Die digitale Transformation der Rechnungsstellung und des gesetzlichen Berichtswesens hat dazu geführt, dass sie zu einem Überlebenspaket für Unternehmen geworden ist, die Effizienz, Präzision und nahtlose Einhaltung ihrer steuerlichen und regulatorischen Anforderungen wünschen. Statistisch gesehen erreichte der Markt für elektronische Rechnungsstellung im Jahr 2023 ein Volumen von rund 14 Mrd. USD und wird voraussichtlich im Zeitraum 2024-2032 mit einer CAGR von 18% wachsen und im Jahr 2032 rund 61 Mrd. USD erreichen. Die Zahlen sind enorm und vielversprechend; sie zeigen den Bedarf an Genauigkeit, Nachhaltigkeit und schnelleren Methoden. Aber haben Sie schon einmal darüber nachgedacht, was die Haupttreiber für dieses kontinuierliche Wachstum sein könnten?

Inhaltsübersicht

- Einführung

- Die wichtigsten Vorteile von SAP Document and Reporting Compliance

- Einhaltung von Vorschriften und Standards

- Herausforderungen beim Einsatz von SAP DRC

- Schließen Sie sich mit der TJC Group für Ihre SAP DRC Implementierung zusammen

- Das letzte Wort

- Nützliche Links pro Land

Einführung

In den letzten 10 bis 15 Jahren hat sich die Landschaft der Steuereinhaltung und -berichterstattung drastisch verändert. Mit den strengeren Anforderungen an die Berichterstattung im internationalen Geschäft hat auch der globale regulatorische Druck zugenommen. Aber auch die Behörden haben sich gewandelt und verfolgen nun einen strategischeren, kommerzielleren und digitaleren Ansatz. Das Aufkommen des digitalen Zeitalters hat sich positiv auf die Steuer- und Regulierungslandschaft ausgewirkt, z. B. durch die Einführung der elektronischen Rechnungsstellung und der elektronischen Berichterstattung in der ganzen Welt. Für die Unerfahrenen: Viele Länder haben die elektronische Rechnungsstellung und die elektronische Berichterstattung zur Pflicht gemacht, während einige Länder auf dem Weg sind, dies ebenfalls einzuführen.

Die wichtigsten Treiber für digitale Compliance-Initiativen

Es mag Dutzende von Gründen geben, warum digitale Compliance-Initiativen die beste Vorgehensweise sind, aber unter diesen sind die folgenden die absoluten Schlüsselfaktoren der digitalen Compliance-Landschaft –

Steuerhinterziehung verhindern

Hin und wieder hören wir von Prominenten oder Unternehmern, die Steuern hinterziehen. Es gibt jedoch weitaus mehr Unternehmen, die ihre Steuern nicht an ihre Regierung zahlen. Dafür kann es mehrere Gründe geben, und es muss eine Lösung gefunden werden. Zum Glück kann die elektronische Rechnungsstellung und Berichterstattung dabei helfen. Sie helfen bei der Echtzeitkontrolle von Geschäftstransaktionen, gehen über die elektronische Rechnungsstellung hinaus und verringern die Mehrwertsteuerlücken, die auf Milliardenbeträge geschätzt werden.

Effizienz steigern

Ein weiterer Grund für digitale Compliance-Initiativen ist die höhere Effizienz, die sie mit sich bringen. Mit digitaler Compliance können Behörden Steuereinnahmen viel müheloser und schneller verwalten. Außerdem wird das Berichtswesen automatisiert, es werden Analysen, Prognosen und Statistiken bereitgestellt und das öffentliche Beschaffungswesen digitalisiert.

Wirtschaftliche Digitalisierung

Automatisierung ist ein wichtiger Bestandteil derdigitalen Compliance. Sie hat Regierungen auf der ganzen Welt dabei geholfen, ihre Wirtschaft zu digitalisieren und Prozesse für die Finanzierung, Interoperabilität und so weiter zu implementieren. Die Digitalisierung hat auch dazu beigetragen, die Unterstützung von KMU, die operative Effizienz und die Verwaltung der Ausgaben zu verbessern.

Die Vorschriften werden sich weiter entwickeln, und je mehr sie zunehmen, desto anspruchsvoller können sie sein. Gesetzliche Vorgaben erfordern Echtzeitdaten als Voraussetzung für den Betrieb von Unternehmen. Es mag wie eine Herausforderung erscheinen, aber mit den richtigen Tools wie dem SAP Document and Reporting Compliancewird es viel einfacher, mit den Vorschriften Schritt zu halten und gleichzeitig die damit verbundenen Herausforderungen zu bewältigen.

Was ist SAP DRC?

Die SAP Document and Reporting Compliance, oder SAP DRC, ist eine Lösung, die alle Aspekte der elektronischen Rechnungsstellung und des elektronischen Berichtswesens abdeckt. Mit ihrer Hilfe können Sie alle Ihre elektronischen Dokumente und periodischen Berichte mit den SAP-Systemen erstellen, verarbeiten und überwachen. SAP DRCDie Funktion von SAP DRC ermöglicht es Unternehmen, die Einhaltung lokaler gesetzlicher Rahmenbedingungen und Vorschriften zu gewährleisten. unterstützt mehrere Länder und Sprachen und bietet einen zentralen Ansatz für die Verwaltung von Dokumenten bei gleichzeitigem vollständigen Zugriff und Einblick in die Berichte.

Darüber hinaus hilft die Funktion eDocument Cockpit von SAP DRC bei der einfachen Zusammenarbeit mit Dokumenten; SAP Application Interface Framework (SAP AIF) und SAP Integration Suite helfen bei der nahtlosen Integration mit anderen SAP-Systemen. Mit SAP DRC können Unternehmen sicherstellen, dass ihre SAP-Systeme den Vorschriften entsprechen und die Genauigkeit und Zuverlässigkeit der in den Systemen gespeicherten Informationen aufrechterhalten.

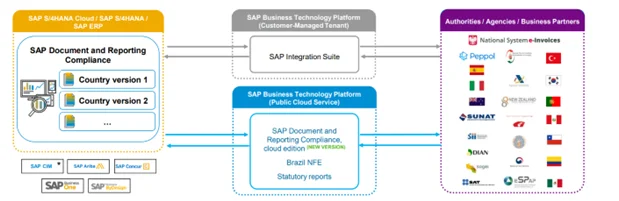

SAP Document and Reporting Compliance besteht aus zwei Komponenten.

- Der erste Teil bezieht sich auf die Geschäftssysteme(SAP S/4HANA, ERP oder andere Geschäftsplattformen), um die Einhaltung der Vorschriften zu einem nahtlosen Schritt innerhalb Ihrer Geschäftsprozesse zu machen, ohne Datenredundanz und ohne Datenreplikation. Dieser Teil verwaltet die lokale Zuordnung oder das Format auf der Grundlage lokaler Vorschriften, die vollständig in die Geschäftsprozesse integriert sind, die Geschäftsüberwachung in Echtzeit und nahtlose Korrekturen für alle Arten von Vorschriften weltweit.

- Der zweite Teil ist auf der SAP Business Technology Platform (BTP) zur Skalierung und Vereinfachung der elektronischen Integration mit lokalen Behörden und Plattformen. Dabei kann es sich um die SAP Document and Reporting Compliance, die Cloud Edition handeln, bei der es sich um einsatzbereite Services handelt, oder um die vom Kunden verwalteten SAP Integration Suite-Tenants, die je nach Land/Szenario einsatzbereit sind. Diese Komponente verwaltet die Authentifizierung, Verschlüsselung und digitale Signatur auf der Grundlage der lokalen Vorschriften.

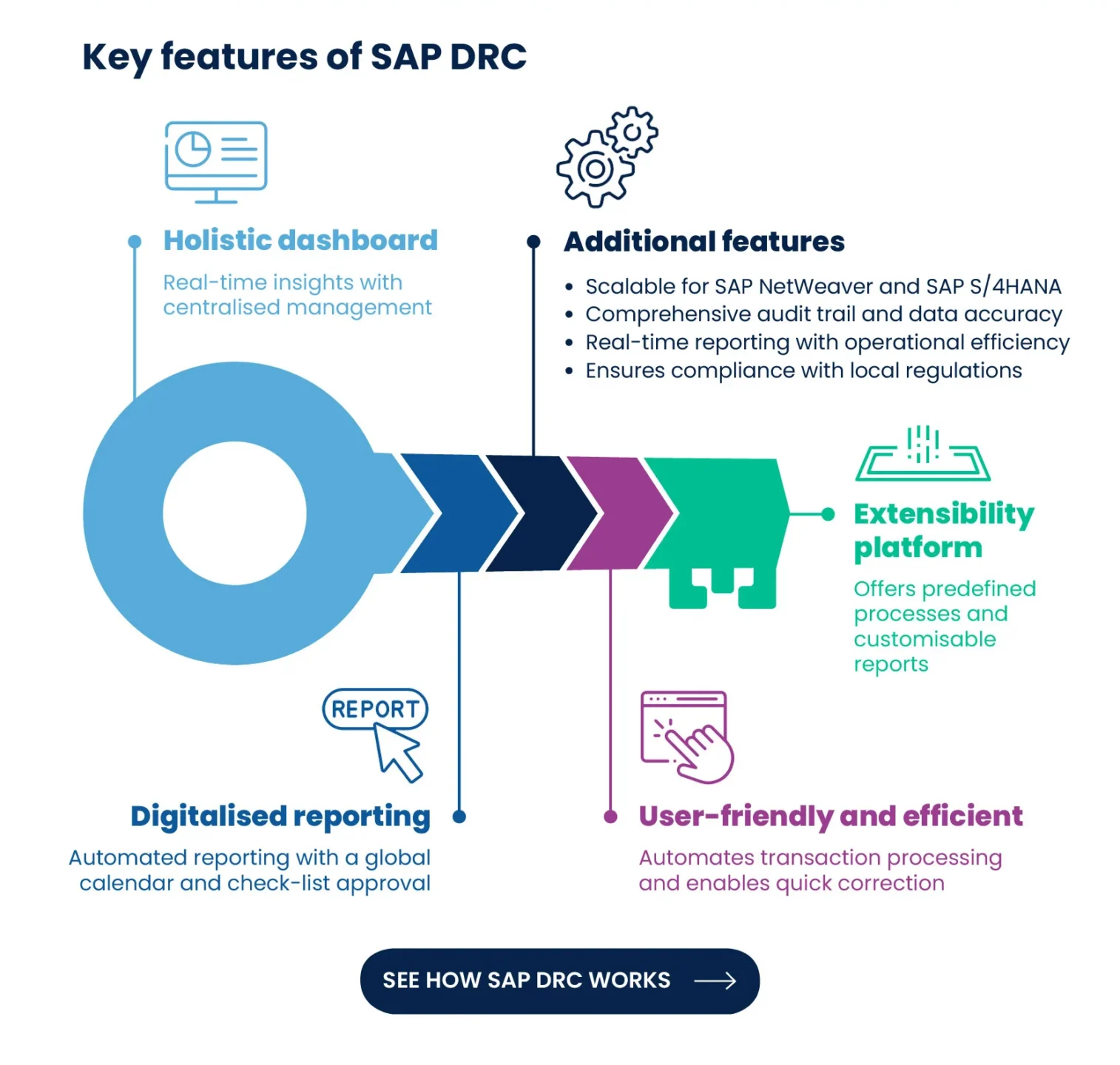

Hauptmerkmale und Funktionen von SAP DRC

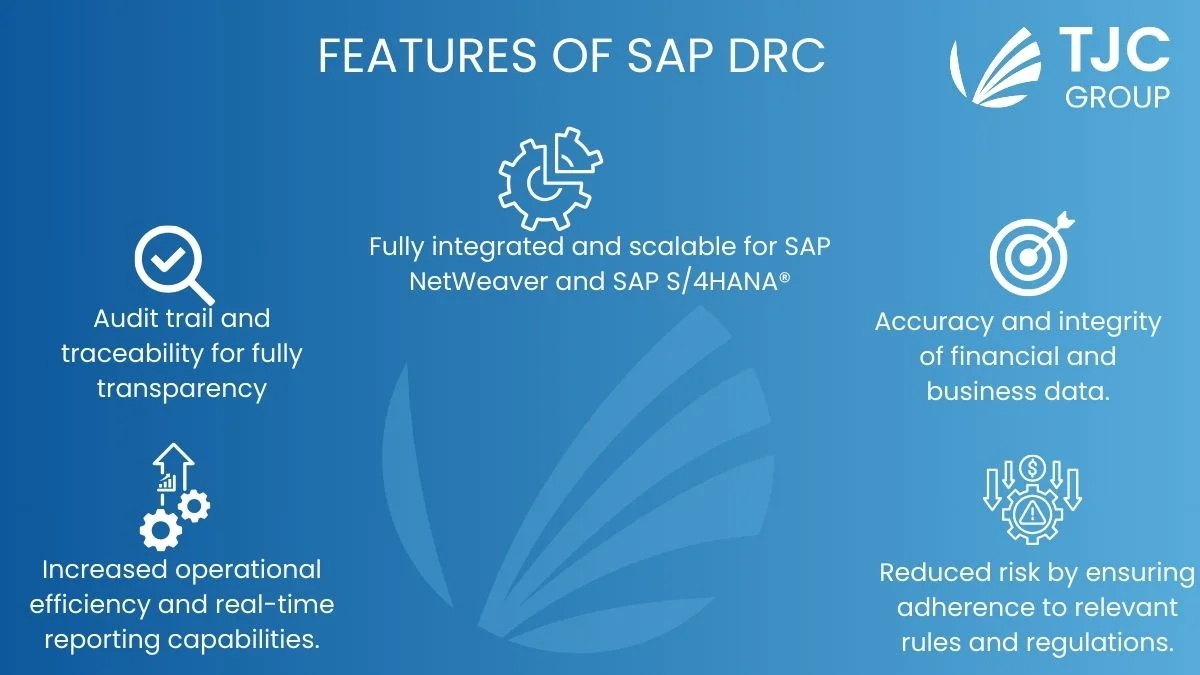

SAP Document and Reporting Compliance verfügt über umfassende Funktionen, die es zu einer bevorzugten Wahl machen; einige der wichtigsten Merkmale und Funktionen sind

Entwickelt mit einem ganzheitlichen Dashboard

- Die SAP DRC Lösung hilft Ihnen, Echtzeit- und umsetzbare Erkenntnisse in Ihre ERP-Systeme einzubetten, um Störungen zu vermeiden und einen reibungslosen Betrieb zu ermöglichen.

- Das ganzheitliche Dashboard ermöglicht es den Nutzern, Korrekturen und Nachverfolgungen durch seinen zentralen Einstiegspunkt effektiv zu verwalten.

- Das Dashboard bietet länderübergreifend eine einheitliche Benutzererfahrung und gewinnt dadurch an Flexibilität, um spezifische Anforderungen zu erfüllen.

Erfahrung mit digitalisierten Berichten

- SAP DRCDie Funktion, mit der Benutzer Verpflichtungen weltweit abfragen und überwachen können, ist eine Klasse für sich. Es verfügt über einen Compliance-Kalender, der eine einfache Überwachung der Verpflichtungen ermöglicht.

- Die Lösung digitalisiert und automatisiert Aktivitäten durch Genehmigungsanpassungen im System des Datensatzes. Dies geschieht mit Hilfe einer maßgeschneiderten Checkliste.

- Die digitalisierte Berichtsfunktion automatisiert Einreichungen und hilft dabei, datengestützte Einblicke in Transaktionen zu gewinnen, wodurch ein vollständiger Prüfpfad und die Rückverfolgbarkeit unterstützt werden.

Erweitern und erstellen Sie Szenarien

- SAP Document and Reporting ComplianceDie Erweiterungsplattform hilft bei der Erweiterung und Erstellung von Szenarien. Benutzer haben Zugriff auf eine Bibliothek mit vordefinierten Prozessen und Echtzeitszenarien, die wiederverwendet werden können.

- Darüber hinaus lassen sich mit den Funktionen Compliance-Berichte definieren, die mühelos hinzugefügt und kopiert werden können, um Geschäftsanforderungen zu erfüllen.

- Die Funktion ermöglicht auch die Wiederverwendung von Geschäftsfunktionen in allen Basis-, personalisierten und Partnerszenarien.

Einfacher Betrieb

- Die SAP DRC-Automatisierungsfunktion ermöglicht eine einfache Bedienung und verbessert die Übertragung und digitale Freigabe von Geschäftsvorgängen durch lokale Standards.

- Mit der DRC-Lösung können Benutzer registrierte Rechnungen überwachen und den Abgleich mit öffentlichen Stellen automatisieren.

- Darüber hinaus können die Benutzer Transaktionen leicht korrigieren, indem sie direkt in die zugrunde liegenden Transaktionen einsteigen.

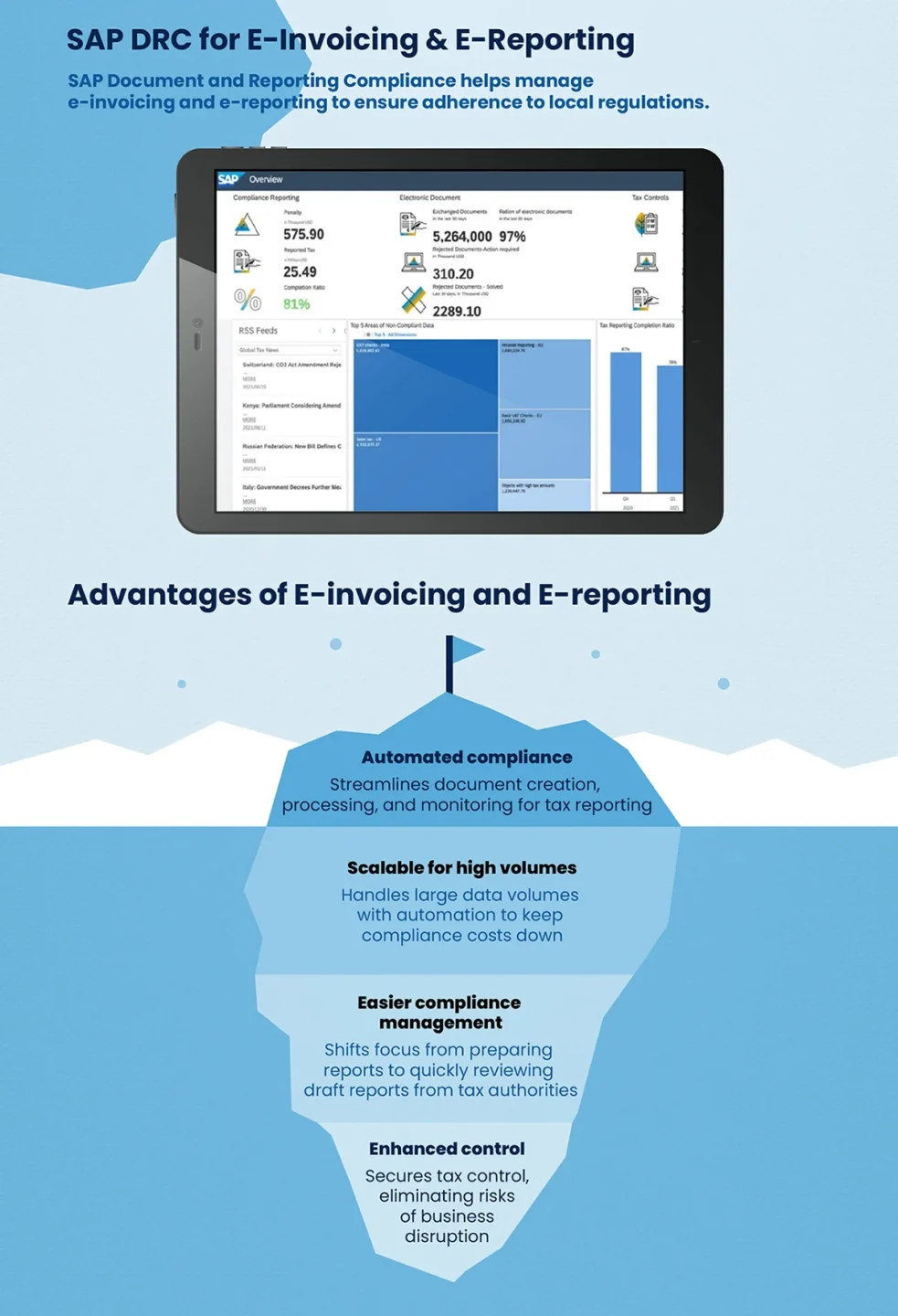

Wie unterstützt der SAP DRC Unternehmen bei der digitalen Transformation?

Die digitale Transformation des Steuererklärungsprozesses führt zu strengeren Kontrollen und gleichzeitig zu einem Paradigmenwechsel bei der Abschaffung der traditionellen Compliance-Rollen. Die Steuerpflichtigen werden von der Erstellung regelmäßiger Berichte zur Prüfung der von den Behörden erstellten Erklärungsentwürfe übergehen. Der Prozess muss innerhalb der bestehenden operativen Kapazitäten schnell durchgeführt werden. Dabei ist zu bedenken, dass die Prüfungstätigkeit die Analyse mehrerer Datensätze umfasst, die in die Tausende oder sogar in die Millionen gehen können. Daher werden Automatisierung und Technologie zunehmend zu einem wesentlichen Bestandteil der gesamten Rechnungsstellung, Berichterstattung und Steuereinhaltung.

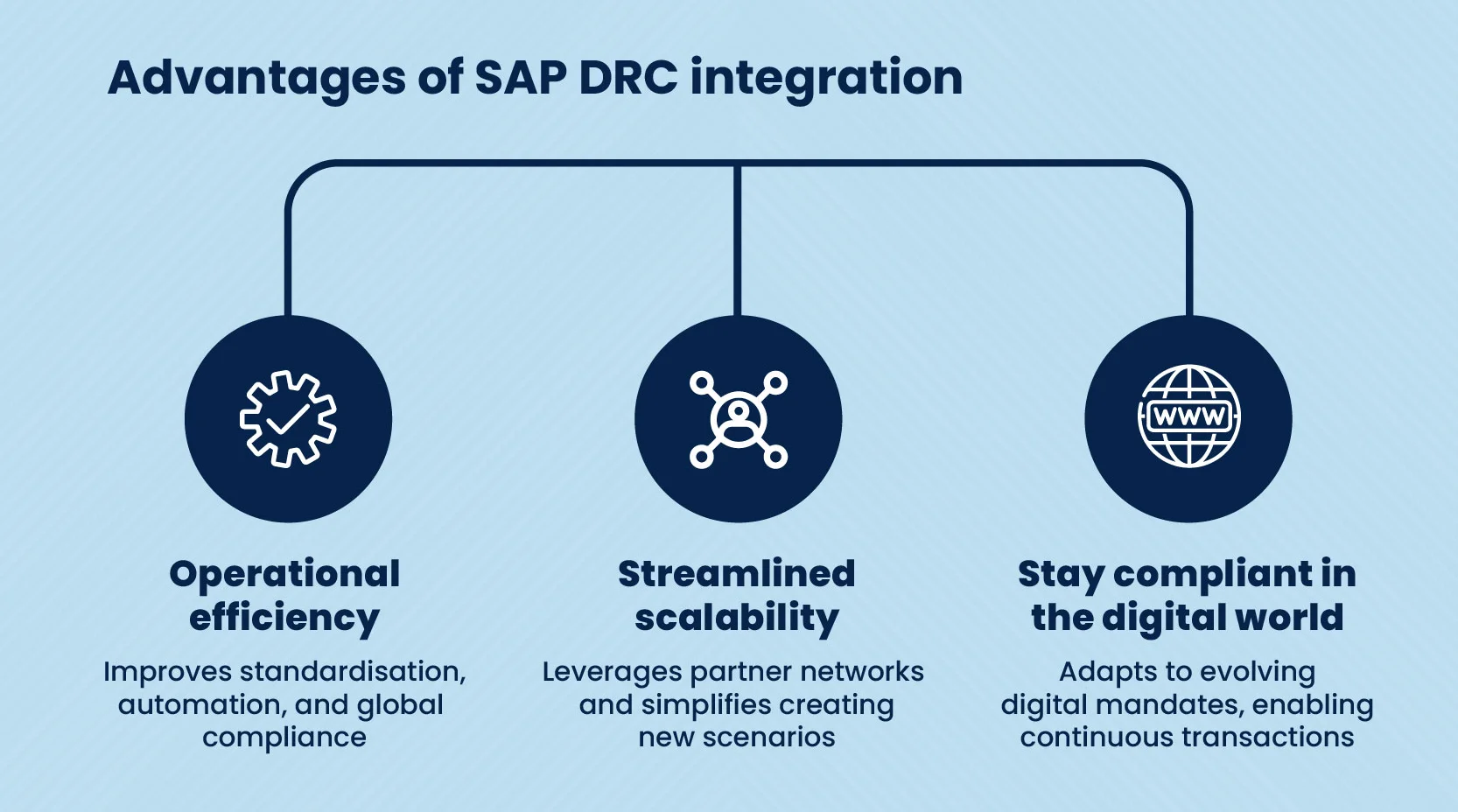

SAP Document and Reporting Compliance hilft Organisationen (oder Unternehmen) bei der Bewältigung aller Herausforderungen im Bereich der elektronischen Rechnungsstellung und der gesetzlichen Berichterstattung. Die Lösung hilft Ihnen dabei, in der digitalen Welt konform zu bleiben, indem sie einen optimierten Ansatz für die Einhaltung von Steuervorschriften bietet. Darüber hinaus hilft Ihnen die Zusammenstellung mit eingebetteter Automatisierung dabei, die Effizienz zu maximieren, Compliance- und Kostenrisiken zu reduzieren und die Nachhaltigkeit von Steuervorgängen zu erhöhen.

Die wichtigsten Vorteile von SAP Document and Reporting Compliance

Kunden suchen nach Lösungen, die ihre Geschäftsabläufe effektiver und einfacher machen. Wenn es um die digitale Rechnungsstellung und die Steuerlandschaft geht, gibt es nicht viele umfassende Lösungen. Daher war es bei der Entwicklung von SAP DRC ein wichtiger Aspekt, es mit modernsten Vorteilen auszustatten. Wieso den? – um sicherzustellen, dass die Kunden die Leichtigkeit des digitalen Berichtswesens auf die bestmögliche Weise erleben. Im Folgenden finden Sie einige Vorteile, die die SAP-Lösung für die Einhaltung von Berichtspflichten zu einer außergewöhnlichen Lösung machen

Steigert die Effizienz Ihrer Geschäftsabläufe

Die Lösung für die Einhaltung von Dokumenten und Berichten von SAP verbessert nicht nur Ihre Automatisierungsbemühungen, sondern steigert auch Ihre betriebliche Effizienz um ein Vielfaches. Die Lösung optimiert die Einhaltung von Vorschriften und verbessert die Nachhaltigkeit, indem sie elektronische Dokumente und gesetzlich vorgeschriebene Berichte global verwaltet usw.

Rationalisiert Ihre Geschäftsprozesse

SAP DRCDie Erweiterungsfunktion der Plattform hilft bei der Erstellung neuer Szenarien, die es Anwendern ermöglichen, SAP-Dokumente und Berichtsfunktionen an ihre spezifischen Geschäftsanforderungen oder branchenspezifischen Anforderungen anzupassen. Sie strafft und vereinfacht Ihre Geschäftsprozesse mit Hilfe einer einheitlichen Benutzererfahrung.

Nahtlose Integration mit SAP ERP- und S/4HANA-Systemen

Ein wesentlicher Vorteil von SAP Document and Reporting Compliance (DRC) ist die nahtlose Integration mit SAP ERP und S/4HANA Systemen. Dadurch entfällt die Notwendigkeit der Datenreplikation, was den Arbeitsaufwand für das IT-Team erheblich reduziert. Mit DRC werden elektronische Dokumente und gesetzlich vorgeschriebene Berichte direkt aus SAP-Daten in Übereinstimmung mit den lokalen gesetzlichen Anforderungen erstellt, wodurch der manuelle Aufwand minimiert und die Genauigkeit gewährleistet wird.

Erweiterte Analyse- und Berichtsfunktionen

Die digitale Landschaft wird nie aufhören, sich zu entwickeln – sie wächst und wird weiterhin schnell wachsen. Angesichts ihrer Auswirkungen auf die Geschäftsabläufe ist es unumgänglich, mit diesen sich ständig ändernden Trends Schritt zu halten. SAP DRC bietet Unternehmen nicht nur durch seine Automatisierungsfunktionen, sondern auch durch seine fortschrittlichen Analysefähigkeiten Vorteile. Darüber hinaus können Sie mit dieser Lösung für die Einhaltung von Dokumenten gesetzliche Vorgaben problemlos umsetzen und mit einer integrierten Lösung von der periodischen Berichterstattung zur kontinuierlichen Transaktionskontrolle übergehen.

Skalierbarkeit und Flexibilität für zukünftiges Wachstum

Jede Lösung muss skalierbar und flexibel sein, um sich an neue Änderungen anzupassen, die in der Zukunft eintreten könnten. Glücklicherweise verfügt Ihre SAP DRC über ein flexibles Framework, das sich an die Bedürfnisse und rechtlichen Vorgaben verschiedener Länder und Regionen anpassen lässt. Darüber hinaus passt sich die Lösung mühelos an verschiedene Geschäftsprozesse an und wirkt sich so positiv auf eine skalierbare Zukunft aus.

Verbesserte Datenverwaltung und Zugänglichkeit

Die SAP Document and Reporting Compliance hilft bei der Erstellung und Verwaltung von Compliance-Berichten. Die Lösung bietet eine Reihe von Funktionen, die die Erstellung und Verwaltung von Daten rationalisieren. Sie können die Erstellung von Berichten automatisieren, die regelmäßige Erstellung von Berichten planen und den Status der Berichte verfolgen. Insgesamt verbessert SAP DRC Ihren Datenverwaltungsprozess und ermöglicht Ihnen gleichzeitig einen einfachen Zugriff auf die Berichte.

Einhaltung von Vorschriften und Standards

Compliance-Herausforderungen für Unternehmen

Mit den neuen Technologien und den sich ständig ändernden Vorschriften stehen Unternehmen oft vor Herausforderungen bei der Einhaltung von Vorschriften. Nicht nur das, es gibt auch Hindernisse bei der Aufbewahrung von Daten für Audits und andere rechtliche Zwecke. Die Aufbewahrung von Daten für einen bestimmten Zeitraum muss mit den rechtlichen, administrativen, betrieblichen und geschäftlichen Anforderungen vereinbar sein. Darüber hinaus müssen Unternehmen sicherstellen, dass die Informationen sicher aufbewahrt werden und bei Bedarf zur Verfügung stehen, allerdings unter Einhaltung der Gesetze zum Schutz der Privatsphäre und des Datenschutzes.

Einige der häufigsten Herausforderungen, denen sich Unternehmen bei der Einhaltung von Vorschriften stellen müssen, sind folgende

Vielfältiges regulatorisches Umfeld

Leider sind die staatlichen oder gesetzlichen Vorschriften komplex und variieren von Branche zu Branche und von Region zu Region. Für Unternehmen ist es eine Herausforderung, sich in der sich entwickelnden und komplexen Gesetzeslandschaft zurechtzufinden, insbesondere wenn sie international tätig sind. Außerdem müssen sie sich über Gesetzesänderungen auf dem Laufenden halten und gleichzeitig sicherstellen, dass die Richtlinien mit den lokalen und internationalen Gesetzen übereinstimmen.

Datenvermehrung

Daten sind einer der wichtigsten Aspekte eines jeden Unternehmens, und Unternehmen produzieren riesige Datenmengen, die es schwierig machen, sie zu verwalten und zu speichern. Dieses zunehmend schwierige Thema kann sich auf Ihre Strategien auswirken, denn wirksame Aufbewahrungsvorschriften hängen davon ab, wie effizient Daten identifiziert und entsprechend ihrem Wert und ihrer Sensibilität klassifiziert werden können.

Datensicherheit

Sich entwickelnde Technologien

Die sichere Aufbewahrung von Daten zur Erfüllung gesetzlicher Anforderungen muss für Unternehmen eine Priorität sein. Und man muss bedenken, dass die aufbewahrten Daten verfügbar sein müssen, wenn sie benötigt werden. Dies unterstreicht, wie wichtig es ist, starke Sicherheitsmaßnahmen zum Schutz sensibler Daten vor unbefugtem Zugriff und zunehmenden Sicherheitsbedrohungen zu implementieren.

Mit den sich weiterentwickelnden Technologien auf dem Laufenden zu bleiben, kann zu einer mühsamen Aufgabe werden. Um mit den aktuellen Aufbewahrungspraktiken Schritt zu halten, müssen Unternehmen ihre Richtlinien, IT-Infrastruktur usw. aktualisieren – als Reaktion auf die neuen Datenformate, Speichertechnologien und Kommunikationswege.

Wie hilft der SAP DRC bei der Einhaltung von Vorschriften?

Wenn Sie sich fragen, wie SAP DRC diese Herausforderungen meistern und die Compliance einhalten kann, dann haben wir hier die Lösung für Sie.

Vorbereitung und Einreichung von Daten

SAP DRC unterstützt Sie dabei, kritische Geschäftsdaten für die Einreichung vorzubereiten, und zwar mit der Möglichkeit, manuelle Anpassungen oder Umstrukturierungen vorzunehmen. Dadurch wird sichergestellt, dass die Daten den gesetzlichen Anforderungen entsprechen und gleichzeitig die elektronische Verarbeitung durch externe Systeme ermöglicht wird. In einigen Fällen ist auch der Abgleich bestehender Daten mit denen von Geschäftspartnern oder Steuerbehörden unerlässlich. SAP DRC hilft dabei, den Prozess korrekt durchzuführen, die Anforderungen zu erfüllen und sicherzustellen, dass die Daten innerhalb der internen und externen (Geschäftspartner, Steuerbehörden usw.) Organisationen konsistent bleiben.

Versöhnung

SAP DRC erleichtert den Abgleich zwischen internen Aufzeichnungen und Aufzeichnungen, die auf den Plattformen der Steuerbehörden verfügbar sind; Unstimmigkeiten können nahtlos überprüft und entsprechend genehmigt oder abgelehnt werden. Es bietet einen Rahmen für die Konsistenzprüfung, um Prüfungen zu automatisieren, Unstimmigkeiten zentral zu überprüfen und Korrekturen einzuleiten, mit der Möglichkeit, Unstimmigkeiten zu identifizieren und die Behebung zu rationalisieren. Sie hilft auch dabei, fehlende Datensätze vor dem Ende des Zeitraums zu erkennen, während sie automatisch die von den Behörden erstellten Meldeentwürfe überprüft und sie akzeptiert oder ablehnt, um die periodische Einreichung abzuschließen. Die Abgleichsfunktion ist in den Ländern verfügbar, in denen die Portale der Behörden eine API und Zugang zum Abrufen der eingereichten Datensätze bieten.

Gesetzlich vorgeschriebene Berichterstattung

SAP Document and Reporting Compliance erstellt automatisch die erforderlichen gesetzlichen Berichte in dem von den Behörden erwarteten gesetzlichen Format und umfasst gebrauchsfertige Szenarien/Berichte für über 400 Vorschriften in mehr als 55 Ländern. Steuerexperten können nachvollziehbare Anpassungen mit Funktionen vornehmen, die die zugrundeliegenden Geschäftsdokumente aufschlüsseln, und erhalten eine revisionssichere Dokumentation. Mit Transparenz über Steuerfristen sowie Genehmigungen und automatischer Einreichung bei den Behörden.

Elektronische Dokumente

Ausgehende elektronische Dokumente werden automatisch im Format lokaler, gesetzeskonformer Dateien mit digitalen Links zu den zugrunde liegenden Transaktionen in SAP ERP und S/4HANA erstellt. Ausgehende elektronische Dokumente werden automatisch entweder an Geschäftspartner oder Steuerbehörden übermittelt.

Eingehende elektronische Dokumente werden automatisch von Steuerbehörden oder Geschäftspartnern empfangen und interpretiert und in ein für Menschen lesbares Format (HTML- oder PDF-Format) umgewandelt, ohne dass eine OCR erforderlich ist. Eingehende elektronische Dokumente werden automatisch mit der Lösung für die Verwaltung von Lieferantenrechnungen zur weiteren Verarbeitung für die Rechnungsprüfung, den Workflow und die Genehmigung integriert. Der Status der Dokumente wird in Echtzeit aktualisiert, erlaubte Aktionen werden entsprechend gesteuert.

Von SAP Document and Reporting Compliance unterstützte Länder

Wie bereits erwähnt, hat jedes Land seine eigenen gesetzlichen Bestimmungen und Compliance-Anforderungen. Unterstützt SAP DRC alle Länder der Welt? Nun, hier ist eine Liste für Sie –

- Angola

- Argentinien

- Australien

- Österreich

- Belgien

- Brasilien

- Bulgarien

- Kanada

- Chile

- China

- Kolumbien

- Kroatien

- Tschechische Republik

- Dänemark

- Ägypten

- Finnland

- Frankreich

- Deutschland

- Griechenland

- Ungarn

- Indien

- Indonesien

- Irland

- Israel

- Italien

- Japan

- Kasachstan

- Luxemburg

- Malaysia

- Mexiko

- Niederlande

- Neuseeland

- Norwegen

- Oman

- Peru

- Philippinen

- Polen

- Portugal

- Katar

- Rumänien

- Russland

- Saudi-Arabien

- Serbien

- Singapur

- Slowakei

- Südafrika

- Südkorea

- Spanien

- Schweden

- Schweiz

- Taiwan

- Thailand

- Türkei

- Ukraine

- UAE

- Vereinigtes Königreich

- Vereinigte Staaten

- Venezuela

Herausforderungen beim Einsatz von SAP DRC

SAP Document and Reporting Compliance ist zwar die beste Lösung für die Einhaltung von Vorschriften für die elektronische Rechnungsstellung und das elektronische Berichtswesen, aber bei der Implementierung der Lösung können Sie auf einige Herausforderungen stoßen, wie z. B. –

Die Komplexität der Implementierung: Die Implementierung von SAP DRC kann ein langwieriger Prozess sein, wenn die Konfiguration des Kunden von den SAP-Standards oder Best Practices abweicht. Daher ist es wichtig, den richtigen Partner mit dem richtigen Fachwissen und der richtigen Unterstützung für eine erfolgreiche Implementierung zu haben.

Herausforderungen bei der Anpassung: Obwohl die Lösung recht flexibel und skalierbar ist, kann die Anpassung an spezifische organisatorische Anforderungen zuweilen zu einer Herausforderung werden. Für eine effektive Verbesserung ist möglicherweise externer Input erforderlich.

Vertrauen in das SAP-Ökosystem: SAP DRC ist ein Jackpot für Unternehmen, die in SAP-Systeme investiert haben, aber für diejenigen, die nicht zum SAP-Ökosystem gehören, kann die Integration eine Herausforderung darstellen. Das heißt nicht, dass es nicht möglich ist, aber es wird ein bisschen komplexer sein!

Kostenüberlegungen: Da das Preismodell auf der Anzahl der Transaktionen basiert, können Kunden mit einem Minimalpaket beginnen und haben so die Möglichkeit, klein anzufangen und dann allmählich groß zu werden.

Das sind zwar Herausforderungen bei der Bereitstellung der Lösung, aber sie sind machbar – Sie müssen nur den richtigen Partner und die richtige Unterstützung haben. Und wie können Sie das sicherstellen? Indem Sie sich mit der TJC Group zusammentun!

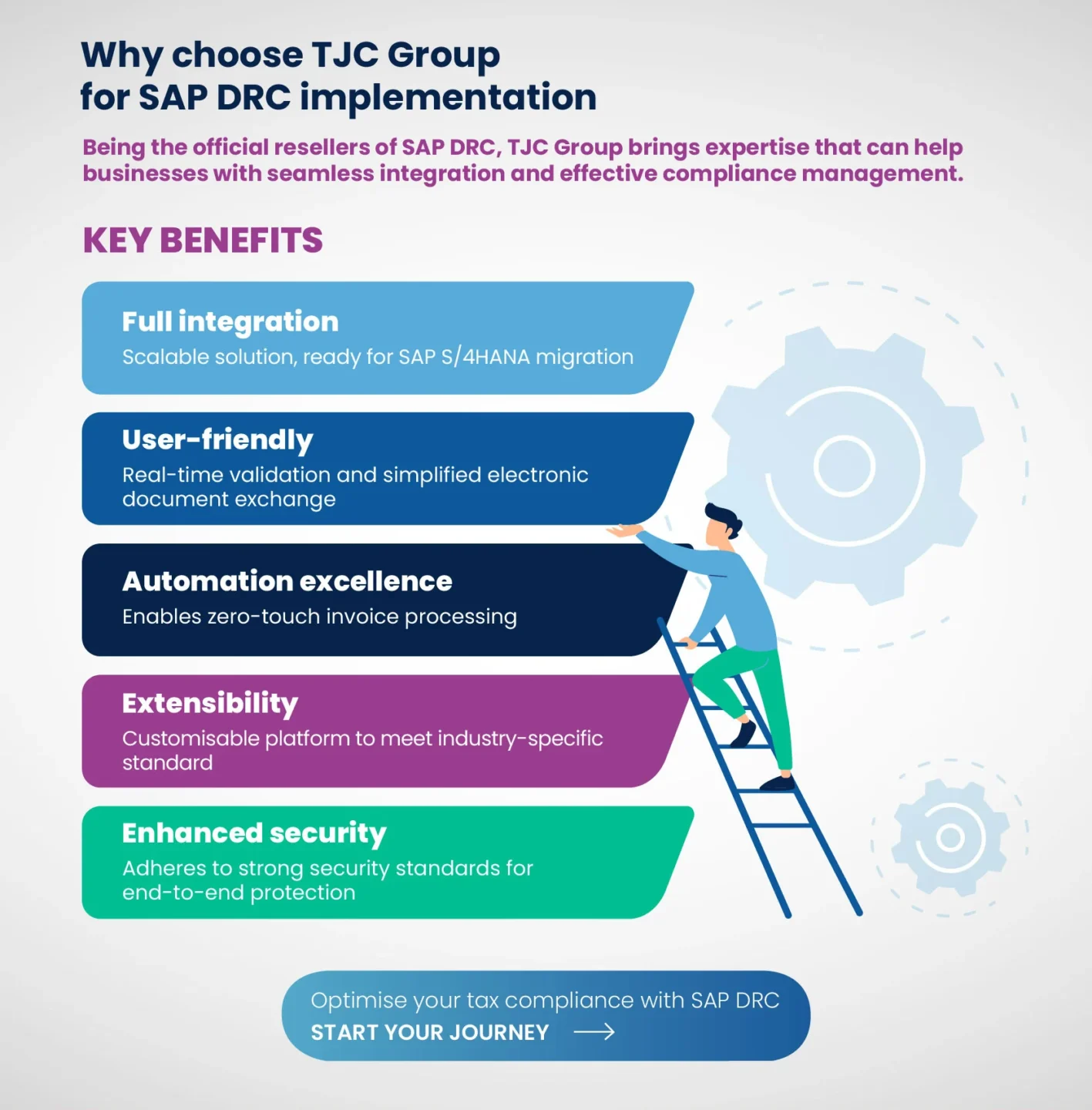

Schließen Sie sich mit der TJC Group für Ihre SAP DRC Implementierung zusammen

Die Einhaltung von Steuervorschriften muss mit höchster Priorität behandelt werden und ist ein entscheidender Faktor für Unternehmen. Mit SAP DRC können Unternehmen aufatmen. Mit dem richtigen Partner wird der gesamte Prozess jedoch noch einfacher und nahtloser. Unsere SAP DRC Beratungsdienste sind so zugeschnitten, dass unsere Kunden während des gesamten Prozesses eine reibungslose Erfahrung machen. Mit dem hervorragenden Fachwissen und der Erfahrung unserer Teammitglieder ist es das Ziel der TJC Group, die Implementierung so einfach und effizient wie möglich zu gestalten.

Nutzen Sie die Vorteile des SAP DRC mit der TJC Group

Mit uns können Kunden SAP Document and Reporting Compliance nahtlos einsetzen und von den Vorteilen profitieren, die sich daraus ergeben.

Integration: SAP DRC ist skalierbar und flexibel; daher stellen wir sicher, dass Sie es für Ihre SAP S/4HANA-Migration vollständig integrieren können.

Automatisierung: Wahrscheinlich einer der begehrtesten Vorteile von SAP DRC. Mit uns können Sie mit Hilfe der Integration eingehender automatisierter Lösungen eine Zero-Touch-Rechnungsbearbeitung erreichen.

Erweiterbarkeit: Die Erweiterungsplattform von SAP DRCist ein wesentliches Merkmal, das die Lösung von der Masse abhebt. Die TJC Group nutzt sie zu ihrem Vorteil, indem sie sicherstellt, dass bei der Implementierung der Lösung alle branchenspezifischen und geschäftlichen Anforderungen erfüllt werden.

Sicherheit: Ein Aspekt, über den immer wieder gesprochen wird: Datensicherheit gehört zu den wichtigsten Faktoren für Unternehmen. Wenn Sie sich für die Beratungsdienste der TJC Group SAP DRC entscheiden, können Sie genau das gewährleisten. Wir haben einen strengen Sicherheitskodex, der sicherstellt, dass die notwendigen Richtlinien und Verfahren eingehalten werden. Mit unserer ISO27001-Zertifizierung sind unsere Sicherheitsprozesse jetzt noch robuster geworden.

Unser maßgeschneiderter Ansatz für die SAP DRC Implementierung

Das B2G-Expertenteam der TJC Group, das sich auf SAP DRC spezialisiert hat, verfolgt einen maßgeschneiderten Ansatz, der durch die SAP Activate-Methodik gestützt wird.

Die SAP Activate-Methodik ist ein bewährter Prozess für die Projektplanung und -durchführung, der die Bereitstellung optimierter Vorlagen und Beschleuniger gewährleistet.

Während des Projekts definieren unsere Experten zunächst den optimalen Anwendungsbereich, entwickeln eine erste Umfangsangabe sowie einen Zeit- und Ablaufplan für die Implementierung. Am Ende jeder Phase führen wir ein Project Quality Gate durch, um zu überprüfen, ob die geforderten Leistungen und die für die jeweilige kritische Phase durchzuführenden Maßnahmen akzeptiert werden, um die Projektqualität zu verbessern und das Projektrisiko zu minimieren.

Wir führen ein erstes Projekt-Scoping mit einer gründlichen Analyse der rechtlichen Anforderungen und einer Lückenanalyse durch, um die Risiken für die Projektimplementierung und die Auswirkungen auf das Geschäft zu identifizieren und zu mindern. Das Team geht jedoch noch einen Schritt weiter: Es besteht aus talentierten und erfahrenen SAP-Finanzberatern, die wie eine Erweiterung Ihres Teams arbeiten.

Warum sollten Sie die TJC Group für die SAP DRC Implementierung wählen?

Wir sind seit mehr als 25 Jahren in der Branche tätig und verstehen die gesetzlichen Anforderungen an Steuern und Rechnungsprüfung, die geschäftlichen Bedürfnisse und die technischen Aspekte der Compliance. Wenn Sie sich mit der TJC Group zusammentun, können Sie nicht nur eine mühelose und zeiteffiziente Implementierung von SAP DRC sicherstellen, sondern auch eine nahtlose Unterstützung nach der Inbetriebnahme.

SAP-Kenntnisse: Das Wissen der TJC Group umfasst SAP-Lösungen, Steuern, Technologie und mehr. Das umfassende Fachwissen unserer Organisation kann die Kluft zwischen den Beteiligten überbrücken und eine kompetente Synergie zwischen den Steuer- und IT-Teams schaffen.

Fachliche Experten: Wir verfügen über Fachexperten, die über umfangreiche Erfahrungen mit Steuer- und SAP-Projekten verfügen. Darüber hinaus verfügen wir über ein spezielles Business to Government (B2G)-Team, das dafür sorgt, dass Unternehmen die laufenden regulatorischen Änderungen einhalten und ihnen hilft, Kosten für die Nichteinhaltung von Vorschriften und Reputationsrisiken zu vermeiden.

Modernste Technologie: Als ein Unternehmen, das neue Technologien vorantreibt und sich zu eigen macht, kann man mit Sicherheit sagen, dass eine der wichtigsten Stärken des Unternehmens seine fortschrittliche Technologie ist. Es wird Sie überraschen zu erfahren, dass mehr als 40% unserer Mitarbeiter in der Forschung und Entwicklung tätig sind, um den reibungslosen Ablauf aller Prozesse zu gewährleisten.

Das letzte Wort

Die TJC Group bietet ein einzigartiges Leistungsversprechen, einen kundenorientierten Ansatz und eine nachweisliche Erfolgsbilanz bei Projekten. Unsere starke Partnerschaft mit SAP sichert uns den Zugang zu den neuesten Innovationen und hält uns über die kommenden Markt- und Branchentrends auf dem Laufenden.

Die Website SAP DRC ist ein echter Wendepunkt in der elektronischen Rechnungsstellung, der elektronischen Berichterstattung und der digitalen Steuerlandschaft. Sie können nicht nur Ihre Abläufe rationalisieren, sondern auch in der heutigen, sich ständig verändernden und schnell wachsenden digitalen Welt die Vorschriften einhalten.

Kontaktieren Sie uns noch heute für eine Demo und lassen Sie Ihre SAP DRC-Implementierungsherausforderungen hinter sich!

Nützliche Links pro Land

Zusätzliche Ressourcen

Resources from international organisations

eInvoicing Country Factsheets for each Member State and other countries (europa.eu)

VAT in the Digital Age (europa.eu)

The e-invoicing voice in Europe – EESPA

SAP useful links

Announcements of Legal Changes – SAP for Me

Manager für regulatorische Änderungen (cloud.sap)