Inhaltsübersicht

- 1. Einführung

- 2. Was sind die Herausforderungen bei der Einführung von E-Invoicing und E-Reporting?

- 2.1 Unterschiedliche Regelungen in verschiedenen Ländern

- 2.2 Datenintegrität ist eine Herausforderung

- 2.3 Die Integration von ERP-Systemen kann kompliziert sein

- 2.4 Herausforderungen für die Systemsicherheit

- 2.5 Abgleich von e-Rechnungsdaten und Mehrwertsteuererklärungen

- 2.6 Auswirkungen auf den Cashflow

- 3. Wie können Organisationen diese Herausforderungen meistern?

- 4. Implementierung von SAP DRC mit der TJC Group

1. Einleitung

e-Invoicing und e-Reporting sind in vielen Ländern wie Frankreich, Italien, Südkorea, Singapur und Indien bereits erfolgreich eingeführt. Viele weitere Länder bereiten sich darauf vor, sie in den kommenden Monaten und Jahren umzusetzen. Das bringt jedoch eine Reihe von Herausforderungen mit sich, die die Unternehmen bewältigen müssen. Doch welche Herausforderungen gibt es, und wie kann man sie bewältigen? In diesem Blog geht es genau darum. Lesen Sie weiter, um mehr zu erfahren.

2. Was sind die Herausforderungen bei der Umsetzung von e-Invoicing und e-Reporting?

Jede Lösung hat ihre Vor- und Nachteile, so auch die elektronische Rechnungsstellung und Berichterstattung. Obwohl sie Unternehmen geholfen haben, ihre Abläufe in Bezug auf die Steuervorschriften erheblich zu rationalisieren, sind hier einige der Herausforderungen, mit denen Unternehmen konfrontiert sind.

2.1 Unterschiedliche Regelungen in verschiedenen Ländern

Die größte Herausforderung bei e-Invoicing und e-Reporting besteht darin, dass die Einhaltung von Gesetzen und Vorschriften von Land zu Land unterschiedlich ist. Sie sind vielleicht ähnlich, aber nicht völlig gleich. Elektronische Fakturierungs- und Berichterstattungslösungen werden überall eingeführt, ohne dass ein universeller Ansatz vorhanden ist. Das macht den Prozess komplex, insbesondere für international tätige Unternehmen. Die Einhaltung der Steuergesetze der einzelnen Länder kann mühsam sein, und es sind nicht nur die Steuervorschriften: In einigen Ländern gibt es Vorgaben zu Rechnungsformaten, Datenaufbewahrungsfristen, digitalen Signaturen und Authentifizierungsmethoden. Sie können sich zwar mit allen Vorschriften vertraut machen, aber das ist auf Dauer keine effiziente Lösung.

2.2 Datenintegrität ist eine Herausforderung

Datengenauigkeit und -integrität sind für die elektronische Rechnungsstellung und Berichterstattung von zentraler Bedeutung. Da die Daten direkt an die Behörden gehen, können Fehler und Unstimmigkeiten dazu führen, dass Unternehmen mit hohen Strafen belegt werden. Hier kommt die Implementierung von robusten Datenvalidierungstechniken ins Spiel. Daneben können digitale Signaturen (gemäß den Vorschriften des jeweiligen Landes) und andere Überprüfungsmethoden Ihre Daten vor Betrug und Manipulation schützen. Die Frage ist jedoch, inwieweit sie zuverlässig sind.

2.3 Die Integration von ERP-Systemen kann kompliziert sein

Eine weitere Herausforderung bei der Einführung von e-Invoicing und e-Reporting ist die Integration von ERP-Systemen, die ziemlich komplex ist. ERP-Systeme müssen mit APIs und anderen Geschäftssystemen/-techniken integriert werden, die an die Struktur der elektronischen Rechnungsstellung und des elektronischen Berichtswesens angepasst sind. Die Integration kann sich jedoch als komplex erweisen, da Unternehmen in ihren Abteilungen oder Tochtergesellschaften unterschiedliche ERP- oder Rechnungssysteme verwenden. Darüber hinaus kann die Integration dieser verschiedenen Systeme aufgrund der unterschiedlichen Datenstrukturen, Technologien und Versionen, Kommunikationsprotokolle usw. kompliziert sein. Aus diesem Grund müssen Unternehmen die Daten möglicherweise umwandeln, abbilden oder bereinigen, um Kompatibilität und einen genauen Informationsaustausch zu gewährleisten.

2.4 Herausforderungen für die Systemsicherheit

e-Invoicing und e-Reporting ist ein Schritt der Regierungen in aller Welt zur Verbesserung der Steuersysteme. Die Sicherheit des Systems bleibt jedoch eine Herausforderung, die auf veraltete Systeme oder Technologien zurückzuführen sein kann. Angesichts neuer Aktualisierungen der Vorschriften ist es wichtig, einen zentralisierten und nachhaltigen Ansatz zu verfolgen, damit die Unternehmen diese Sicherheitsrisiken vermeiden und die sich ständig ändernden Trends problemlos bewältigen können.

2.5 Abgleich von e-Rechnungsdaten und Mehrwertsteuererklärungen

Eine weitere Herausforderung, mit der Unternehmen konfrontiert sind, ist der komplizierte Abgleich von e-Invoicing-Daten und Mehrwertsteuererklärungen. Es könnte ein Szenario entstehen, in dem Unternehmen nach dem Hochladen der Rechnung in das e-Invoicing-Portal die Daten abgleichen müssen. Obwohl dies automatisch geschehen sollte, gibt es Fälle, in denen die Benutzer ein Tool oder Dienstprogramm für den Abgleich der Daten verwenden müssen.

2.6 Auswirkungen auf den Cashflow

Ein regelmäßiger Cashflow ist für jede Organisation – ob groß oder klein – von vorrangiger Bedeutung. Doch bei e-Invoicing und e-Reporting stellt sich oft die Frage: Was ist, wenn der Cashflow langsam ist? Bei ineffizienten Systemen sind Auswirkungen auf den Cashflow möglich. Denn es kommt zu Verzögerungen bei der Versendung der Rechnungen oder es können Ungenauigkeiten auftreten, die zu Streitigkeiten führen können. Abgesehen davon verzögern solche Ineffizienzen im System auch Zahlungen von Kunden, kreieren verpasste Gelegenheiten für Skonti u.Ä., was sich direkt auf die Forderungen und den Cashflow des Unternehmens auswirkt.

3. Wie können Organisationen diese Herausforderungen bewältigen?

Eine der effektivsten Möglichkeiten, diese Herausforderungen zu meistern, ist die Implementierung von SAP Document and Reporting Compliance (SAP DRC). Es ist die ideale Lösung; nicht nur für diese, sondern für alle Belange von e-Invoicing und e-Reporting.

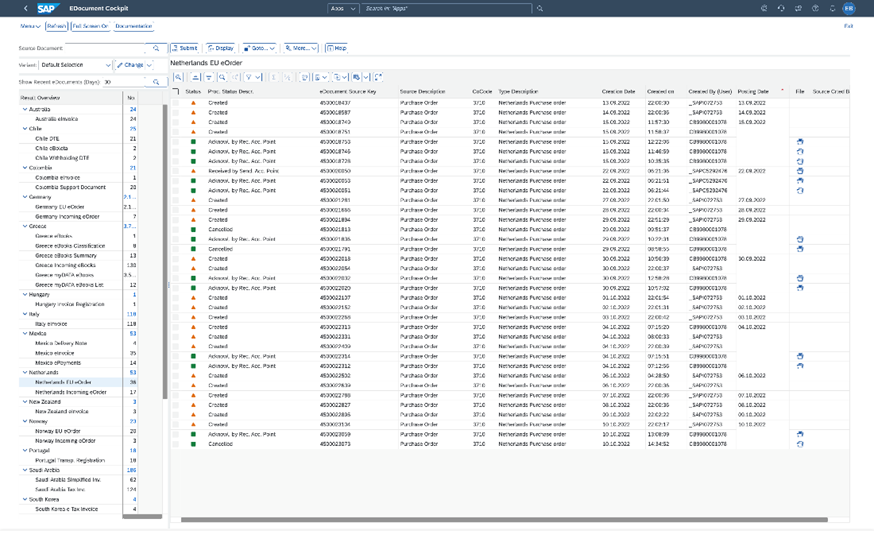

SAP DRC ermöglicht die Erstellung, Verarbeitung und Überwachung von Transaktionsdokumenten und regelmäßigen Berichten. So ermöglicht es Unternehmen, die rechtlichen Rahmenbedingungen und Vorschriften der Region einzuhalten. Die Lösung bietet einen optimierten Ansatz für die Einhaltung von Steuervorschriften. Zusammen mit der eingebetteten Automatisierung trägt die Lösung für das Dokumentenreporting und die Einhaltung von Vorschriften dazu bei, Effizienz zu maximieren, Kosten und Compliance-Risiken zu reduzieren und die Nachhaltigkeit der Steueraktivitäten zu verbessern.

3.1 Merkmale von SAP DRC, die Sie kennen müssen

SAP DRC verfügt über herausragende Funktionen, die es zu einer der zuverlässigsten Lösungen für alle Anforderungen im Bereich e-Invoicing und e-Reporting machen.

1. SAP DRC wird mit einem Compliance-Kalender geliefert, der die Benutzer dabei unterstützt, die Verpflichtungen weltweit zu überwachen.

2. Es automatisiert die Einreichung von Anträgen und gewährt datengestützte Einblicke in die Transaktionen, wodurch eine vollständige Prüfung unterstützt wird.

3. Die Lösung wird mit einer maßgeschneiderten Checkliste geliefert, die Aktivitäten durch Anpassungen an Genehmigungen in den Systemen der Akte digitalisiert und automatisiert.

4. SAP DRC kann dabei helfen, in Echtzeit verwertbare Erkenntnisse in die ERP-Systeme einzubetten, was dazu beiträgt, Unterbrechungen zu vermeiden und einen reibungslosen Betrieb zu gewährleisten.

5. Es verfügt über eine zentrale Eingabestelle, die eine effiziente Verwaltung von Korrekturen und Folgemaßnahmen ermöglicht.

4. Einführung von SAP DRC mit der TJC Group

Die Wahl des richtigen Partners für die Implementierung der SAP DRC-Lösung ist entscheidend dafür, dass Unternehmen die Vorteile der Lösung voll ausschöpfen können. Hier erfahren Sie, wie die TJC Group Sie bei der Implementierung von SAP DRC mit ihrer SAP Activate-Methodik unterstützt.

- Mit der bewährten SAP Activate-Methodik helfen wir bei der Planung und Durchführung des Projekts und liefern optimierte Vorlagen und Beschleuniger.

- Unser Expertenteam führt ein erstes Projekt-Scoping durch, um die Möglichkeiten zu ermitteln und die Risiken für die Projektumsetzung und die Auswirkungen auf das Geschäft zu minimieren.

- Wir definieren den besten Anwendungsbereich, entwickeln ein erstes Scope Statement, eine Fit/Gap-Analyse und erstellen einen Projektplan für die Implementierung von SAP DRC.

- Die TJC Group geht mit ihren talentierten und erfahrenen SAP-Finanzberatern, die wie eine Erweiterung Ihres Teams arbeiten, noch einen Schritt weiter.

Die TJC Group verfügt über mehr als 25 Jahre Erfahrung in der Unterstützung von Kunden bei Herausforderungen im SAP-Datenmanagement für Steuer- und Prüfungszwecke. Das Unternehmen kennt die rechtlichen Anforderungen für Steuer- und Wirtschaftsprüfung, die geschäftlichen Bedürfnisse und die technischen Aspekte der Compliance.

Wenden Sie sich noch heute an uns, um Ihre Herausforderungen im Bereich e-Invoicing und e-Reporting mit SAP DRC zu meistern.