A few months back, our tax compliance experts reported that the Danish Bookkeeping Act is all set to come into force in 2024, which aims at strengthening tax compliance, enhancing financial reporting transparency to fight against tax frauds, and so on in Denmark. Cut to April 2024, the Bookkeeping Act has new updates for organisations. Wondering what they are? Here’s a comprehensive blog for you. Read on!

Table of contents

Introduction

Gone are the days when people had to spend hours entering data into the system or checking for manual errors in their data. Today, we live in an age where automation and digitalisation have made business operations much easier, more effective, and seamless. Moreover, with green initiatives and sustainability gaining momentum, it has become a corporate social responsibility to ensure more use of digital methods rather than manual or paper ones. This brings us to the positive impact of e-invoicing and e-reporting – a solution that has been made mandatory across the world.

As a matter of fact, Denmark has been one of the forerunners in the implementation of e-invoicing, mandating the use of B2G electronic invoicing ever since 2005. The Danish tax administration has always encouraged the use of e-invoices in accordance with the European standard EN 16931 and VAT in the Digital Age (ViDA) proposal. And now, under the plans of the new Danish Bookkeeping Act, business authorities in Denmark plan to introduce B2B e-invoicing in phases over the next few years.

Why are new rules being implemented?

Before we jump into the nuances of the new Bookkeeping Act, let’s talk about why these rules are being implemented.

A broad political majority in Denmark, in 2021, joined forces into a political agreement to create a reform package for the country’s economy. Interestingly, the main objective of this reform package is to strengthen efforts to prevent and fight fraud while making it easier for organisations to comply with their bookkeeping duty. Consequently, the new reform package, as proposed, includes two primary initiatives that organisations based or operating in Denmark must be aware of –

- An amended Danish Financial Statements Act, implementing changes to the auditing requirement.

- A new Danish Bookkeeping Act

What is the Danish Bookkeeping Act?

The Bookkeeping Act, known as Bogføringsloven is a Danish legislation governing the principles and requirements for all the digital accounting and bookkeeping practices in Denmark. One of the key aspects of this act is that all organisations must mandatorily adopt digital reporting by 1st January 2026. Apart from this, as aforementioned, the act also lays down the base and requirements for implementing e-invoicing for all B2B transactions.

Latest update on the Danish Bookkeeping Act

As of March 2024, there has been a new executive order on the requirements for non-registered systems and is said to come into effect from 1st January 2025. Here are the sections under the new order that you must know of –

Who does the executive order apply to?

The new executive order applies to organisations covered by section 16 (1) of the Bookkeeping Act and uses a digital bookkeeping system in accordance with section 16 (2) (2) of the act. Having said that, the order applies only to those functions that relate to the organisation’s bookkeeping and its automation requiring the digital bookkeeping; not to those functions that are a part of any digital service or software, including in the form of modules, extensions and applications. The new executive order is also not applicable to any other digital system that the organisation uses, even if they deliver data to the company’s digital accounting system.

Requirements for the organisation’s digital bookkeeping system

As per the latest executive order, the requirements for the organisation’s digital bookkeeping system are as follows –

The organisation must make sure that the digital accounting system comprises fields of the following conditions for each individual transaction –

- The transaction date, which must have the payment date, date of purchase, and so on

- The amount of the transaction

- Receipt number

- The transaction text

- The exchange rate of the transaction or any other conversion factor if the registration is done in any currency other than DKK

The organisation must ensure that the digital accounting system designates the following information for each posted transaction –

- The date of registration

- The consecutive number or ID

- The initials or signature or anything like of the person or the program under whom/which the transaction was posted

According to the new executive order, the company must ensure that the digital bookkeeping system saves any changes made while ensuring that users cannot alter, backdate, or delete any posted transaction in the system.

The organisation must also ensure that the digital accounting system can store the recorded transaction documents related to purchases or sales, containing the following information –

- The date of issue of the transaction

- The nature of the supply

- The transaction amount

- The details of the sender and the recipient – name, address, and the CVR number or the SE number

- Information on the VAT amount

- The payment information

Keep in mind that these requirements do not apply to cash register strips from a sales registration system. Having said that, these requirements do not apply to documents of recorded transactions that are available in physical forms or to those that are received with respect to sales or purchases of goods and services outside Denmark’s borders.

What are the requirements of the Danish Bookkeeping Act?

The main system requirements

There are three main system requirements under the Danish Bookkeeping Act that organisations must bear in mind –

- The system must support the organisation’s continued transaction registrations with the indication of attachments corresponding to each registration. Along with this, the system must also support the safe storage of the registrations and attachments for five years at the least.

- The system must have proper technical and organisational IT security measures, ensuring a high level of privacy related to the functions of the digital bookkeeping system, like user and access management, automatic backup at least weekly for full backup, and storage on a server in country within the EU or EEA

- The system supports reconciliation of the company’s bookkeeping with the company’s bank account.

- The system must support the automation of administrative processes by enabling accounting as per the public standard chart of accounts and support the automatic sending and receiving of e-invoices via NemHandel in the OIOUBL format for national trade and the Peppol BIS format for international trade across borders.

- The system must support sharing of data by generating a SAF-T-file, as defined by the authorities, in accordance with the applicable standard that is published on the Danish Business Authority’s website www.erst.dk.

How to meet the technical requirements of the Bookkeeping Act?

The process of standardised coding via the public standard charts of accounts is one of the ways to meet the technical requirements of the Danish Bookkeeping Act. This process usually pertains to the automation of the bookkeeping system, making it easier for companies to exchange data with authorities. A few points to meeting the Bookkeeping Act’s technical requirements would be –

- Receiving invoices directly into the bookkeeping system or via third-party

- Supporting VAT reporting, given that ViDA has been the talks of the towns.

However, one of the most important factors that can help organisations meet the technical requirements of the act is implementing the use of Standard Audit File for Tax, popularly known as SAF-T.

Leverage the benefits of SAF-T for your organisation

The Standard Audit File for Tax i.e., SAF-T is a part of the Danish Bookkeeping Act requirements to ensure a simple and more secure way for companies to share their bookkeeping data. Not just limited to this, with SAF-T, the Danish government aims to strengthen tax compliance as well as enhance financial reporting transparency to fight against tax fraud.

To give you a gist of it, the Standard Audit File for Tax is an international standard that enables the electronic exchange of reliable accounting data from organisations to the country’s national tax authorities or external auditors. SAF-T has been implemented in several countries with Portugal being the first country to adopt it in 2008. Over the years, the standard has been increasingly preferred within European countries for effectively filing tax returns electronically. SAF-T is defined by the Organisation for Economic Co-operation and Development (OECD); SAFT-T Denmark is based on the OCED version 2.

What do you get with SAF-T Denmark?

Implementing SAF-T Denmark as a part of your bookkeeping will help you achieve benefits like –

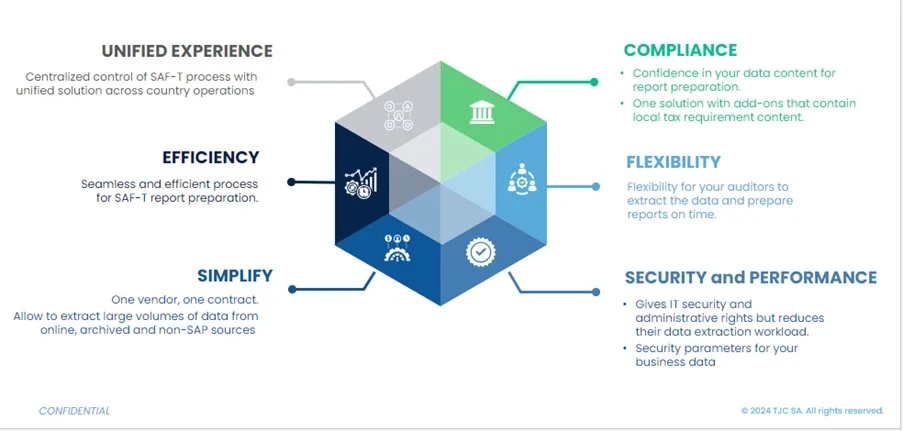

While SAF-T is an impeccable solution to ensure accurate electronic exchange of tax data and more, implementing this solution requires expertise. TJC Group, amongst its many areas of expertise, also assist in the implementation of SAF-T, irrespective of the country within the EU. Joining hands with us for SAF-T implementation will help you gain a plethora of benefits like –

Apart from SAF-T implementation, we also extend our expertise in e-invoicing and e-reporting with SAP Document and Reporting Compliance (SAP DRC), SAP data archiving, legacy system decommissioning, and more. Contact us today to learn more!

Commonly asked questions

Are there any changes in the SAP S/4HANA editions for the bookkeeping system?

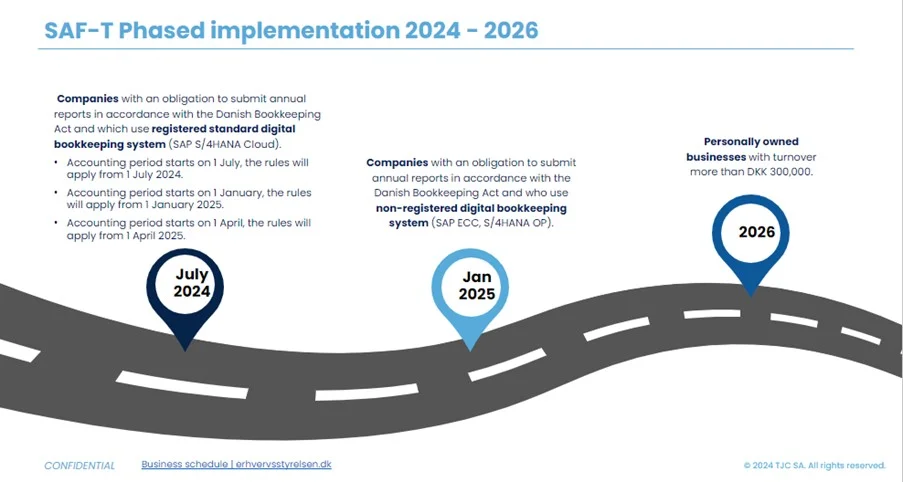

Answer: While initially it was believed that the SAP S/4HANA Cloud for both public and private editions met the requirements of the digital standard cloud bookkeeping system; based on legal analysis and clarifications by the Danish Business Authorities on the definition of their system under the Bookkeeping Act, SAP has decided to halt the application of S/4HANA products to be on the list of registered standard digital bookkeeping system from January 1, 2024.

What about the SAP on-premises products?

Answer: Products like S/4HANA on-premises as well as the SAP ECC do not meet the cloud or hybrid digital standard requirements defined by the Danish Business Authority. Hence, they are considered to be more customer-specific systems, falling under the non-registered bookkeeping system. The requirements for non-registered systems under the Danish Bookkeeping Act are expected to be valid from 1st January 2025.

Are all the organisations in Denmark obligated to have a registered digital standard bookkeeping system from 2024?

Answer: Surprisingly, no! They are not obligated to have a registered digital standard bookkeeping system from 2024. Organisations can use non-registered systems provided they are compliant with the regulations of the Danish Bookkeeping Act. Having said that, it is also required that organisations provide accurate documentation stating that their solutions meet the requisites of a non-registered system upon request at all times.