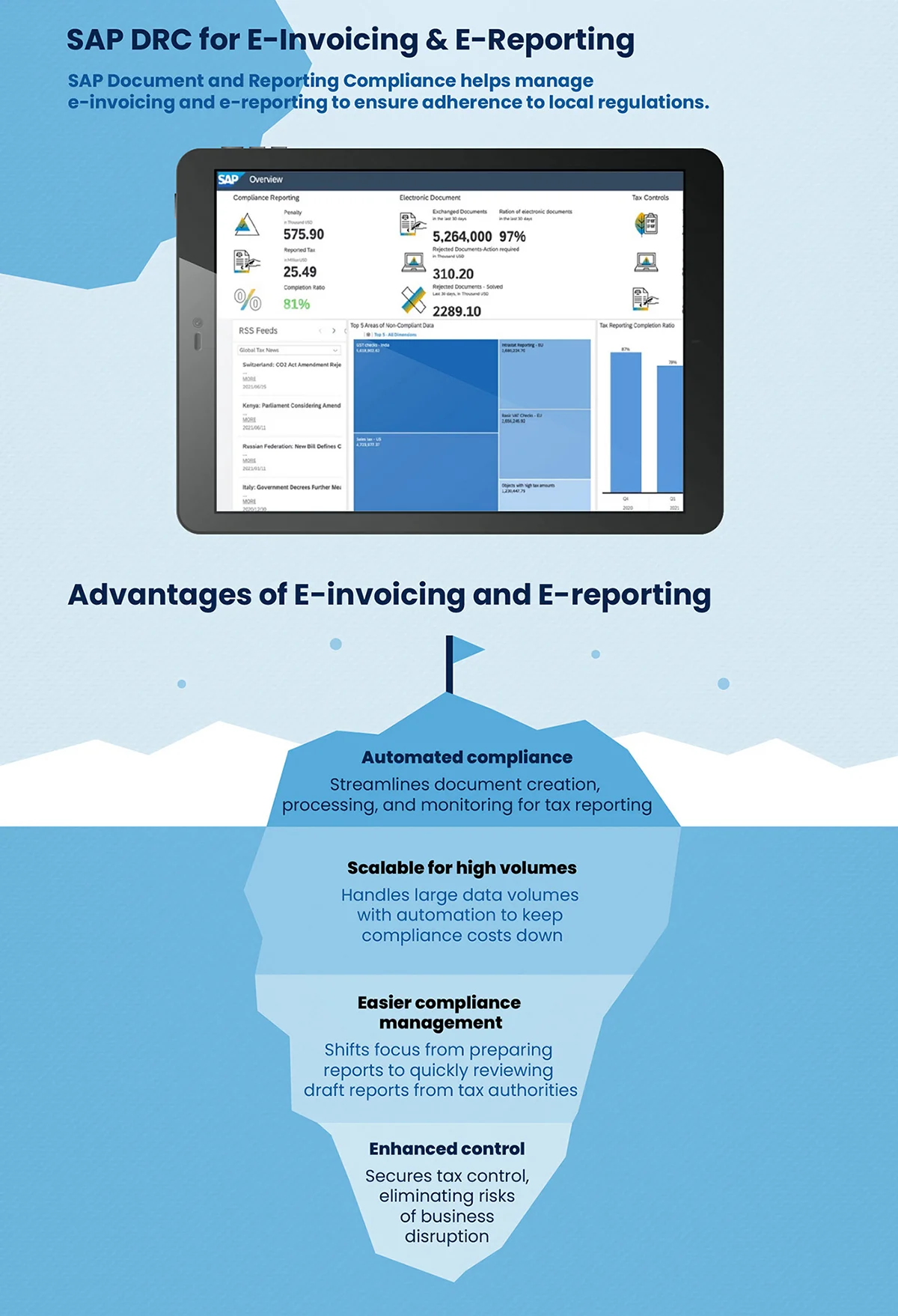

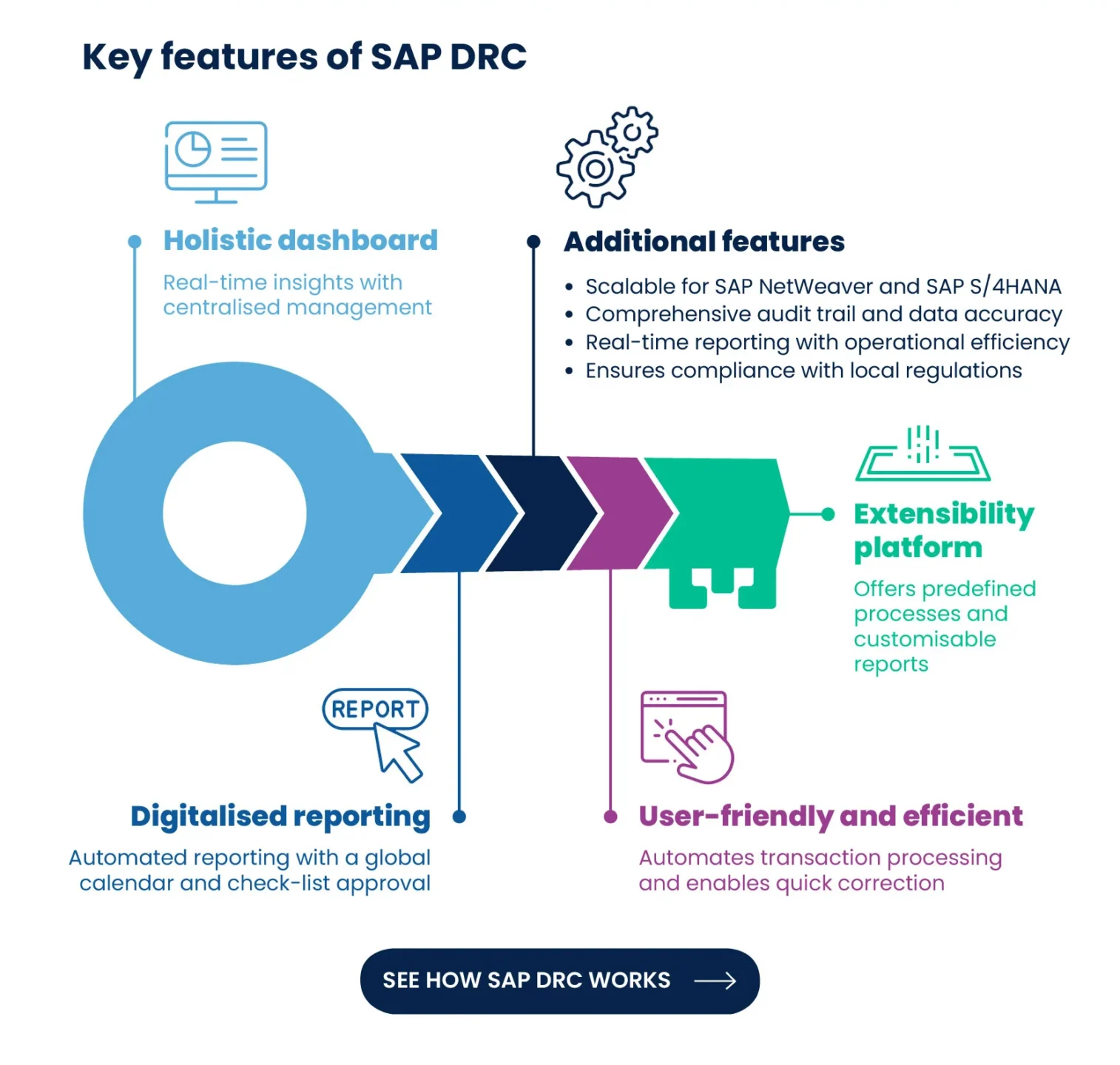

Fortunately, you have SAP Document and Reporting Compliance (SAP DRC) at your disposal. It is your go-to software solution for overcoming any challenges related to e-invoicing and e-reporting. The solution helps you create, process, and monitor transactional documentation and periodic reporting, thereby enabling organisations to remain compliant with the region’s legal framework and regulations.

The SAP Document and Reporting Compliance offers a more streamlined approach to tax compliance powered by its embedded automation. In turn, this automation enables organisations to maximise efficiency, reduce compliance risks, and enhance the sustainability of tax operations. Moreover, all these features, when combined, help achieve significant cost reduction.

Stand-out features of the SAP DRC solution for organisations

Interestingly, the SAP DRC solution is designed with extraordinary features, making it one of the most reliable solutions to overcome the challenges of e-invoicing in 2025. Some of them are listed below:

- The SAP Document and Reporting Compliance solution features a compliance calendar, enabling users to prompt and monitor obligations worldwide.

- The solution helps automate submissions and gain insights, which are backed by data on transactions. Furthermore, this feature helps support a complete and comprehensive audit.

- One of the most interesting features of the SAP Document and Reporting Compliance is the customised checklist. It helps digitalise and automate activities through adjustments to approvals within the record systems.

- Yet another stand-out feature of the DRC solution is its ability to embed real-time, actionable insights into the ERP systems. In turn, this helps prevent disruptions and ensures a smooth operation.

- Lastly, this solution has a centralised entry point that helps in managing any corrections and follow-ups in a much more proficient manner.

SAP DRC is truly one of the most efficient and comprehensive global e-invoicing and reporting solutions, making its implementation into organisations much easier and streamlined.

The final word

All in all, it is crucial to ensure that organisations are prepared to comply with the ever-changing global regulations when implementing electronic invoicing and reporting. That being said, partnering up with experts who can help with e-invoicing implementation can be a significant boon to organisations.

TJC Group holds expertise in SAP DRC implementation, following a customised approach backed by the SAP Activate methodology. It is a proven process that helps in planning and executing the project, thereby ensuring the timely delivery of optimised accelerators and templates. Our team of B2G experts defines the best scope of practice while developing an initial scope statement and timeline for the implementation.

With 25+ years of experience in overall data management and tax compliance, our experts ensure that we execute Project Quality Gate at the end of each phase, verifying that acceptance is met for all the deliverables required, enhancing project quality and minimising project risk exposure. Join us in implementing SAP Document and Reporting Compliance and tackling the challenges of e-invoicing in 2025 with seamless efficiency. Contact us now for more information!