Table of contents

- Introduction

- What is e-invoicing?

- What is e-reporting?

- Merging the pros of e-invoicing and e-reporting

- Drivers of e-invoicing in Europe

- How is e-invoicing deployed across the world?

- The different formats for e-invoicing and e-reporting

- What are the different channels for e-invoicing?

- What are the different models for Continuous Transactions Control (CTC)?

- Key benefits of e-invoicing and e-reporting

- How can organisations prepare for the e-invoicing mandate?

- Challenges of e-invoicing & e-reporting

- SAP DRC for e-invoicing & e-reporting

- Key features of SAP DRC

- Benefits of integrating SAP DRC for e-invoicing & e-reporting

- Choosing TJC Group as your partner for SAP DRC

- TJC Group’s methodology for SAP DRC implementation

- What makes TJC Group stand out from the crowd?

- Countries that support SAP DRC

- Conclusion

- Additional resources for e-invoicing

Introduction

The concept of e-invoicing and e-reporting is not new; however, its relevance has grown exponentially in recent years. But what made this concept grow multi-fold? There can be multiple factors supporting this argument – amongst them, minimising compliance risk and sustainability. Along with this, the COVID-19 pandemic acted as a catalyst in pushing forward digital technologies like e-invoicing and e-reporting. With e-invoicing and e-reporting, real-time reporting on business activities is possible, which is a need in the end-to-end tax management landscape. Read this detailed blog to understand the nuances of e-invoicing and e-reporting, and how SAP Document and Reporting Compliance (SAP DRC) is the way to go forward.

What is e-invoicing?

In simple words, electronic invoicing, or e-invoicing, is a form of electronically billing invoices between a supplier and a buyer. The invoice comprises the same information that a paper invoice would have i.e., purchase order, line items, purchase amount, credit notes, and so on. That said, keep in mind that an e-invoice is different from a digital invoice. While digital invoices are just PDFs or scanned documents of paper invoices, e-invoices are files that contain structured data, which are automatically exchanged and processed by accounting and ERP systems.

“The e-invoicing solution helps make operation more seamless, where the invoices can be transmitted into the customer’s ERP system directly in just a few seconds. E-invoicing has unfolded progressively across the globe and more countries have plans to adopt it to automate processes in their finance departments and save cost. “

However, most recently, governments in several countries (Italy, France, Spain, Poland, and so on) have started mandating the use of e-invoicing for organisations of all sizes. Although, PEPPOL could be considered as a global standard as many countries outside Europe widely use it in B2B; in general, the mandate states that businesses must electronically transfer invoices to other businesses, in parallel to tax authorities. That said, technical implementations, required formats, and other factors do vary from country to country and are subject to changes. Read on to learn more about it.

What is e-reporting?

Electronic reporting or e-reporting is a process in which vendors electronically transmit value-added tax (VAT) data directly to the tax authorities. However, a few countries (for example: SII Spain) do require the buyer to send the VAT invoice transactions; consequently, in France e-reporting, some specific transactions such as self-billing, intra-community acquisitions, and so on, are required.

E-reporting is also known as real-time reporting as the transmission of data happens in real time or near real time.

The electronic reporting mandate allows tax authorities to better estimate the VAT information, track performance and trends in the economy, detect inconsistencies, errors, and frauds early, and much more. Although, an e-reporting requirement is likely to link to an e-invoicing mandate, it can also be a stand-alone one.

Furthermore, e-reporting can vary depending on the type of transaction. For the most part, e-reporting is centralised model, meaning that businesses send transactions to the platform of tax authorities. However, a few countries like France, use a decentralised model to allow businesses to choose either public or private dematerialisation platform; continuing to use their current platform can help businesses to minimise their cost of reinvestment. This also helps both suppliers and buyers to complete the e-invoicing process without intermediation while only having to provide the required data to the country’s tax authorities.

The e-reporting flow comprises the records of all the stages through which the information passes – from the receipt by the specific dematerialisation platform to its declaration to the national platform. It helps in extensively monitoring the life cycle of the declaration transmissions. Generally speaking, it is suggested to keep track of the following statuses –

- Data received by the platform

- Data accepted by the platform

- Partially accepted data

- Rejected data

Merging the pros of e-invoicing and e-reporting

Invoices are the main source of information for VAT and business activities; therefore, e-reporting becomes an extension of e-invoicing, organically. Several countries in the European and LATAM regions have combined e-invoicing and e-reporting requirements into one mandate. Again, the implementations vary from region to region, but the principle is similar.

There is a pre-clearance model that some countries have adopted where suppliers must submit the invoices to the tax authorities first; after the approval from the tax authorities, the invoices can be forwarded to the buyers. For example, in Europe, pre-clearance centralised model is used in Italy, Romania and Poland. Pre-clearance is not accepted in ViDA DRR, so the adaption is anticipated for these countries to converge to ViDA.

With e-invoicing and e-reporting merged together, the process of exchanging invoices data between suppliers and buyers become more streamlined while enabling tax authorities to retrieve the much-required VAT information in real time.

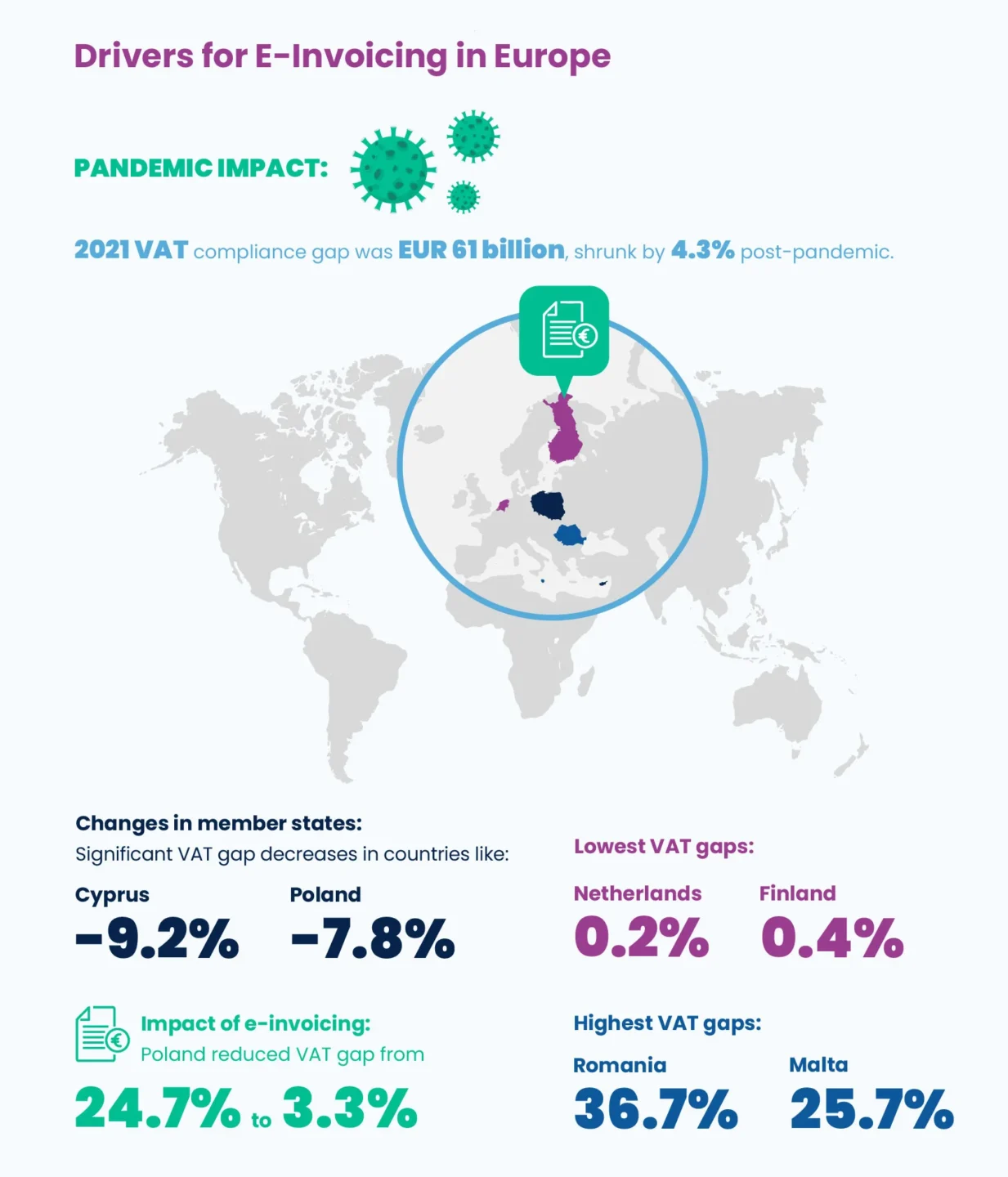

Drivers of e-invoicing in Europe

The last three years, especially 2020, was a tough one owing to the global pandemic. It became more volatile, uncertain, complex, and ambiguous than before, and the tax compliance landscape was no exception.

However, in 2021, there was a recovery in revenue and liability, exceeding pre-pandemic levels. In the past two years, the VAT compliance gap significantly narrowed – in 2020, the gap decreased by 1 percentage point (pp) and in 2021, it was 4.3 pp. That said, in 2021, the VAT compliance gap estimate came up to EUR 61 billion or 5.3% of the VAT Total Tax Liability (VTTL).

At the member state level, the VAT compliance gap showed significant albeit turbulent Year-over-Year (YoY) changes in 2021. Compared to 2020, the changes ranged from a 10.7 pp decrease to a 0.7 pp increase. Despite this, overall VAT compliance increased in only two EU-27 member states, namely, Denmark (0.7 pp) and Sweden (0.2 pp).

The most significant decreases in the VAT gap were seen in Cyprus (-9.2 pp), Italy (-10.7 pp), Poland (-7.8 pp), Belgium (-6.7 pp), and Ireland (-6.0 pp).

Coming to the smallest VAT gaps, the following countries were on the list – the Netherlands (-0.2 pp), Finland (0.4%), Spain (0.8%), and Estonia (1.4%). Generally, negative estimates are not possible; however, in member states where non-compliance is already low, negative values can occur due to statistical and measurement errors. Consequently, on the opposite side of the ranking are Romania (36.7%), Malta (25.7%), Greece (17.8%), and Lithuania (14.5%).

Although, in nominal terms, the largest gaps were estimated for France (EUR 9.5 billion) and Romania (EUR 9.0 billion). Check out https://taxation-customs.ec.europa.eu/taxation-1/value-added-tax-vat/vat-gap_en for more information!

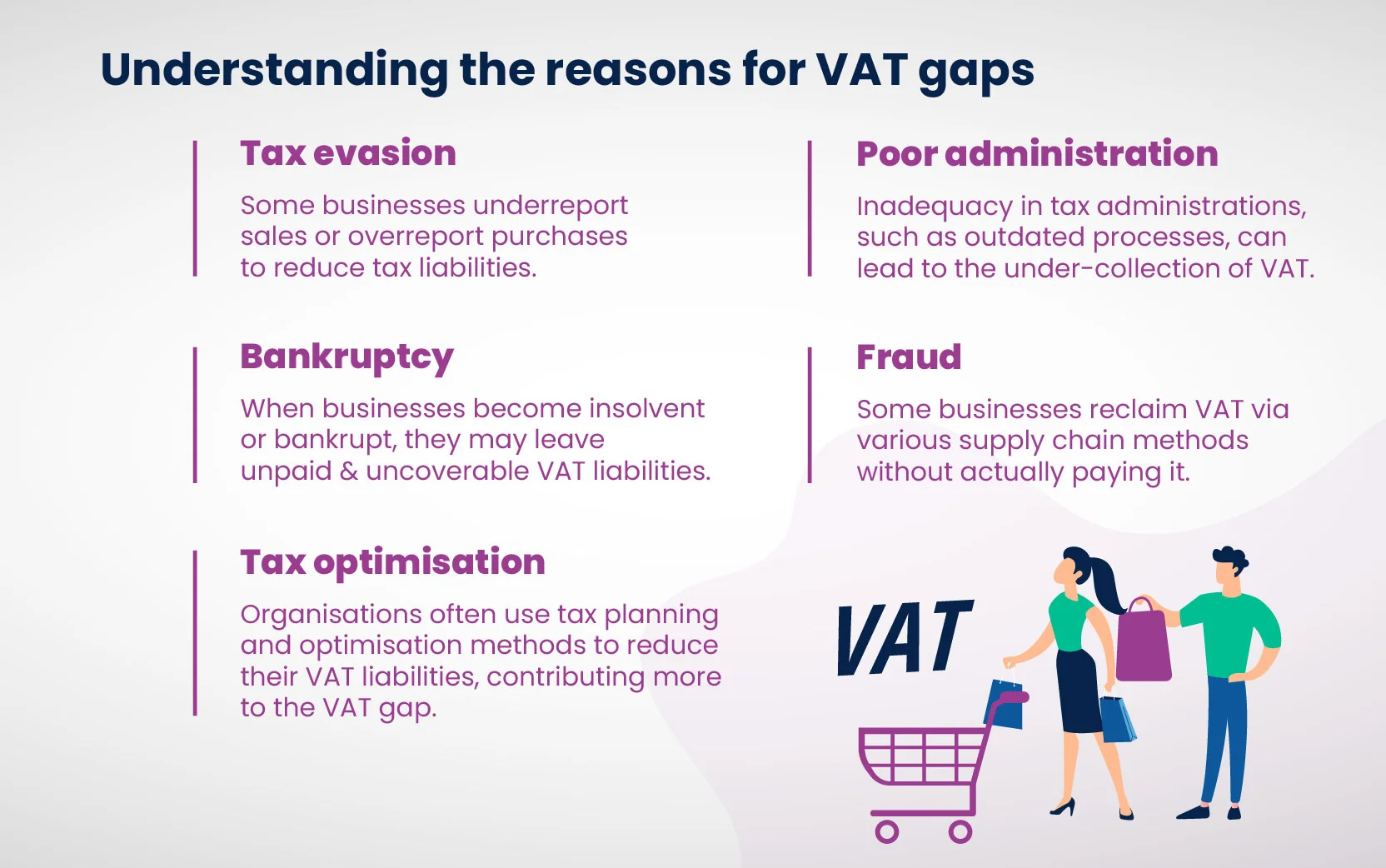

Why do these gaps occur? What are the driving factors for these gaps? The reasons are simple –

- Fraud and tax evasion

- Poor administration

- Corporate insolvency

- Corporate bankruptcy

- Legal tax optimisation

So, how can TAX authorities reduce the gaps? The enforcement of tax requirements is the starting point. Evidently, the SAF-T adoption helped Poland reduce its VAT gap from 24.7% to 3.3% between 2015 and 2021. However, even with post audit models like the SAF-T, tax authorities must wait until the end of the month or a set tax audit period to access and audit their taxpayer data. But, with e-reporting, tax authorities have a copy of taxpayer data in near real-time (1 – 4 working days), making the process much more efficient. The e-invoicing solution offers the ultimate approach because invoices must be pre-approved by tax administration before issuing to customers, eliminating potential revenue leaks. As a matter of fact, real-time VAT reporting enabled Spain to achieve a significantly large VAT gap reduction.

Over the years, the VAT landscape has evolved, and with that, VAT in the Digital Age, or ViDA, intends to modernise the system to simplify VAT compliance for businesses and to ease cross-border e-commerce transactions. ViDA is European Union’s effort to create a digital-backed single market, where both consumers and businesses can trade more efficiently and effectively. Moreover, VAT in the Digital Age can also help reduce the VAT gaps. The digitalisation of VAT compliance helps increase the tax revenues as well as improve compliance – making this approach more politically palatable to increasing realised taxes than raising VAT rates.

To learn more about ViDA, head on to our detailed blog here: https://www.tjc-group.com/blogs/what-is-vat-in-the-digital-age-vida/

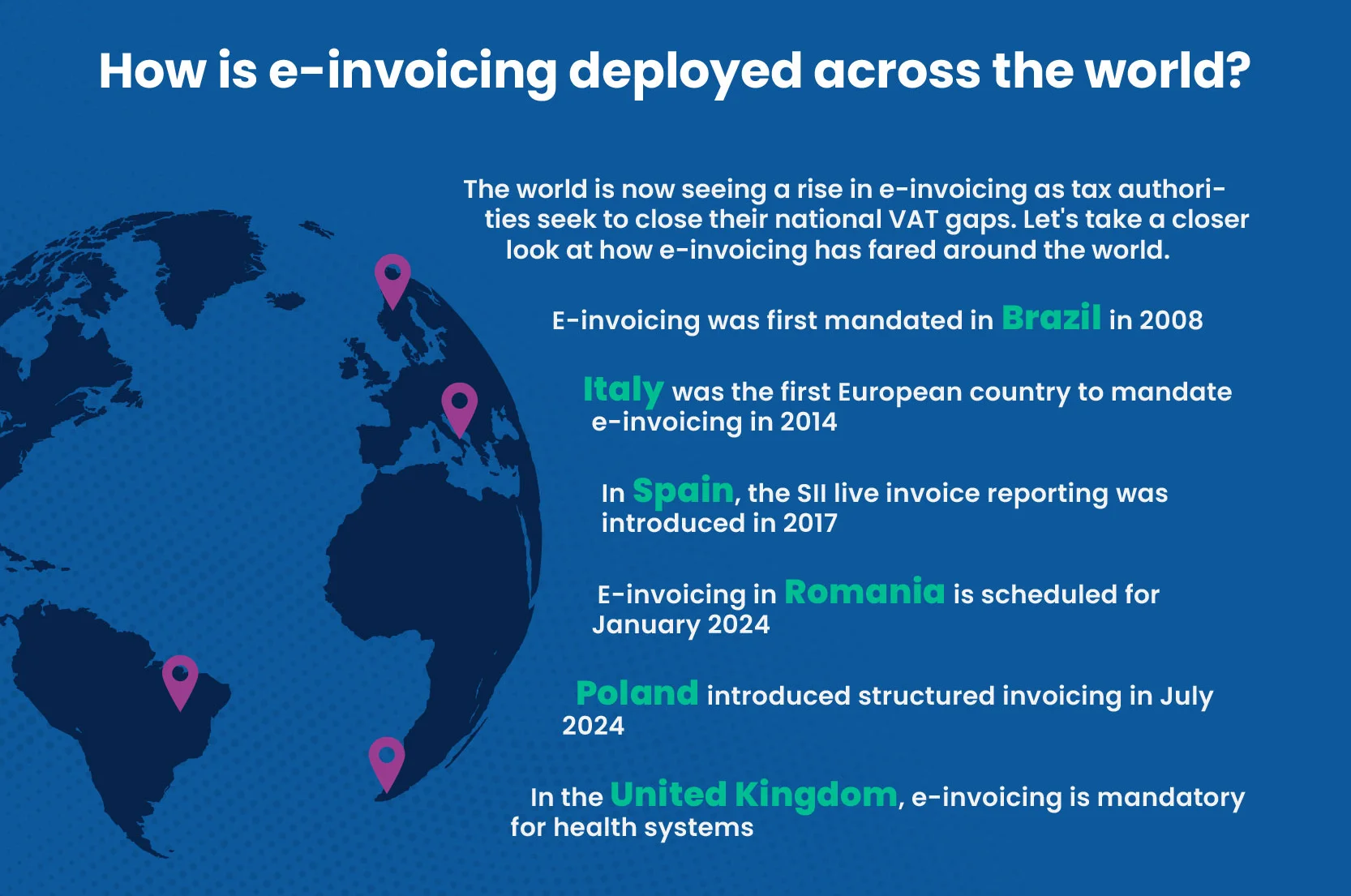

How is e-invoicing deployed across the world?

E-invoicing was first mandated in Brazil in 2008 with the introduction of a clearance electronic invoicing model, where the country’s tax authority must receive and clear the invoice before the supplier can issue it. This model was later adopted by most Latin American countries. In Europe, Italy was the first European country to mandate e-invoicing for B2G transactions in 2014, followed by B2B and B2C transactions in 2019, using the Sistema di Interscambio (SDL) platform.

In Spain, the SII live invoice reporting was introduced in 2017, requiring the electronic provision of relevant VAT data for issued and received invoices to the Spanish Tax Agency (AEAT). Spain’s SII qualifies as a “Continuous Transaction Control” system, and the use of mandatory e-invoices is foreseen for large taxpayers in October 2025 while for the rest, it is planned to be adopted by October 2026.

E-invoicing in Romania is scheduled for January 2024 for companies, while B2G e-invoicing has been mandatory since July 1, 2022, using the RO eFactură protocol.

Poland introduced structured invoices known as KSEF, which became mandatory for taxpayers starting in July 2024, as per the latest decision made by the European Commission.

In the United Kingdom, electronic invoicing is not mandatory for B2G or B2B transactions, except in the public health system, where it is recommended by the Tax Authority.

Elsewhere in the world, countries in Asia have adopted PEPPOL, such as Singapore, Austria, New Zealand, and are accelerating their adoption to make e-invoicing mandatory. The introduction of mandatory e-invoicing varies depending on the country, legal requirements, and the type of transactions involved. There is no standard e-invoicing model or electronic invoice document globally. Different models use different technologies, infrastructures, formats, and methods for transferring documents, but they share a common objective: reducing VAT fraud and increasing tax income.

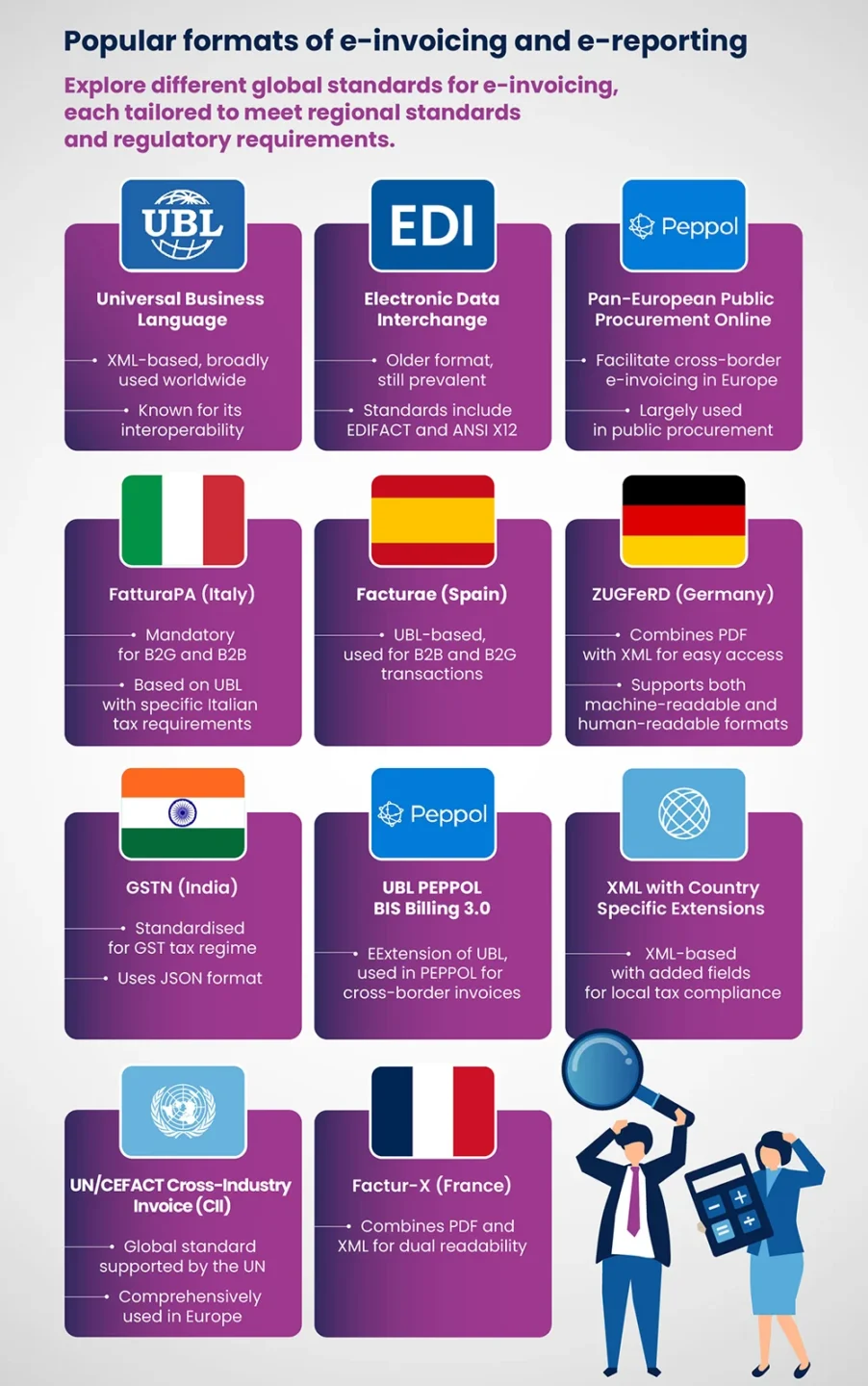

The different formats for e-invoicing and e-reporting

There are several e-invoicing standards in existence. The EU’s Directive 2014/55/EU on electronic invoicing in public procurement noted that “several global, national, regional, and proprietary standards exist; none of them prevails, and most of them are not interoperable with one another. Here is a non-exhaustive list:

- UBL (Universal Business Language): UBL is an XML-based standard for e-invoices widely used internationally. It is designed to be a universal format for electronic business documents, including invoices. UBL is recognized by many governments and organisations for its interoperability and adaptability.

- EDI (Electronic Data Interchange): EDI is an older but still widely used format for electronic invoicing, involving the structured exchange of data in a standardised format between computer systems. Various EDI standards exist, including EDIFACT and ANSI X12, used in different regions.

- PEPPOL (Pan-European Public Procurement Online): PEPPOL is a framework that facilitates electronic procurement processes in Europe, including specifications for e-invoices. Public sector organisations and their suppliers use it for cross-border e-invoicing within Europe.

- FatturaPA (Italian E-Invoicing Format): Italy has its own e-invoicing format called FatturaPA, mandated for business-to-government (B2G) and business-to-business (B2B) transactions. It is based on the UBL standard but has specific requirements for Italian taxation.

- ZUGFeRD (Central User Guide of the Forum for Electronic Invoicing in Germany): ZUGFeRD is a German e-invoicing standard that combines a PDF file with an XML file containing structured invoice data, making e-invoicing more accessible with both human-readable and machine-readable formats.

- Facturae (Spanish E-Invoicing Format): Spain uses the Facturae format for its electronic invoicing requirements, based on the UBL standard, and used for both B2G and B2B transactions.

- GSTN (Goods and Services Tax Network) in India: India has adopted a specific e-invoicing format under the GST regime. E-invoices in India are standardised in terms of data elements and are generated in JSON format.

- UBL PEPPOL BIS Billing 3.0: This is an extension of the UBL standard, commonly used within the PEPPOL network for cross-border e-invoicing in Europe.

- XML with Country-Specific Extensions: Many countries adopt XML-based formats with country-specific extensions to meet their unique legal and tax requirements. These extensions often include additional data fields for tax details and other regulatory information.

- UN/CEFACT Cross-Industry Invoice (CII): A global standard for electronic invoicing supported by the United Nations, widely used in Europe and other regions.

- Factur-X: A format that combines both a human-readable PDF and a structured XML invoice, primarily used in France.

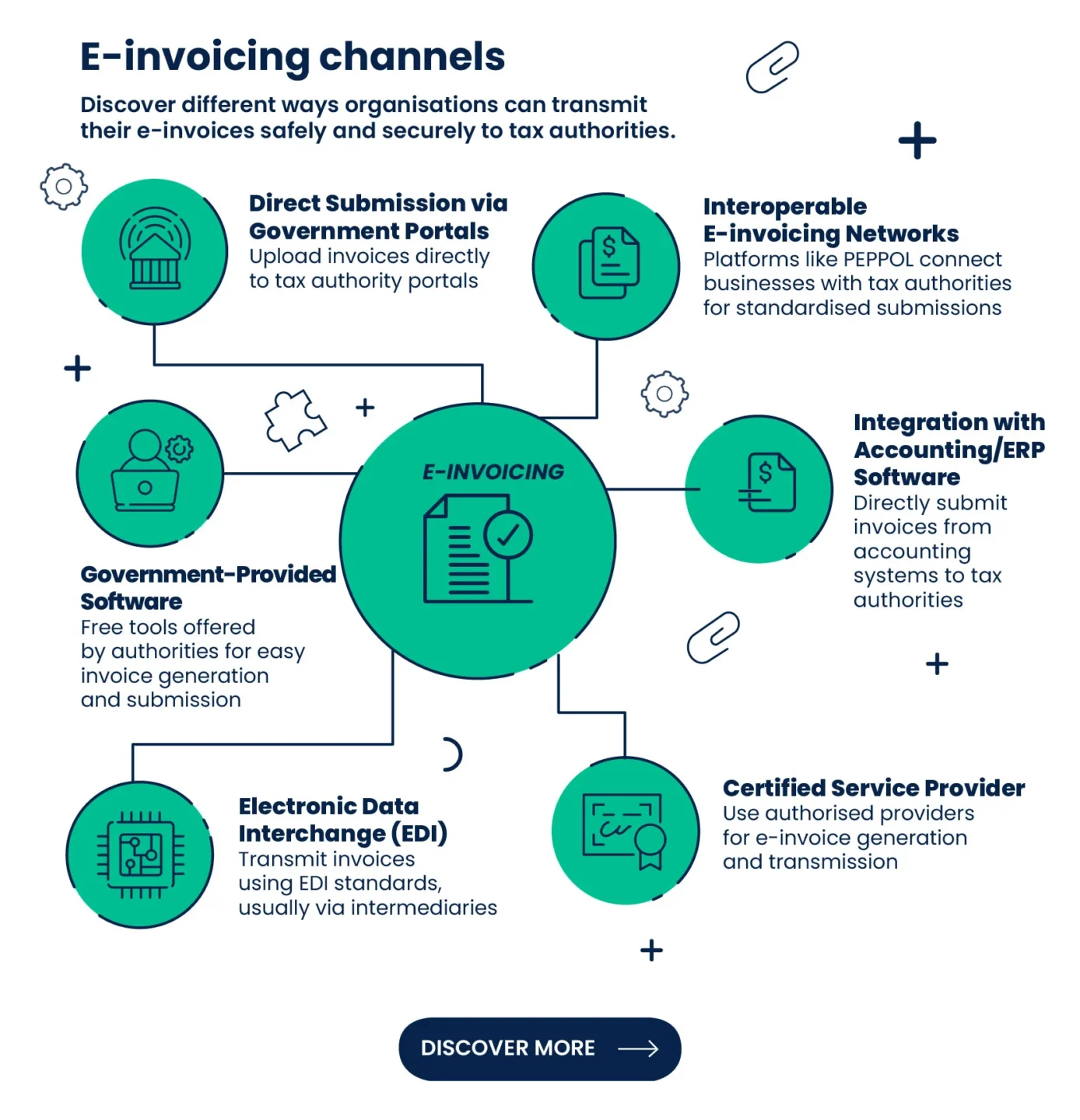

What are the different channels for e-invoicing?

The term ‘invoice channel’ refers to the method by which a digital invoice is transmitted from the sender to the receiver. There are various channels available, including:

- Direct Submission via Government Portals: In many countries, tax authorities provide secure online portals or platforms where businesses can directly upload and submit e-invoices. These portals are typically designed to accept e-invoices in a specific format or standardised schema.

- Interoperable E-Invoicing Networks: Some countries have established interoperable e-invoicing networks or platforms that connect businesses and tax authorities. These networks allow businesses to submit e-invoices in a standardised format, and tax authorities can access the data electronically. PEPPOL (Pan-European Public Procurement Online) is an example of such a network used in Europe.

- Integration with Accounting/ERP Software: Businesses often integrate their accounting or ERP (Enterprise Resource Planning) software with tax authority systems. This integration allows for the automatic submission of e-invoices and related transaction data directly to tax authorities in real-time or at specified intervals.

- Certified Service Providers: Some countries require businesses to use certified e-invoicing service providers. These providers ensure that e-invoices are generated, transmitted, and stored in compliance with local regulations. They often have direct connections to tax authorities for submission.

- Electronic Data Interchange (EDI): In regions where EDI standards are prevalent, businesses may use EDI to transmit e-invoices to tax authorities. EDI messages can be sent directly or through intermediaries that offer EDI services.

- Government-Provided Software: In certain countries, tax authorities offer free or subsidised e-invoicing software that businesses can use to create and submit e-invoices in the required format.”

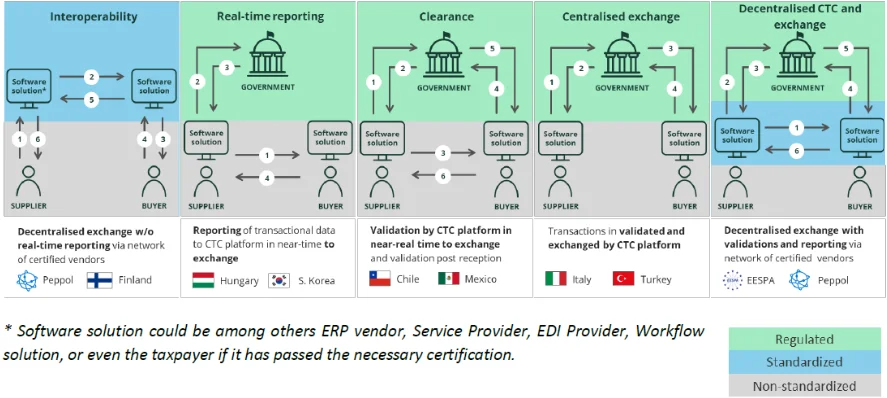

What are the different models for Continuous Transactions Control (CTC)?

CTC models are country-specific and vary in detailed design and implementation. They can be either centralised, requiring suppliers to send e-invoices through a centralised tax authority system, or decentralised, allowing suppliers to e-invoice buyers directly while simultaneously sending reporting data to the tax authority. These models can be grouped into broad categories based on their typical features:

- Interoperability Model

- Real-time Invoice Reporting Model

- Clearance Model

- Centralised Exchange Model

- DCTCE (Dynamic Control Tax Collection Environment)

For an overview of the transaction flow, refer to the pictogram below.

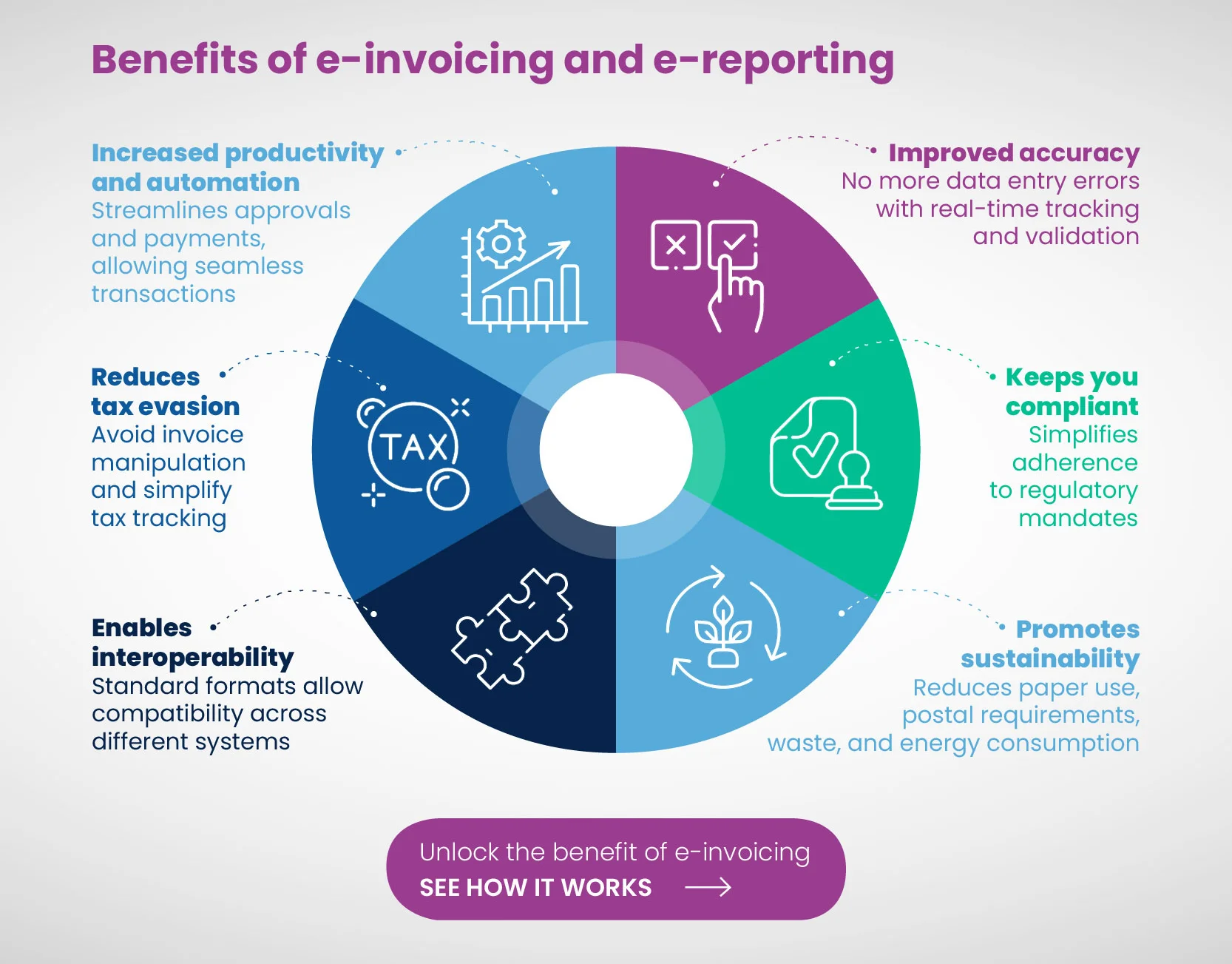

Key benefits of e-invoicing and e-reporting

Now that we have discussed why merging e-invoicing and e-reporting is a win-win situation for both suppliers and buyers, and the government – let’s check out the key benefits that the mandates come with.

Note for the reader: These benefits are cumulative, regardless of the region.

1. Increased productivity and automation

One of the key advantages of e-invoicing and e-reporting is that it increases productivity and automation. Electronic invoices are easy to approve and pay, which enables maximum efficiency. By spending lesser time in manually entering invoice data and following up their payments, customers (both suppliers and buyers) can focus more on higher-value activities, directly adding to the growth of their businesses’ ROI.

2. Reduction in invoice processing cost

Paper invoices require high material, labour, printing, and postage costs (even if digital PDFs are used, the manual labour is time-consuming). With the help of e-invoicing, it automates the process while eliminating all the physical aspects, thereby, reducing the cost of invoicing altogether. This helps the accounting teams to save team while allowing them to focus on more strategic tasks.

3. Increased accuracy

Under the e-invoicing and e-reporting system, there is a reduction in data entry errors ensuring more accuracy. This is due to improved visibility and end-to-end tracking. Apart from this, customers can also keep a track of approvals, invoice validation, and payments in real time. This reduces the chances of errors, otherwise made manually, like data inaccuracy, overpayments, duplicate payments, etc. Moreover, implementing e-invoicing and e-reporting mandates also enables in a closed audit trail, simplifying tracking and settlements.

4. Higher compliance

A major benefit of e-invoicing and e-reporting is that it is more than just a mandate. It allows customers achieve a higher compliance level with ease. As a matter of fact, the e-invoicing and e-reporting mandate becomes necessary for regulatory compliances, like the norms in Europe and Asian countries like Singapore.

5. Helps the buyers

Once the e-invoices are uploaded on the government portal for authentication, they will be shared with the respective buyer, which will help them reconcile the purchase order with the e-invoice. That said, it also gives the buyer the leverage of accepting and rejecting the electronic invoice on a real time basis.

6. In-depth insights into spending and savings

Yet another benefit of e-invoicing– they enable customers track their spending and savings efficiently. Essentially, this allows the procurement and leadership teams to track and gather strategic insights into their cost centres while helping them identify opportunities to save more. Therefore, the data available helps in better and more informed decision-making, which saves both time and resources.

7. Curbs the chances of tax evasion

Real time access to data helps curb the chances of invoice manipulation as the invoices will generate before a transaction is carried out. It further reduces the scope of fake invoices, and since the input tax credit and output tax details are available easily, tax authorities can track fake inputs conveniently.

8. Allows interoperability

Due to the generation of e-invoices in a standardised format, the invoices generated by a software can be read by different types of software, allowing for interoperability.

9. Green initiative

Green solutions are the need of the hour, and e-invoicing and e-reporting helps in that. It eliminates the requirement for paper-based invoices, contributes to energy efficiency, reduces wastage and costs associated within the supply chain processes.

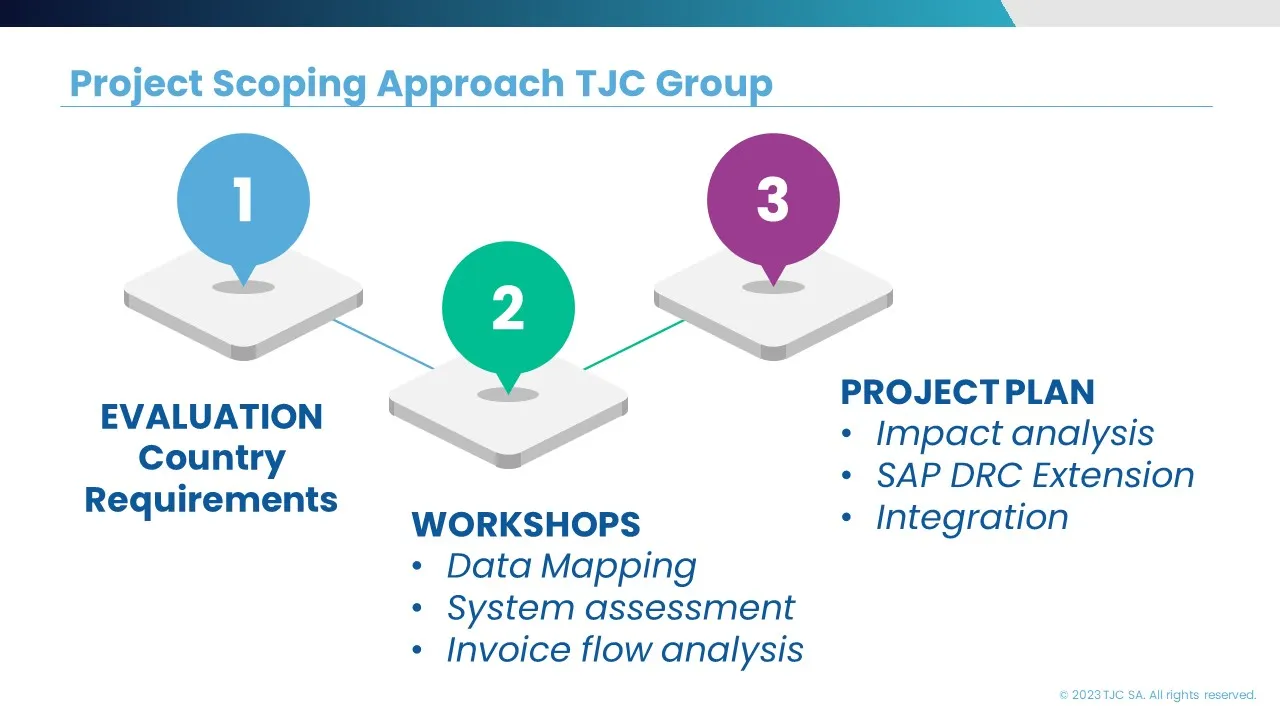

How can organisations prepare for the e-invoicing mandate?

The digitalisation of invoicing has an impact on daily business operations, financial systems, master data governance, and the work of individuals. To understand these impacts, an initial analysis of the existing situation is essential during implementation. It helps identify non-standard processes and specific system information settings. Having a clear overview of each transactional invoicing scenario is crucial for the successful digitalization of invoices.

This can be achieved through scoping investigations, which help address the main challenges for the taxpayer, including data, processes, and technology.

Project scoping activities aim to determine the source of invoice data, the availability of required data, transaction posting procedures, the type of invoicing document, the invoicing process, the stakeholders involved, and the settings in the ERP system for generating invoices.

Having a clear overview of existing scenarios ensures that operations remain uninterrupted and compliant with tax regulations.

Challenges of e-invoicing & e-reporting

While electronic invoicing and electronic reporting are streamlining business operations pertaining to tax regulations, there are a few challenges that organisations come across –

Legal and regulatory compliance in different countries

While e-invoicing and e-reporting are being adopted across the globe, a universal approach is still missing, causing the process to be quite complex for internationally operating enterprises.

The reason – every country has their own tax legislations, and complying with them can be tedious. Countries have specific regulations governing e-invoicing, including invoicing formats, data retention periods, digital signatures, and authentication methods. Familiarising yourselves with those regulations is a way out, but is it the most effective solution to this challenge?

Complications while integrating the ERP systems

Organisations must integrate their ERP systems with API’s that are customised and comply with the e-invoicing and e-reporting structure.

However, API integration can be challenging. Many organizations use different ERP systems or billing systems across their various departments or subsidiaries. Integrating these diverse systems can be challenging due to differences in data structures, communication protocols, technologies, and versions. Data may need to be transformed, mapped, or cleaned to ensure compatibility and accurate information exchange.

Data integrity

For electronic invoicing and reporting, maintaining data accuracy and integrity is essential. The data goes directly to the government authorities and discrepancies can lead to penalties.

Implementation of robust data validation techniques, employing digital signatures, and other authentication methods can safeguard against fraud and tampering – but, to what extent?

System security issues

Electronic invoicing and reporting is a step taken by governments globally to alleviate taxation systems. However, it has been noticed that there are a few system security issues, which may be due to outdated technologies or systems.

In the light of the upcoming updates, it is imperative for businesses to adopt a more sustainable and centralised approach to avoid these security issues while tackling the ever-changing trends.

Complications in reconciliation of e-invoice data and VAT returns

A scenario occurs when after the invoice is uploaded on the e-invoicing portal, organisations must reconcile e-invoice data.

Although it should be done automatically, it has been noted that users need help of a tool or utility to reconcile the same – which can again be a challenging at a higher level.

Impact on the cashflow

Cashflow is of utmost importance to any organisation. However, with e-invoicing and e-reporting, the question often arises – what if the e-invoicing flow is slow?

Inefficient e-invoicing system can lead to delays in sending invoices and inaccurate Invoices causing disputes. It means that payments from customers are also delayed, company missed opportunities for early payment discounts, impacting the company’s receivables and cash flow.

So, is there a solution to addresses these challenges altogether? As a matter of fact, there is – the SAP Document Reporting and Compliance (SAP DRC) solution!

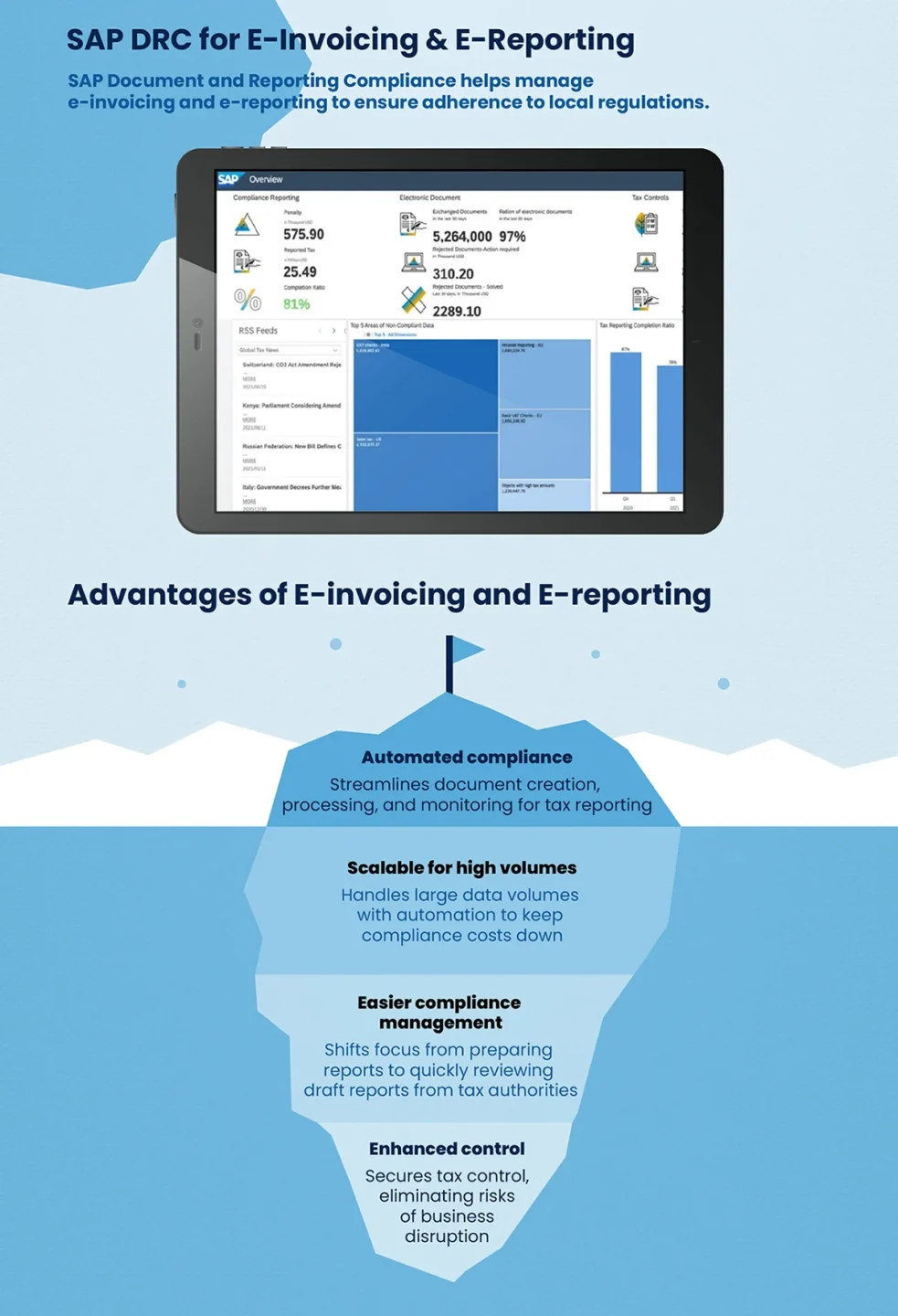

SAP DRC for e-invoicing & e-reporting

SAP Document and Reporting Compliance is your go-to solution for tackling all e-invoicing and e-reporting concerns. It allows you to create, process, and monitor the transactional documentations and periodic reporting – enabling organisations to stay compliant with the local legal framework and regulations.

With digitisation taking over the process of tax clearance, not only does it translate into more tighter controls (with risks of business disruptions), but it also creates a paradigm shift in capsizing the traditional roles in compliance – as taxable parties, enterprises will transition from preparing periodic reports to auditing the draft returns prepared by the authorities. This process has to be done quickly within the existing/decreasing operational capacity. Although, it might sound uncomplicated, keep in mind that audit activities involve analysis of several records (in thousands or even in millions). Therefore, automation and technology are becoming a quintessential part of e-invoicing and e-reporting activities to help prevent the explosion of tax compliance costs.

To help organisations (or enterprises) with capabilities to address these e-invoicing and statutory reporting challenges, the SAP Document and Reporting Compliance is the one-stop-shop solution. It enables organisations to stay compliant in the digital world; with its streamlined approach towards tax compliance, compiled with embedded automation, SAP DRC helps maximise efficiency, reduce compliance and cost risks, and increase sustainability of tax operations.

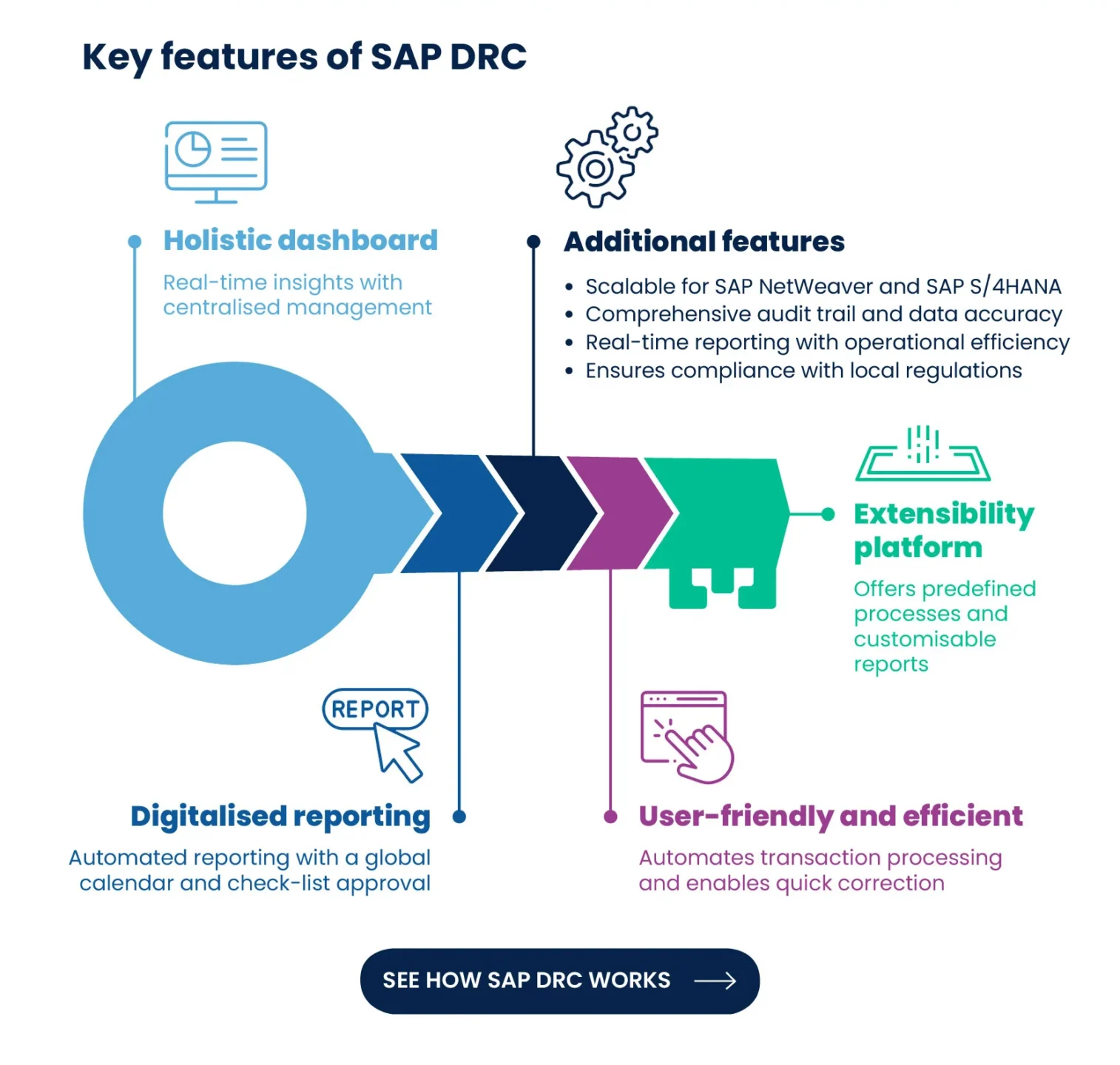

Key features of SAP DRC

The SAP Document and Reporting Compliance solution comes with comprehensive features that makes it stand out of the crowd. Here are a few key features that one must most definitely know of –

It comes with a holistic dashboard

- With SAP DRC, you can embed real-time, actionable insights into your ERP systems, preventing disruptions to enable a smooth operation.

- Users can manage corrections and follow-ups effectively with the help of a centralised entry point.

- One can enjoy a unified user experience across countries while gaining the flexibility to meet specific needs.

Easy to use, efficient to operate

- The SAP DRC solution helps automate the transmission and digital clearance of the business transactions through local standards.

- It allows users to correct the transaction efficiently by drilling down into the underlying transactions directly.

- Users can monitor registered customers while automating reconciliation with public agencies.

SAP DRC offers digitalised reporting

- The solution enables users to prompt and monitor obligations worldwide with the help of a compliance calendar.

- It helps digitalise and automate activities through adjustments to approvals in the system of the record with the help of a customised checklist.

- SAP DRC automates submissions while gaining insights backed by data into transactions, thereby, supporting a complete audit.

Extensibility platform to extend and create scenarios

- With SAP DRC, users can access a library of predefined processes and real-time scenarios, which are ready to be reused.

- Users can define compliance reports for adding or copying existing reports seamlessly to meet the business requirements.

- It enables repurposing of business features for a unified user experience across all the standard, customised, and partner scenarios.

Apart from these, the other important features of SAP DRC are –

- Fully integrated and scalable for SAP NetWeaver and SAP S/4HANA®.

- Audit trail and traceability for fully transparency.

- Accuracy and integrity of financial and business data.

- Increased operational efficiency and real-time reporting capabilities.

- Reduced risk by ensuring adherence to relevant rules and regulations.

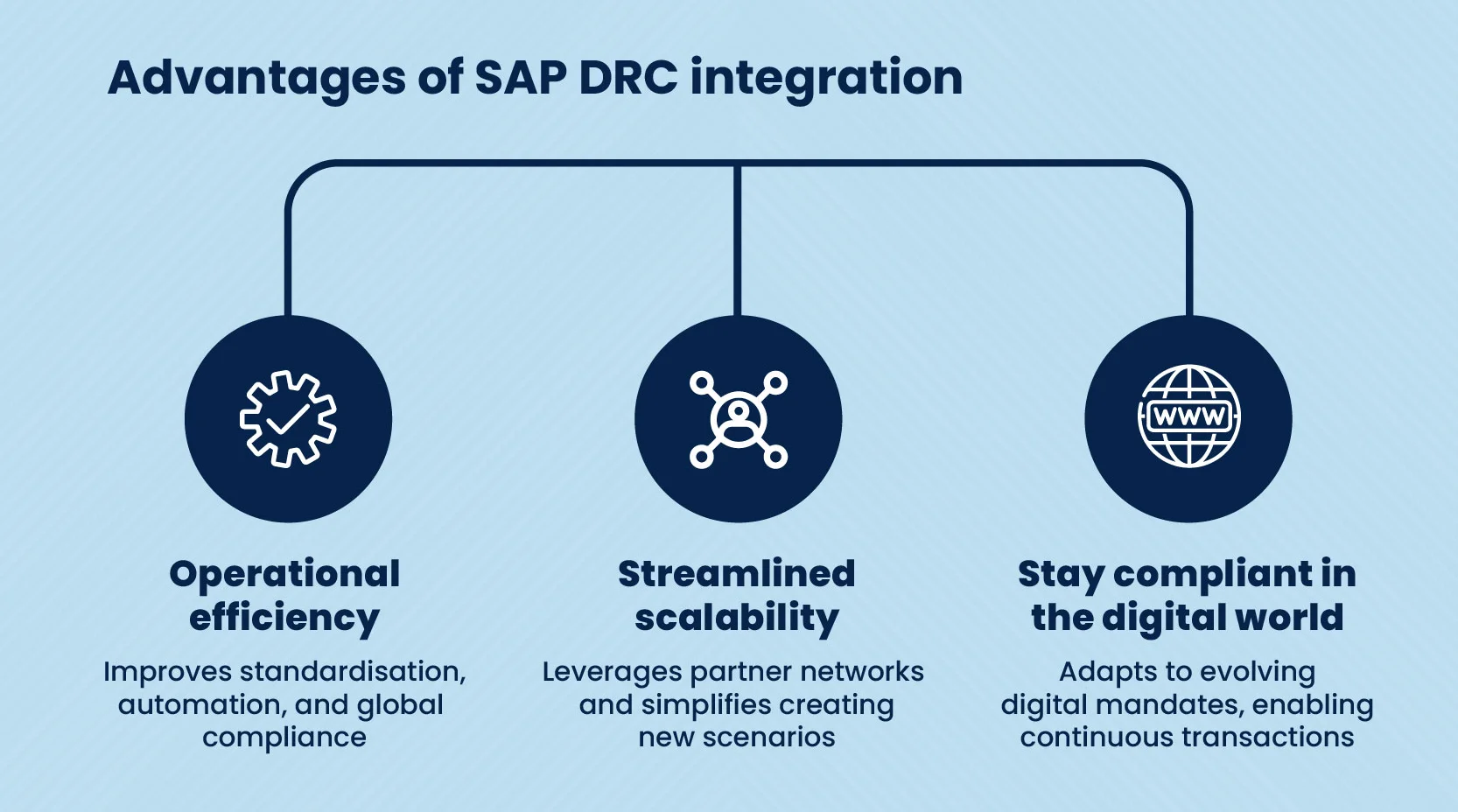

Benefits of integrating SAP DRC for e-invoicing & e-reporting

Along with the key features, the SAP Document and Reporting Compliance is packed with extraordinary benefits that makes it a preferred choice –

Boost efficiency of your operations

SAP DRC not only helps organisations boost their efficiency, but also their standardisations and automation efforts. Along with this, it helps in optimising compliance, enhancing sustainability by managing e-documents and statutory reporting globally, and so on.

Scale to more streamlined operations

One of the benefits of SAP DRC is that it helps create new scenarios while leveraging your partner ecosystem to meet the business requirements. It is done with the help of a unified user experience and simplified operations.

Stay compliant and ahead in today’s digital world

The digital world never stops evolving – with each passing day, it is growing. And it is essential to stay on top of these ever-changing trends, which is where organisations can benefit from SAP DRC. It helps you adopt the legal mandates with an effortless transition from periodic reporting to continuous transaction controls with an integrated solution.

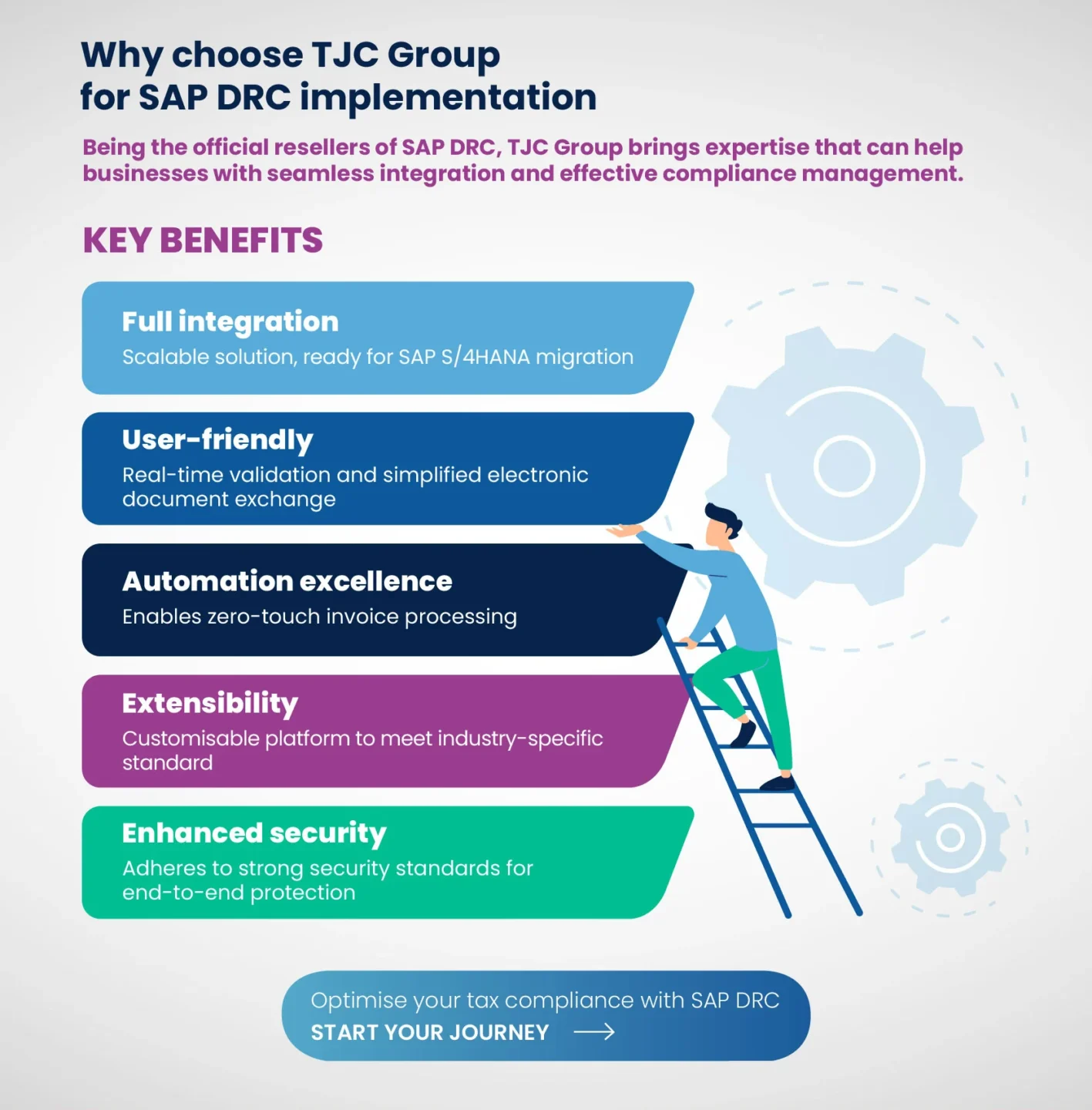

Choosing TJC Group as your partner for SAP DRC

Tax compliance is an essential factor that organisations must address with the utmost urgency. Although SAP Document and Reporting Compliance is one of the best solutions to manage your e-invoicing and e-reporting challenges, choosing the right partner for its implementation is paramount. After all, that’s where the game changes, and where TJC Group comes into the picture.

Choosing TJC Group for SAP DRC implementation will help you benefit its pros such as –

- Integration: The solution is entirely integrated and scalable for SAP S/4HANA migration.

- Ease-of-use: We help with real-time validation and also assist in the exchange of outgoing electronic documents.

- Automation: Choosing SAP DRC with TJC Group will help you attain zero-touch invoice processing through integration to incoming automated solutions.

- Extensibility: The extensible platform helps meet industry-specific and business requirements.

- Security: It offers robust security, meeting necessary policies of organisations.

TJC Group’s methodology for SAP DRC implementation

SAP Activate methodology

- TJC Group uses proven SAP Activate methodology for project planning and execution to deliver optimised templates and accelerators.

- Our team of experts define the best scope of practice while developing an initial scope statement and project schedule for SAP DRC’s implementation.

- TJC Group performs an initial project scoping that is vital to identify s and mitigates risks for project implementation and business impact.

- We go the extra mile with our talented and senior SAP finance consultants, who work as an extension of your team.

What makes TJC Group stand out from the crowd?

TJC Group has 25+ years of experience assisting clients with challenges pertaining to SAP data management for tax and audit purposes. The company understands the legal requirements for tax and audit, the business needs, and the technical aspects of compliance. Collaborating with TJC Group helps organisations in several ways –

SAP knowledge: The TJC Group’s knowledge covers SAP solutions, tax, and technology. The company’s vast expertise can bridge the gap between stakeholders while creating synergy between the tax and IT teams.

Subject matter experts: TJC Group’s subject matter experts have broad experience working on both tax and SAP projects. The company’s dedicated Business to Government (B2G) team helps organisations stay compliant with ongoing regulatory changes so they can avoid non-compliance charges and reputational risks.

State-of-the-art technology: One of the most significant strengths of TJC Group is its advanced technology. More than 40% of its workforce is dedicated to R&D to help ensure the smooth operation of all processes.

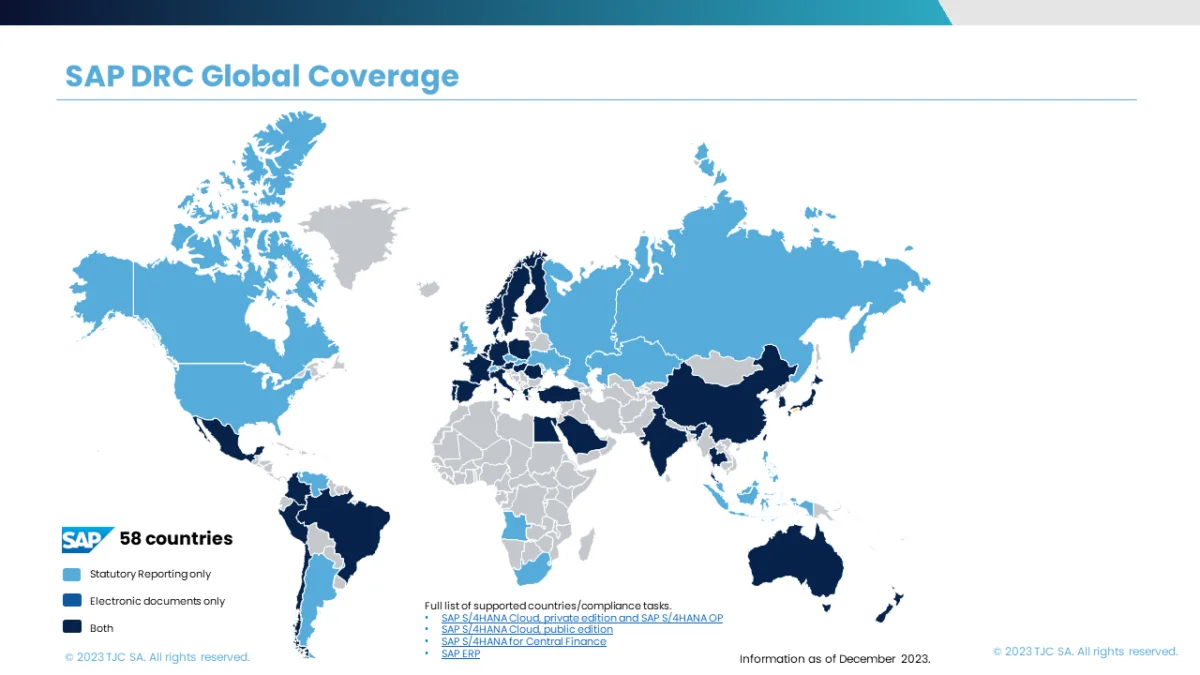

Countries that support SAP DRC

The SAP Document and Reporting Compliance have been implemented across various countries. Some of which are –

Conclusion

The SAP Document and Reporting Compliance is a game-changer for the e-invoicing and e-reporting world. Organisations not only can streamline their operations but also enable them to stay compliant in today’s evolving digital world. If you are looking for a partner for SAP DRC implementation, look no further! Contact us today for a demo and let your e-invoicing and e-reporting challenges take the backseat.

Would you like to have this information in a PDF format? Download now the Guide for e-invoicing and e-reporting.

Additional resources for e-invoicing

Resources from international organisations

- eInvoicing (europa.eu)

- eInvoicing Country Factsheets for each Member State and other countries (europa.eu)

- VAT in the Digital Age (europa.eu)

- The e-invoicing voice in Europe – EESPA

- PEPPOL e-invoicing platform

SAP useful links

TJC Group resources

- Guide for the digitalization of VAT in Europe

- Guide to VAT Reporting & E-Invoicing Harmonisation Across the EU

- Infographic SAP Document and Reporting Compliance (SAP DRC)

Global e-Invoicing Portals and Resources by Country

With governments mandating e-invoicing and e-reporting, the challenge that comes with it are the several country-specific regulations that organisations have to take care of. To make the process easier for our audiences, we have created a list of the countries along with their portals, so that you can have all the information you need at a click of your finger. Explore the table given below