Author: Priyasha Purkayastha, Global Content Manager, TJC Group | Consultant: Patchanok K, B2G Lead, TJC Group

As per the latest Royal Decree of the Belgian government, the technical and procedural framework has been set. With effect from 1st January 2026, it will be mandatory for organisations to implement B2B e-invoicing in Belgium. As per the updated decree, it expands on the existing electronic invoicing laws, aligning the mandate with EU’s VAT in the Digital Age (ViDA) requirements. Additionally, the Royal Decree also confirms the key regulations for structured e-invoicing between taxpayers in Belgium.

Table of contents

- Introduction

- E-invoicing in Belgium: Key takeaways from the latest Royal Decree

- PEPPOL BIS standard

- The VAT rounding rules for e-invoicing

- Penalties pertaining to the new mandate

- October 2021: Belgium announces its plan for e-invoicing

- November 2022: Taking the first step towards e-invoicing

- March 2023: E-invoicing in Belgium for B2G broadens

- December 2023: The drafting of the e-invoicing law

- July 2025: Belgium confirms e-invoicing for B2B

- Global e-invoicing and reporting with SAP DRC

- Conclusion

- E-invoicing in 2025: Round-the-world updates

Introduction

Belgium recently joined the list of the countries implementing global e-invoicing and reporting. The country has recently updated its Royal Decree stating that B2B e-invoicing will mandatorily come into effect from 1st January 2026. Apart from this, the decree also puts forth the required standards for syntax, semantics, and transmission methods. Additionally, it details out on the new penalties that organisations may have to pay in case of any discrepancies. Moreover, Belgium’s Royal Decree aligns with the ViDA regulations of the EU; therefore, organisations and taxpayers must also ensure that they are in-line with the requirements of the VAT in the Digital Age norms.

E-invoicing in Belgium: Key takeaways from the latest Royal Decree

PEPPOL BIS standard

The new decree states the use of PEPPOL BIS as its standard format; however, other formats are allowed, only if they conform to the European e-invoicing standards (EN 16931). Keep in mind that for e-invoicing in Belgium, organisations cannot disregard the PEPPOL BIS format – meaning, even if an alternate format is used, companies should still be technically capable of sending and receiving structured electronic invoices in the said PEPPOL BIS format. Moreover, the Royal Decree serves as a confirmation that the PEPPOL network will be the backbone of e-reporting, expected to come into effect in 2028 for domestic transactions.

The VAT rounding rules for e-invoicing

One of the most important changes that the new Belgian e-invoicing decree comes with are the rounding rules for VAT. As of now, businesses calculate VAT at the level of line items (i.e., per line or per rate) in their ERP or billing software. Starting from 1st January 2026, organisations must ensure that the VAT rounding limits to the total amount and not on a per line basis. In fact, this new regulation bids goodbye to the current practices of rounding amount per item for the ease of accounting. Moreover, this new change of VAT rounding rules help ensure consistency and accuracy in automated processing.

Penalties pertaining to the new mandate

For a smooth and streamlined e-invoicing in Belgium, organisations must ensure compliance with the said rules of the new Royal Decree. Non-compliance with the regulations will lead to heavy penalties and sanctions that organisations have to pay. As a matter of fact, with the existing sanctions for non-compliance like failing to timely issuance of e-invoices, the latest decree lays out new non-proportional penalties. The new penalties are majorly introduced for organisations if and when they fail to meet the obligation to possess the technical means to send and receive e-invoices. The new penalties are as follows –

- For a first violation, organisations will be fined EUR 1,500

- For a second violation, organisations will be fined EUR 3000

- For further or subsequent violations, organisations will be fined EUR 5000

E-invoicing and tax authorities will grant a grace period of three-months to organisations for rectification of their systems. Within the three months, if the systems aren’t rectified, organisations may face new penalties from the authorities. Having said that, bear in mind that, other non-compliance issues like incorrect format, late issuance, and so on, organisations will be penalised under existing VAT fine frameworks.

Global e-invoicing and reporting in Belgium: The timeline of implementation

The planning for e-invoicing in Belgium was into effect ever since 2021. Here’s the timeline of the country’s implementation of electronic invoicing and reporting –

October 2021: Belgium announces its plan for e-invoicing

The Finance Minister of Belgium, in relation to 2022 Budget Agreement, released a policy note, affirming the government’s plans to implement global e-invoicing and reporting for B2B transactions mandatorily. This was in accordance with the Belgian government’s intentions to close the country’s VAT gap – which was estimated at EUR 4.4 billion (12.3% of lost VAT) in 2019.

November 2022: Taking the first step towards e-invoicing

Interestingly, the government of Belgium introduced electronic invoicing for business-to-government (B2G) transactions, making it mandatory for public contracts over €215,000. Additionally, the government also introduced PEPPOL into its transactions, making it a norm that structured e-invoices must be issued through the PEPPOL network.

March 2023: E-invoicing in Belgium for B2G broadens

In March of 2023, the Belgian government widens its B2G mandate for most public contracts, i.e., both under and over €215,000. Moreover, the submission of e-invoices in a structured format was made compulsory with added requirement that it complies with the global e-invoicing and reporting standards of the EU (EN 16931).

December 2023: The drafting of the e-invoicing law

In December 2023, the Belgian authorities proposed a draft law to amend the VAT code for introducing an obligation for electronic invoicing. The proposed law stated that under an e-invoicing mandate, all the e-invoices should be sent and received in a structured format, complying with the European standard EN 16931 while using the PEPPOL network. Additionally, the law also stated that businesses must use service providers that are certified for PEPPOL for transmission of structured e-invoices.

July 2025: Belgium confirms e-invoicing for B2B

As of July 2025, the government introduced a Royal Decree that formalises the implementation of mandatory e-invoicing in Belgium for B2B transactions. The e-invoices must be structured with PEPPOL BIS being the standard format. Non-compliance to regulations will lead to hefty administrative fines.

Global e-invoicing and reporting with SAP DRC

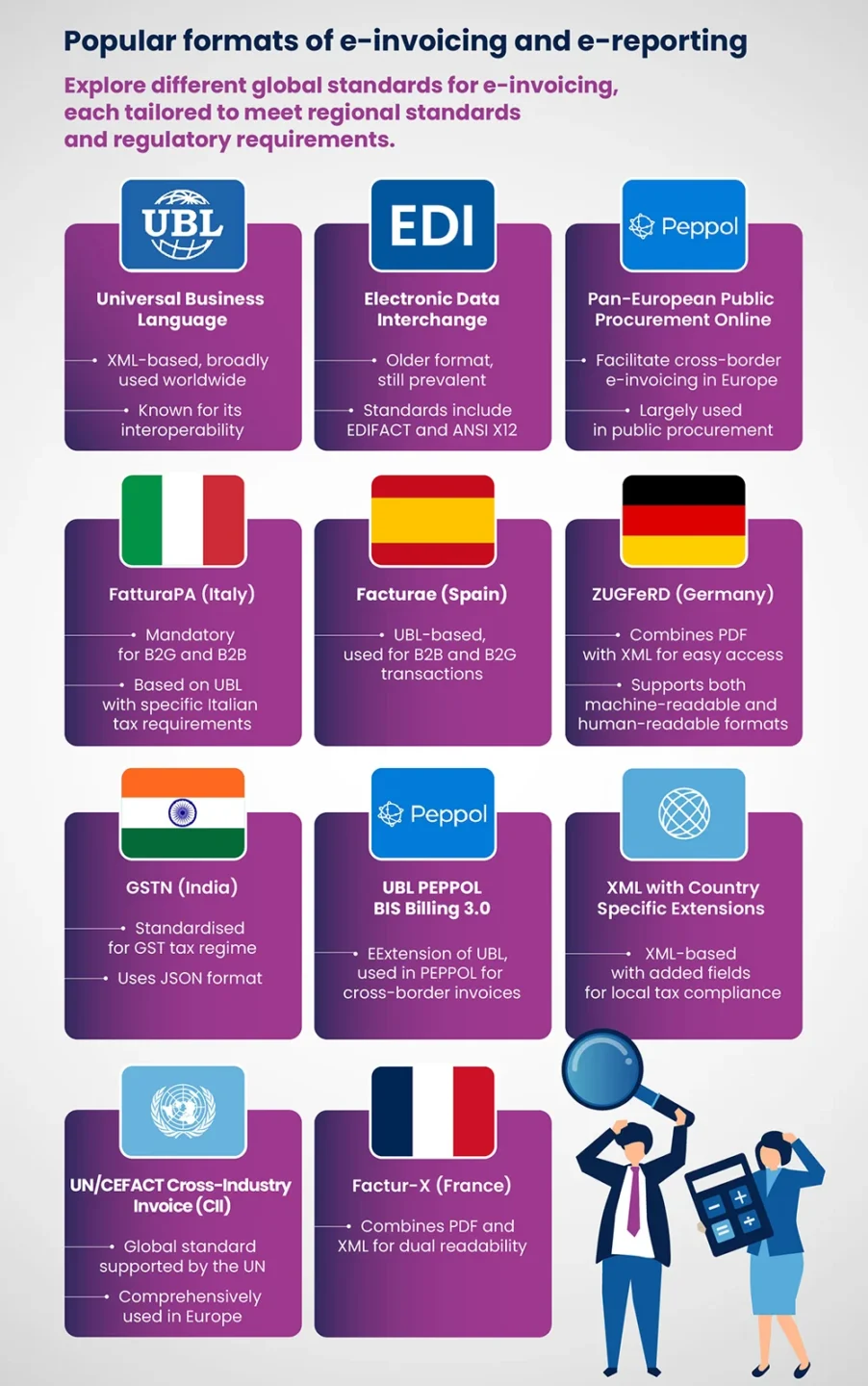

With electronic invoicing and reporting gaining momentum across the world, organisations must gear up to implement the solution when the time comes. However, implementing e-invoicing and e-reporting is not an easy task – because of the plethora of regulations, pertaining to several countries. Moreover, non-compliance can also lead to several fines, leading to financial burdens and losses. Not just that, there are other challenges of e-invoicing as well, which can be a hassle for organisations.

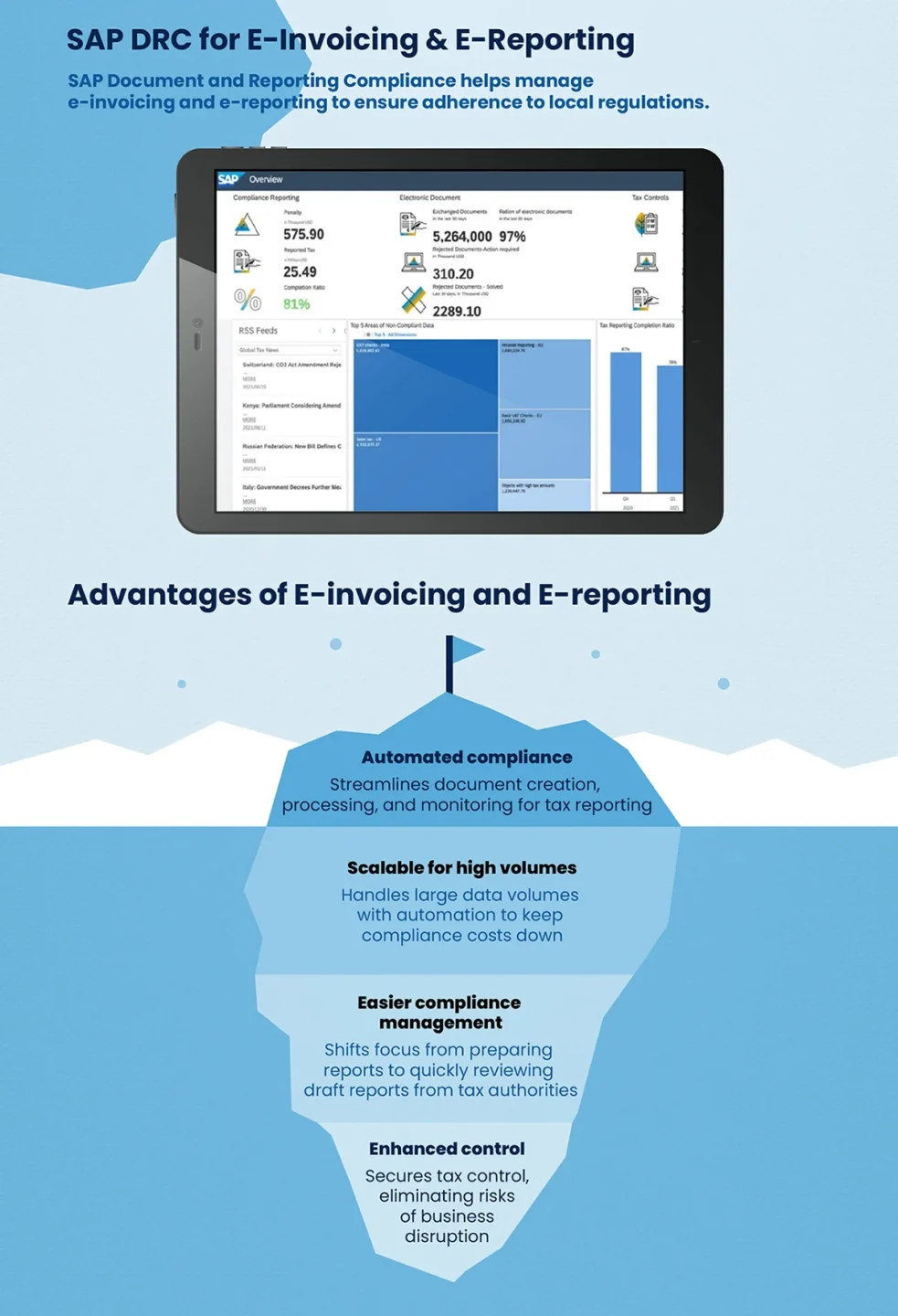

Fortunately, SAP Document and Reporting Compliance or SAP DRC helps tackle challenges of electronic invoicing. The solution comes with a compliance calendar, allowing users to prompt monitor global e-invoicing and reporting regulations. Additionally, the solution automates the submission of e-invoices, gaining insights backed by data on transactions. Moreover, SAP DRC comes equipped with a centralised point of entry that manages any corrections while ensuring timely follow-ups much more efficiently.

Conclusion

With e-invoicing in Belgium gearing up for implementation in January 2026, it is important to prepare your organisation if your operations are based out of the country. TJC Group comes with unparalleled expertise in the implementation of SAP DRC for e-invoicing, following a personalised approach, which is backed by the SAP Activate methodology. Moreover, our team of B2G experts defines the best scope of practice, develops an initial scope statement, and sets a realistic timeline for implementation.

Join hands with us to prepare your organisation for e-invoicing implementation, not only in Belgium, but for several other countries. Contact us now for more information!

Also, stay tuned with us for more updates on electronic invoicing and reporting.

E-invoicing in 2025: Round-the-world updates

- E-invoicing in 2025: An interesting glance at its global deployment

- E-invoicing in Germany: Important things you need to know in 2025

- E-invoicing in Singapore: Everything you need to know in 2025

- Challenges of e-invoicing in 2025: A roadmap to overcoming them with SAP DRC