The way businesses operate and interact with regulatory bodies and government is changing at a very rapid pace. One area that’s changing especially rapidly is tax and financial compliance – particularly when it comes to reporting processes. This article outlines the 6 key stages involved with SAF-T readiness, shared by TJC’s expert tax and data compliance consultants who advise clients on their Business to Government (B2G) reporting obligations. Keep reading to learn all the tricks!

New audit standards rolled out across Europe

Numerous European countries have adopted new audit and reporting standards which can make data extraction from within SAP more complex and time-consuming. Add S/4 HANA into the mix and things can rapidly become highly costly too.

SAF-T is a good example and the requirements imposed by regulators have wide-reaching implications for multi-national companies tasked with filing fiscal returns. New SAF-T rules are already in force in Poland, France, Portugal, Norway and Romania, with many other countries expected to follow soon.

Although the broad framework is consistent there are many variations in place across different regions which can be confusing. It leaves companies who need to comply with SAF-T vulnerable to making mistakes and sometimes, also risking financial penalties.

SAF-T Accounting or “Standard Audit File – Tax”, is a best practice data format used for the exchange of accounting data between a data originator and regulators. Devised by the OECD, the aim behind SAF-T is to make it easier for companies who have relevant bookkeeping obligations to submit their accounting information to the public authority on request. More specifically, SAF-T is a standard, electronic XML-based format used by companies to submit details relating to general ledger (GL) transactions and vendor/customer reports, inventory and asset reports to the local tax authority.

Get ready for SAF-T requirements

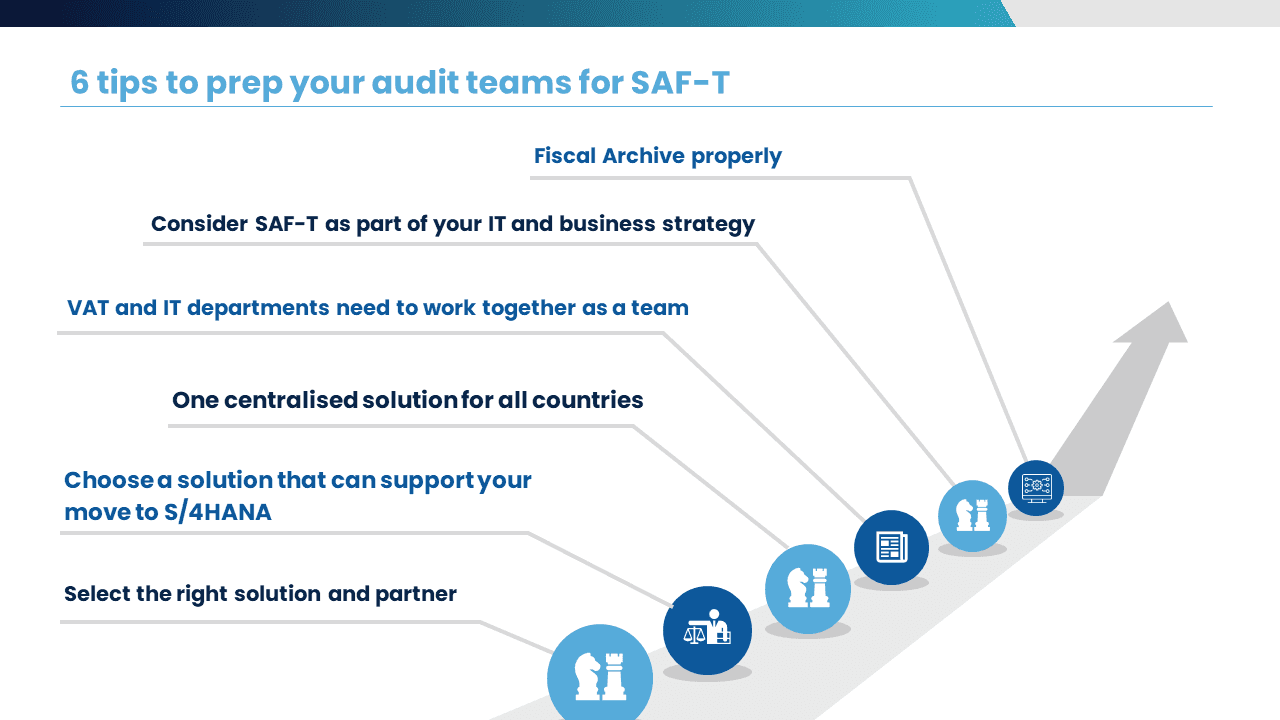

Here’s some tips to help your audit and tax teams bypass the hurdles when prepping for SAF-T requirements:

1. Ensure you can complete a proper Fiscal Archive.

For auditors, following the correct procedures for fiscal archiving and to ensure data consistency will be essential to the compliance process. In this context, fiscal archiving refers to the ongoing process of data freezing, which offers the benefit of being able to maintain archived data in the same state for a specified timeframe. It ensures high-quality audit reports can be prepared using consistent, original data. Importantly, it also satisfies the needs of tax and audit managers, who tend to prefer not to work with live data, especially when generating audit reports.

2. Consider tax compliance within your wider, global strategy.

SAF-T isn’t just something you do in isolation and it’s important to consider SAF-T compliance as part of a wider IT and business strategy. This means forward planning for tax and IT team resource requirements, for changes to IT infrastructure required for compliance and for any necessary alterations to business operation processes, in order to support the production of FEC compliant data files.

3. VAT and IT departments need to work together as a team.

SAF-T compliance requires multi-disciplinary collaboration, with teams of experts working together to understand the tax compliance landscape in each country and to identify further data analytics opportunities with tax reporting processes.

4. One centralised solution for all countries.

SAF-T may be an international standard, but the exact way data needs to be extracted and presented to individual financial regulators varies enormously. Having to compile separate reports for each region would be a waste of resources and the best option is a centralised solution. This would allow SAF-T compliant data to be extracted from within SAP across multiple heterogeneous sources, with the reports and data files that comply with country specific regulations generated automatically.

5. Choose a solution that can support your move to S/4HANA.

Due to the exponential growth of data and the cost of cloud storage – especially HANA – having an automated information lifecycle management strategy is essential. By managing data volume growth, you can manage the long term cost of S/4 HANA ownership. TJC’s range of SAF-T solutions are SAP certified and can support you with the transition to S/4 HANA and ongoing data archiving and reporting.

6. Select the right data extraction solution and B2G partner.

Selecting the right SAF-T solution and implementation partner at the outset will mean you can minimise the time and effort it takes to stay compliant, address errors and perform reconciliations. As experts in data management and SAF-T compliance, TJC can support you with a range of consulting services and SAP certified software to minimise the cost and complexity of SAF-T reporting.

Key takeaways

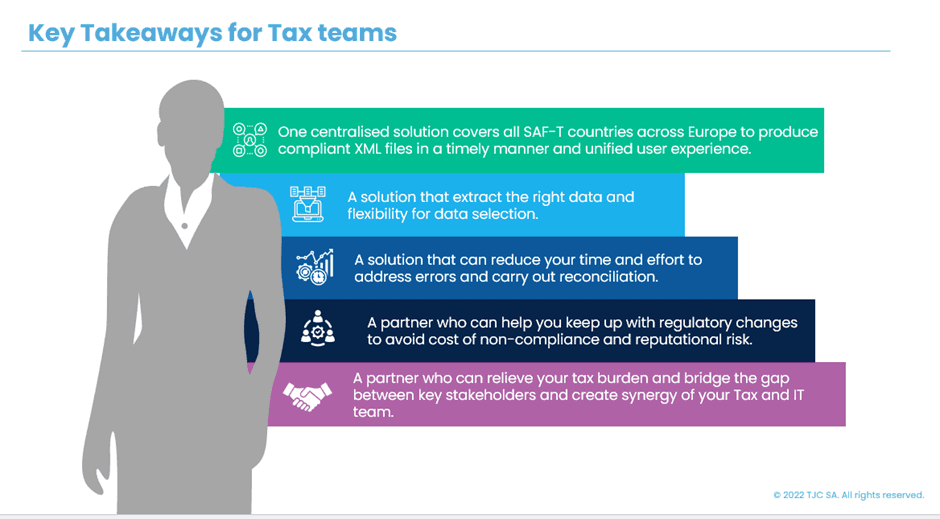

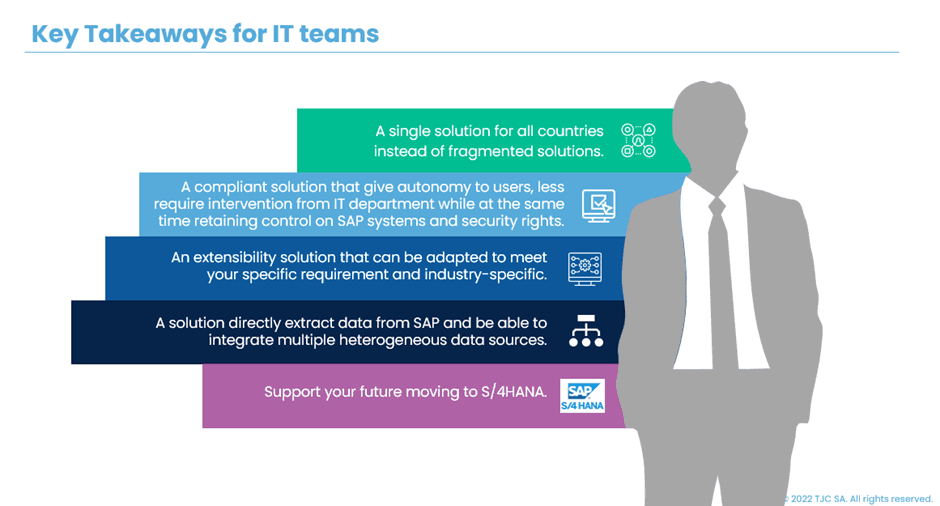

Here’s a few essential takeways for IT and Tax teams:

Conclusion

As more countries transition to e-invoicing and SAF-T, international companies need a strong partner to guide them through the minefield of data reporting and regulatory standards.

As experts in SAP data management, data extraction tools and SAF-T compliance, TJC Group has the skills and capabilities to help you achieve international tax and audit compliance. A strong potential partner with a proven track record, we can support you with a range of consulting services and software to minimise the cost and complexity of reporting.

Find out more about our SAF-T solutions