Table of contents

1. Introduction

The digital transformation of invoicing and statutory reporting is not just a fancy upgrade. It is a comprehensive survival kit for organisations looking for efficiency, precision, and most importantly, seamless compliance. Governments globally have hopped onto the e-invoicing and e-reporting bandwagon, making its adoption mandatory in some countries. As a matter of fact, the electronic invoicing market touched approximately USD 14 billion in 2023. And, it is expected to grow at a CAGR of 18% during 2024-2032, reaching around USD 61 billion in 2032.

The key drivers contributing to the growth of e-invoicing and e-reporting are the regulatory initiatives and mandates; the global shift towards digitisation and automation, and the sustainability landscape, to name a few. But are there more? Absolutely! We covered the drivers of e-invoicing in detail in our previous blog. Click on the button below to read more about it!

Amongst everything that electronic invoicing and reporting offers, did you know there are several e-invoicing formats in existence? Well yes, as amazing as this digital invoicing is, there are a few things that organisations must keep in mind – one of which is the various formats.

2. Different formats of e-invoicing that you must know of

As per EU’s Directive 2014/55/EU on electronic invoicing in public procurement, we have noted that there are several global, national, regional, and proprietary standards. However, most are not interoperable with one another.

So, what are the different formats of e-invoicing? Without any further ado, let’s check them out –

-> Standard formats

2.1 Electronic Data Interchange (EDI)

Introduced first in the 1960s for organisations to exchange documents electronically, the electronic data interchange or EDI is one of the oldest but widely used formats for e-invoicing. In EDI transactions, information transfers directly from a computer application in one organisation to another organisation’s computer system. It defines the location and order of information in a document format. EDI’s automated capability that helps in rapid data sharing contributes majorly to its preferability. There are various electronic data interchange standards like EDIFACT, ANSI X12, ODETTE, TRADACOMS, GS1, etc., used across different regions.

2.2 Universal Business Language (UBL)

Universal Business Language (UBL) is an XML-based standard for e-invoicing widely used across the world. Developed by the Organization for the Advancement of Structured Information Standards (OASIS), it was released in 2004, with the intent to be used in e-commerce, mainly by small to medium-sized companies. However, over the years, UBL evolved as a crucial tool used for international procurement, including electronic invoicing. In November 2014, the European Commission approved this format for its public administrations, making it one of the most sought-after e-invoicing formats by European governments. That said, UBL’s interoperability and adaptability make it even more preferable to governments and organisations.

| Format for e-invoicing | Applicable countries |

| Electronic Data Interchange (EDI) | Worldwide |

| Universal Business Language (UBL) | Global |

| PEPPOL | Global |

| UN/CEFACT CII | Worldwide |

| UBL PEPPOL BIS Billing 3.0 | Global |

| JSON | Global |

| FatturaPA | Italy |

| ZUGFeRD | Germany |

| FacturaE | Spain |

| Factur-X | France |

| XML | Country-specific extensions |

2.3 PEPPOL

The Pan-European Public Procurement Online or PEPPOL format is a framework facilitating electronic procurement processes across the European continent, including specifications for e-invoices. Following a ministerial conference in Manchester, setting out the objectives for a cross-border e-invoicing and procurement system within Europe, the PEPPOL project was launched in 2008 under the EU. PEPPOL is a vast concept in itself, which we will be covering in our upcoming blogs.

2.4 UN/CEFACT Cross-Industry Invoice (CII)

Another popular global format for electronic invoicing is the UN/CEFACT CII, supported by the United Nations and widely used in Europe as well as other regions. This standard simplifies the business transactions and information components of invoices used across various industries within the supply chain. UN/CEFACT has developed a maximum data-set invoice which covers multiple sectors and multiple types of commodities called a cross-industry invoice. However, not all the data in the UN/CEFACT CII will be necessary. Generally, users will only require a subset of the complete CII.

2.5 UBL PEPPOL BIS Billing 3.0

The UBL PEPPOL BIS Billing 3.0 is an extension of the UBL format; however, the catch with this format is that it is commonly used within the PEPPOL network for cross-border e-invoicing within Europe.

2.6 JSON

After the implementation of the Goods and Service Tax (GST) on 1st July 2017 which replaced indirect taxes like the excise duty, VAT, and services tax in India, the government adopted the GSTN i.e., the Goods and Services Tax Network, which is touted as the IT backbone of GST in India. Under this, e-invoices are standardised in terms of their data elements while generating them in the JSON format.

3. Country-specific formats

3.1 FatturaPA, Italy

FatturaPA is Italy’s e-invoicing format, which is mandated for business-to-government (B2G), business-to-business (B2B), and business-to-consumer (B2C) transactions. As a matter of fact, it is a decree provided by Italian Law number 633, 1972, Article 21, subsection 1, and is the only type of invoice accepted by the Italian public administration. FatturaPA has structured content in the XML file, and it is based on the UBL standards. However, FatturaPA does have specific requisites as per the Italian tax laws.

3.2 ZUGFeRD, Germany

The Central User Guide of the Forum for Electronic Invoicing in Germany, commonly known as ZUGFeRD, is a German e-invoicing format, which combines both structured and unstructured formats. Simply put, it combines a PDF file with an XML file, containing invoice data and making e-invoicing more accessible with human-readable and machine-readable formats. Consequently, ZUGFeRD 2.1 is also available in several variations like – Basic, Comfort, and Extended – organisations can choose one as per the variant and compliance with the EU/CEN standards. And now, ZUGFeRD 2.2 – the new version of ZUGFeRD, has important elements added to the EXTENDED profile to improve interoperability with Order-X.

3.3 FacturaE, Spain

FacturaE is Spain’s XML-based e-invoicing format, which uses XML signatures and follows the XadES standard. This electronic invoicing format is based on the UBL standard and used for both B2B and B2G transactions.

3.3.1 FACe

The central platform for sending e-invoices to Spanish authorities is FACe or “Punto General de Entrada de Facturas Electrónicas”. Majorly, this platform serves as the central invoice exchange platform for suppliers and public entities alike. In 2018, this platform extended to B2B electronic invoicing under the name FACeB2B. Those obligated to use this platform include companies that work on behalf of the administration of other firms and those generating invoices over EUR 5,000.

To comply with the 2014/55/EU directive, Spain developed a national Core Invoice Usage Specification (CIUS), thereby regulating compliance laws for the public sector’s e-invoicing as per the requirements.

3.4 Factur-X, France

Primarily used in France, the Factur-X format combines a human-readable PDF and a structured XML invoice. Factur-X is a Franco-German standard for hybrid e-invoice, PDF for users and XML data for process automation. 5 profiles of data for Factur-x: MINIMUM, BASIC WL, BASIC, EN16931 and EXTENDED.

3.5 XML with country-specific extensions

Several countries adopt XML-based format that comes with country-specific extensions for meeting their unique legal and tax requirements. These extensions also include additional data fields for tax details and other regulatory information.

4. E-invoicing and e-reporting with SAP DRC

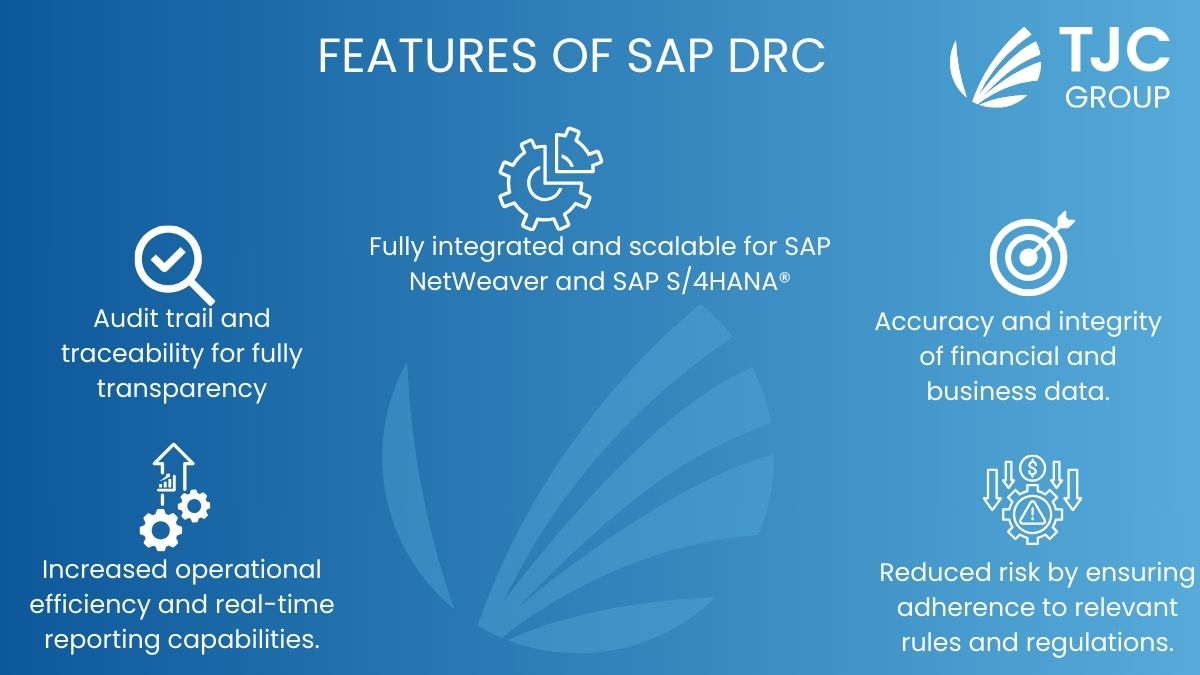

SAP Document and Reporting Compliance is your go-to solution for e-invoicing and e-reporting, allowing organisations to create, process, and monitor transactional documentation and periodic reporting. Thereby, enabling organisations to stay compliant with the local legal framework and regulations. As a matter of fact, the solution comes with a plethora of benefits, majorly focusing on helping organisations stay compliant in today’s digital world.

SAP DRC’s streamlined approach to tax compliance along with its embedded automation helps maximise efficiency, reduce compliance and cost risks, and increase the sustainability of tax operations. Having said that, the aforementioned formats are supported by SAP DRC, thereby making it easier for you to ensure compliance with the regulatory needs.

5. Choose TJC Group as your SAP DRC partner

The right partner for implementing any business solution is necessary for a seamless experience. TJC Group values effortless and satisfactory customer experience at its highest level. Join hands with us to implement SAP DRC and leverage the expertise of our senior SAP finance consultants. Our experts will help you with the process from start to end, and even beyond that. Interestingly, we use the SAP Activate Methodology for its implementation, where our experts help plan and execute the project and deliver optimised templates and accelerators.

TJC Group has 25+ years of experience assisting clients with challenges in SAP data management for tax and audit purposes. The company understands the legal requirements for tax and audit, the business needs, and the technical aspects of compliance.

Contact us today to implement SAP DRC as per your required formats effortlessly!